A Local Oregon Factoring Company

Top Oregon Factoring Company for Business Cash Flow Solutions

If you need to enhance your cash flow through an Oregon factoring company, consider utilizing Bankers Factoring’s services. We will purchase your outstanding invoices and provide immediate liquidity. This discussion discusses our premier Oregon-based factoring services and outlines their advantages.

Oregon Payroll Funding Solutions

Key Takeaways

- Factoring companies in Oregon offer essential financial services by purchasing outstanding invoices at a discount. This provides businesses with immediate cash to manage cash flow and operational costs.

- Choosing a local factoring company in Oregon benefits businesses through personalized services tailored to the regional market dynamics and specific industry needs, such as those in healthcare, transportation, and seasonal industries.

- Factors to consider when selecting a factoring partner include transparent fee structures, favorable contract terms, excellent customer service, and the factoring company’s industry-specific expertise to ensure adequate cash flow management and support for business growth.

Exploring Oregon Factoring Companies

Invoice factoring services provided by factoring companies are a critical resource for Oregon businesses looking to enhance their cash flow management. By purchasing outstanding invoices at reduced rates, Bankers Factoring offers businesses the advantage of immediate liquidity, which they can utilize to meet operational expenses and capitalize on expansion opportunities.

Invoice factoring is ideal for those dealing with long payment cycles or customers who delay payments. It allows them to receive quick payments without waiting for customer transactions.

In the state of Oregon specifically, firms like Bankers Factoring provide customized invoice factoring solutions designed with local business requirements in mind. They deliver options such as funding based on receivables and specialized invoice factoring services that help sustain robust and steady cash flows essential for business operations—benefiting particularly industries susceptible to periodic shifts or functioning with narrow profit margins.

Choosing a local factoring company within Oregon offers additional benefits due to its grasp of regional economic trends and ability to cater service offerings uniquely suited to the specific demands of Oregon-based companies. This innate familiarity with the local environment provides an advantage for businesses seeking to tighten their financial management practices while maximizing potential growth avenues in their marketplace.

How Factoring Works for Oregon Businesses

Invoice factoring is a transaction in which a business sells its accounts receivable to a factor, or invoice factoring company. The procedure provides the selling business with immediate liquidity by allowing it to receive cash upfront without waiting for the due dates of its invoices.

This method assists businesses in avoiding delayed payment cycles and credit term constraints, eliminating the necessity for loan acquisition or use of existing lines of credit. Through this financing approach, ready access to working capital assists companies in covering daily operational expenses and mitigates risks associated with customer non-payment.

Factoring financing offers considerable relief for businesses striving to maintain consistent working capital levels while managing their financial operations efficiently.

The mechanism behind factoring unfolds as follows:

- A company offloads its outstanding invoices onto a factoring firm.

- In return, that firm gives the original issuing business an up-front sum representing part of those invoices’ total value.

- Subsequently, when customers make these payments, they do so directly into an account held by Factor, which must be held until fully paid before they can collect on their behalf from the debtor(s).

For instance, Bankers Factors expedites the process within Oregon, assisting local firms by exchanging unpaid bills at reduced prices via centralized funds distribution channels like Banker’s Factoring for same-day working capital.

Benefits of Choosing an Oregon Factoring Company

Working with a factoring company in Oregon offers the significant advantage of their deep understanding of the local market dynamics. Such companies deliver services customized for the unique requirements of businesses within Oregon, enabling these enterprises to quickly obtain immediate cash, bolster their cash reserves, and manage outstanding debts more effectively.

Compared to other factoring companies, Oregon-based companies often offer superior service by crafting tailored solutions and providing support that resonates with the state’s business landscape. This ensures that firms leveraging factoring services from these local providers gain maximum benefits aligned with their operational needs.

Selecting the Right Factoring Company in Oregon

Choosing the right factoring company in Oregon is a critical decision that can affect your business’s cash flow and financial health.

