What is a Factor Financing Company, and How Does it Work?

Is Invoice Factoring Lending similar to business loans?

A Factoring Company Turns Your Accounts Receivables into Working Capital for a Small Factoring Fee

Accounts Receivable Factoring Finance as a Solution to Cash Flow Problems.

Can I Turn Net 30 to 90-day Invoices into Safe and Ready Cash with Factor Finance?

Entrepreneurs work hard to make their dreams become a reality. They are investing their life savings into their business. But when business owners spend endless days on the road and sleeping in hotels, they stress over making payroll every two weeks. You need a factor financing funding source like Bankers Factoring Company to turn 30 to 60-day-old A/R into working capital you can get the same day.

Factoring financing, invoice factoring, invoice discounting, invoice financing, or accounts receivable factoring removes the stress of poor cash flow and limited working capital. In fact, startups and growing companies benefit from it in terms of sustaining business operations and acquiring new customers. Small business loans are difficult to qualify for from banks and other traditional lenders. Factoring is not a loan but the purchase of your solid B2B and B2G outstanding invoices from factoring companies. You receive a percentage rate, 80-90%, of your good invoices upfront and then the balance less the factoring fee when you clients pay the invoices.

You can also read how does a factoring company work and what is a factoring company and what is your best choice to learn about accounts receivable factoring for small businesses.

What is a Financing Factoring Company?

By selling your open ARs to Bankers Factoring Company, you can receive up to 93% of the value and immediately have payroll funding. Hence, no more hassle of meeting bi-weekly payroll because of poor working capital.

Invoice factoring helps companies take on large commercial accounts with payment terms of up to 90 days. Bankers Factoring non-recourse factoring solutions close cash flow gaps for businesses in many industries. factor Financing is both a short term and long term receivable funding solution.

Please read our article who qualifies for a factoring company by using your accounts receivable when factoring receivables to receive immediate cash as one of the better financing options. You will also here the term discount factoring or accounts receivable financing.

What is factoring financing?

Factoring provides businesses with accounts receivable financing through selling open invoices or selling their open accounts receivable. Thus, financing your business with invoice factoring is a quick and easy way to meet payroll funding without expensive merchant cash advances (MCAs). Even if you were turned down for a business loan or bank line of credit based on your A/R you can turn your invoices into working capital.

Factor financing from Bankers Factoring company can also include third party accounts receivable credit insurance versus buying a policy from insurance companies that offer trade or receivable insurance.

How does factoring provide financing?

When our clients sell their ARs to Bankers Factoring company, we provide two cash payments. The initial cash advance is up to 92% of the A/R value. We then issue the second payment, the factoring rebate, for the remaining balance, less our small fee.

You can also read our article about funding your business with A/R financing when you factor your customers’ invoices based on their credit strength.

To learn more, visit our previous article How Invoice Factoring Works from an award-winning invoice factoring company.