An ideal factoring partner will provide you with:

- Clearly outlined fees without any hidden charges

- Contract terms that benefit your business operations

- Exceptional customer service

- Comprehensive knowledge of your specific industry

These aspects must align with your company objectives to ensure the factoring relationship enhances your business stability and growth.

When evaluating potential factor companies, businesses must consider several key points.

- The fee structure should be straightforward and economical, without concealed expenses.

- It’s essential to thoroughly scrutinize contract terms to correspond with what you require for long-term success.

- The quality of customer care the factoring firm offers is also fundamental when making an informed choice.

Key Considerations When Choosing a Factoring Partner

When selecting a factoring partner, businesses should meticulously examine the fee structures of different factoring companies. This includes understanding any potential additional fees for services like credit checks and invoice processing. Transparency in fee structures ensures that businesses can accurately forecast their costs and avoid unexpected expenses.

Conducting a thorough review and understanding the contract terms is vital. This ensures that the terms align with your business needs and goals and that no hidden clauses could pose a problem in the future. Businesses should not hesitate to seek legal advice to comprehend the contract terms fully.

Finally, a crucial step is to evaluate the outstanding customer service the factoring company provides. Asking for references from current or past clients can provide insights into the company’s reliability and customer support quality. Good customer service can significantly enhance the overall experience and effectiveness of the factoring arrangement.

Evaluating Industry Experience

Selecting a factoring company specializing in your industry ensures that you receive high-quality service and support customized to the demands of your business. A company with in-depth knowledge of your sector is more capable of offering services designed to meet distinctive challenges. It needs you to encounter, facilitating improved cash flow management and enhanced issue resolution.

For example, suppose a factoring firm is proficient in dealing with healthcare clients. It can adeptly manage that industry’s specific billing cycles and payment conditions.

Similarly, companies operating within the transportation or construction sectors stand to gain when they partner with a factoring entity familiar with their peculiar cash flows related to operations.

Types of Factoring Services Available in Oregon

In Oregon, various factoring companies offer specialized services designed to meet the diverse needs of businesses. These services are split into two categories: recourse and non-recourse factoring. In recourse arrangements, if an invoice remains unpaid by the customer, it is up to the business to reimburse the factor. On the other hand, with non-recourse agreements, the responsibility for unpaid invoices shifts away from your company onto the factoring firm itself – this affects both risk level and financial burden.

Industries such as healthcare in Portland may experience payment delays, which could lead to difficulties in cash flow. They can utilize tailored invoicing solutions through healthcare receivables financing options available within these service offerings.

Exploring different forms of factoring arrangements specific to various sectors, like transportation or construction, as well as general business practices, ensures that organizations find appropriate funding support suited perfectly to their fiscal demands.

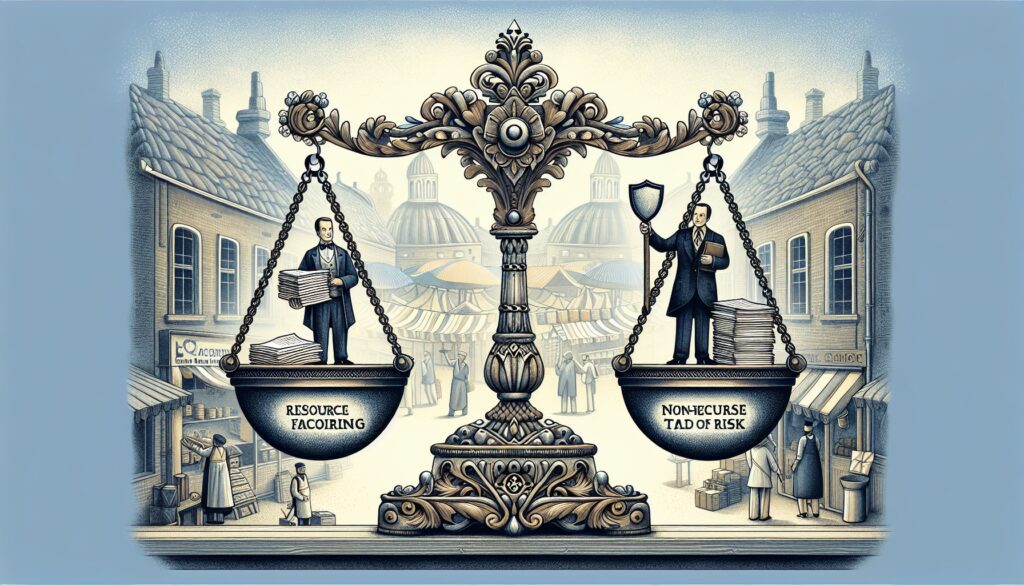

Recourse vs. Non-Recourse Factoring

When engaging in recourse factoring, the business that sells its receivables is partly accountable if it goes uncollected. If the customer fails to pay on time, the business is responsible for compensating the factoring company. This arrangement typically allows for higher advance rates than non-recourse factoring, where such liability does not exist.

Contrastingly, with non-recourse factoring, the company provides factoring services that take on all risks associated with a client’s failure to settle an invoice. When customers do not fulfill their payment obligations under this model of factoring agreement, any financial loss incurred becomes solely the burden of the factoring service provider.

Spot Factoring vs. Whole Ledger Factoring

Factoring individual invoices through spot factoring affords businesses the convenience and discretion to select specific invoices for factoring. This offers a tailored solution that caters to occasional cash flow challenges or for enterprises seeking to explore the advantages of invoice factoring services without entering an extensive commitment.

In contrast, whole ledger factoring entails outsourcing the complete batch of a company’s outstanding invoices. This method ensures a steady stream of cash flow. It is particularly advantageous for business entities that need reliable and systematic access to cash to manage their day-to-day functions optimally.

How Invoice Factoring Solves Cash Flow Problems

Invoice factoring is a practical tool for businesses in Oregon grappling with cash flow dilemmas. When companies opt to sell their outstanding invoices to a factoring company, they secure immediate funds, relieving financial tight spots. This approach is especially advantageous for businesses operating under extended payment terms as it enables them to:

- Garner cash without the delay of customer payments

- Bolster cash flow status

- Satisfy payroll and fulfill other financial commitments

- Pursue avenues for business expansion

- Minimize the hazard of uncollectible debts

Invoice factoring presents an adaptable and efficient method for Oregon-based enterprises seeking effective cash flow management.

Factoring companies are known to extend several advantages, including:

- Providing up to 90% advances on invoiced amounts

- Delivering swift mitigation from limited cash reserves

- Granting prompt availability of funds that smooth out irregularities in income streams and help cover day-to-day expenditures

- Injection of consistent capital into operations fostering both corporate growth and stability

These entities can sustain continuous fluidity in their finances by converting accounts receivable into instant funding through invoice factoring. Consequently, this allows firms to maintain stability, focus on essential operational concerns, and seize potential areas ripe for expansion without becoming preoccupied with fiscal pressures related to inconsistent fund flows.

Immediate Access to Working Capital

Invoice factoring delivers rapid access to necessary working capital, bypassing the protracted and often complex approval procedures associated with traditional bank loans. Businesses can swiftly acquire cash by leveraging up to 90% of their invoice value in just a few days, thus alleviating short-term financial constraints.

Consider an IT consulting firm based in Oregon that utilized factoring to secure payroll funding. This timely influx of cash enabled them to meet employee wage demands. It bolstered their ability to pursue expansion goals effectively — highlighting how vital immediate fund accessibility is for companies facing pressing expenditures or wishing to capitalize on emerging business opportunities.

When it comes to organizations managing seasonal variations in revenue streams—like those prevalent within Oregon’s agricultural sector—factoring proves invaluable. It provides these enterprises with prompt access to operating costs and positions themselves advantageously for upcoming high-demand periods through strategic preparation.

Financing Receivables for Business Growth

Companies utilize factoring as a strategy to finance their receivables, which allows them to:

- Maintain consistent cash flow

- Support expansion plans

- Transform receivables into instant cash

- Seize emerging opportunities

- Widen their business scope

- Develop without depending on conventional bank loans

For instance, manufacturing businesses employ factoring to adeptly handle inventory expenses by securing prompt access to cash. This constant stream of funds enables them to concentrate on primary activities and scale up while avoiding concerns related to cash flow challenges.