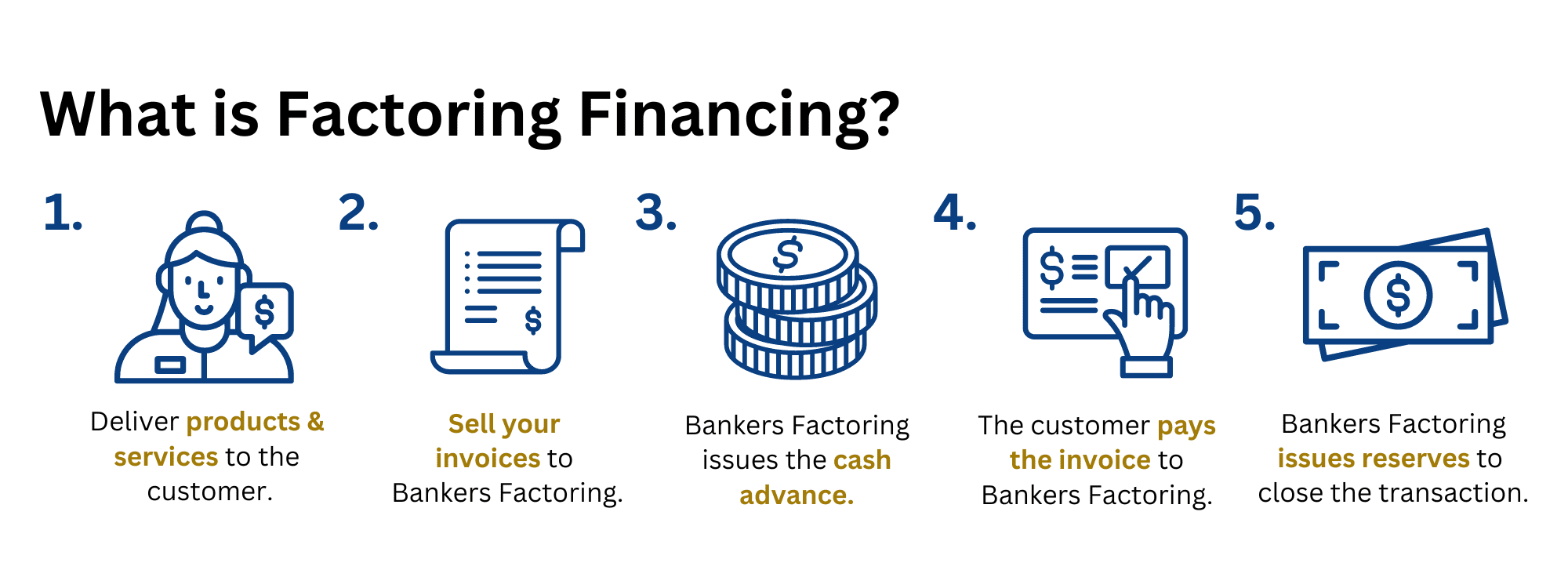

What is the process for factoring in financing?

The process is quick and easy and provides working capital when startups and business owners need it most. Unlike bank loans, which are real estate-driven, factoring companies place a high value on your accounts receivable. Bankers Factoring has an easy application process and promises a factoring proposal in 24 hours from an award-winning invoice financing company.

Here are the steps of factor financing:

- Our Client first invoices their customer (account debtor) for delivered goods or services.

- The client then submits the factoring application to Bankers Factoring.

- Bankers Factoring approves applications based on the customer invoices and the account debtor’s credit.

- Bankers Factoring provides same-day funding after approval of up to 93% of the invoice value.

- Account debtor pays Bankers Factoring company.

- Bankers Factoring then releases the remaining invoice balance, less our small discount rate fee.

The rebate is the final step. We work with clients to develop custom working capital management solutions to sustain cash flow.

If you want to learn more, visit our previous article, Understanding Non-recourse Factoring as a Funding Method, to receive the maximum value of the invoice.

How to qualify for invoice factoring services with a factoring company?

To qualify for AR factoring, your business must have open receivables from a business-to-business (B2B) or business-to-government (B2G) entity. Moreover, invoice factoring approval depends on the customer’s creditworthiness (account debtor).

Invoice factoring is an outstanding solution for business owners with distressed financial situations. Business owners may suffer from bankruptcy, poor credit, or seasonal business demands. Bankers Factoring company works with financially distressed businesses every day to remove the hurdles of traditional lending. We fund based on your customer’s credit profile, not your credit history.

Read Business Financing through receivable factoring finance and A/R Financing Terms & Accounts Receivables Factoring Glossary.

These are the eight main requirements to qualify for invoice factoring financing:

- A completed factoring application

- An account receivable aging report

- A copy of your Articles of Incorporation

- Invoices to factor with confirming delivery of service or product information

- Credit-worthy clients (we will check on their credit for you)

- A business bank account

- A tax ID number

- A form of personal identification

Read a guide to funding your business with accounts receivable financing or invoice discounting.

Is invoice factoring financing right for my business? Is financing factoring a loan?

A/R factoring removes the burden of cash flow gaps due to slow payers and long credit terms. Small businesses are left waiting for cash when your customers have net 30, 60, and 90-day payment terms. If your business lacks working capital or funds, then we can help you.

Please read the pros and cons of factoring your A/R and see the benefits of a factoring company with high advance rates.

Here are everyday situations when business owners use factoring financial services:

- Distressed finances from being bankrupt or poor credit.

- Cash flow issues from slow-paying customers’ invoices.

- Funded their business using expensive credit cards, hurting their personal credit.

- Startups lack the history for a traditional lending source like a bank or credit union.

- Importers and wholesale trade organizations.

- Business owners with no more funds think “factoring loans” could help.

- To acquire new customers and sales via a factoring financing arrangement.

- To cover operating expenses and cash flow shortfalls.

- We offer selective invoice factoring versus spot factoring.

- Not balance sheet driven like a small business bank loan.

- Available with supply chain finance as a financing option versus bank loans.

- Payroll funding even for startup companies.

Industries that use invoice factoring financing

We work with clients from entrepreneurs, startups, and growing companies in many industries and sizes. Some of the many industries Bankers Factoring works with include:

- Payroll and staffing

- Transportation

- Telecommunications

- Oil and Gas

- Government contracting

- Wholesalers and Importers

- Wine and Spirits

- Agriculture/ PACA

How much does invoice factoring finance cost?

The cost of factoring is determined by your invoices’ financing amount, volume, and credit quality. In general, fees range from .75% to 3.5% per month. Bankers Factoring offers tiered pricing for startups that rewards growing businesses with cheaper factoring financial services.

To learn more, visit our previous article, Factoring Rates Explained when using invoice financing or accounts receivable financing for unpaid invoices.

Why Bankers Factoring Company as Your Factoring Finance Solution?

Bankers Factoring adds value to our client’s business by solving the cash flow struggles through our A/R factoring solutions. Our non-recourse factoring provides bad debt protection covering our clients from default on the receivables. Our factoring solutions provide Total A/R Management, allowing business owners to grow their companies.

Please read the 6 causes of cash flow problems and how factoring receivables can help with your cash needs.

We help businesses with no working capital move to have a steady cash flow and improved business operations. We manage the process and take on the credit risk if the invoice is slow or short-paid.

Read how do you factor accounts as a source of business financing via invoice factoring.

Why is A/R factor financing from Bankers Factoring Company?

You receive the following with our Factoring Services:

- A/R Management and non-recourse receivables factoring.

- Bad debt protection with non-payment protection and no more collection calls.

- Start-Up Friendly with an easy-to-understand factoring agreement and fast decision making process.

- Tiered Pricing as your business grows with AR funding.

- Outstanding invoices become same-day working capital.

- Receive 80-93% of the invoice amount face value.

- High advance rate and credit limit with our factoring service.

- Factor fees less than a credit card interest rate.

- Both a short-term and long-term solution to your working capital needs.

- Cash Flow plus third-party collection services for non-payment.

- Special programs for staffing agencies with high cash advances.

- Special factoring programs for trucking companies.

- Same-day funding with low factoring fees and great customer service.

- A quick and easy approval process.

- Low costs with a high advance rate and back-office support.

Please take advantage of our accounts receivables factoring financial services today. Once set up, we can even fund you on the same day. And remember, we are a non-recourse factoring company, unlike many other invoice factoring companies. We have offices throughout the United States, from Hawaii to Florida, and local factoring offices in Cincinnati, Honolulu, Atlanta, and other Bankers Factoring company offices near you.

Find out the benefits of A/R factoring unpaid invoices from b2b companies with Bankers Factoring company’s business funding. When looking to meet your business needs, we were voted a best factoring company in 2022 and 2023, helping entrepreneurs just like you with troublesome cash flows.