Case Studies: Success Stories of Oregon Businesses Using Factoring

Oregon case studies have demonstrated the palpable advantages that factoring can provide for businesses. These examples show how various companies have successfully navigated fiscal challenges and realized expansion by leveraging factoring.

Take, for example, an Oregon-based travel staffing firm that turned to factoring in response to customers taking up to 60 days to settle their payments. Factoring allowed this company to stabilize operations and ensure punctual payroll processing.

Similarly, an Oregon food distributor employed factoring strategies to manage cash flow more effectively and maintain consistent wage payments despite lengthy customer payment terms.

These instances highlight the adaptable nature of factoring as an economic resource. Whether bridging delayed customer payments or propelling business growth initiatives, companies use invoice financing solutions like factoring to support ongoing liquidity needs and foster business development.

Small Business Overcoming Seasonal Cash Flow Issues

Small businesses often experience significant cash flow issues during slower business periods. A small wholesale company in Oregon grappled with inadequate cash flow during these times. Through factoring, this company successfully navigated financial hurdles and sustained its operations.

Factoring offers businesses a flexible funding solution. It allows them to select specific invoices for financing and effectively manage seasonal swings in their cash flow.

An Oregon-based company specializing in holiday decorations employed factoring to leverage seasonal peaks and grow its enterprise. Such flexibility proves vital for companies facing inconsistent cash flows due to seasonal changes.

Turning receivables into immediate access to cash enables small businesses to survive, prepare adequately for busier seasons ahead, and take advantage of emerging growth opportunities. Factored invoicing emerges as an established method for tackling periodic financial challenges related to sustaining adequate levels of liquidity within such enterprises.

Tech Company Expanding Operations with Factoring

Tech firms in Oregon are utilizing factoring to finance their expansion and manage significant projects without being constrained by the wait for customer payments. A tech company based in Portland leveraged this financial strategy effectively, gaining immediate cash, facilitating the scaling of its business, and tackling more significant ventures.

Numerous Portland-based technology companies have tapped into factoring as a pivotal source of funds, allowing them to focus on growth endeavors while bypassing dependence on traditional bank loans. This swift access to working capital ensures these companies can sustain operational consistency while exploring fresh prospects.

Comparing Factoring to Traditional Bank Loans

Several key differences emerge when comparing factoring to traditional bank loans. Factoring offers faster access to capital and greater flexibility without the need for collateral or a strong credit history. A bank loan often requires a lengthy approval process, collateral, and a solid credit history, making it less accessible for many businesses.

Bankers Factoring’s manufacturing factoring programs offer:

- No interest payments

- No repayments

- No long-term obligations

- Accessible and straightforward pricing

This makes factoring an attractive alternative for businesses looking for quick, flexible funding solutions.

While traditional loans can help build a positive credit history, the immediate and flexible nature of factoring can provide the necessary cash flow for businesses to thrive. Comprehending these differences can assist companies in making informed decisions regarding their financing options.

Speed and Flexibility

Invoice factoring distinguishes itself by offering rapid and adaptable funding solutions. Companies can have their factoring applications approved within 3 to 5 days, which is significantly quicker than securing traditional bank loans. The absence of collateral requirements, such as property or inventory, streamlines the entire process.

With funds from invoice factoring sometimes available in less than a day, businesses gain swift access to necessary cash reserves. Such prompt financial support is essential for companies that urgently need to manage expenses or capitalize on opportunities for growth without enduring the delays typically associated with loan approval processes.

Fintech entities like Bankers Factoring offer platforms enabling firms to expedite funding by digitally submitting invoices and swiftly receiving decisions on their loans.

When faced with pressing fiscal demands, businesses find that the skill and efficiency of invoicing financing are far more suited to meeting immediate needs than options like standard bank loans.

Impact on Credit Terms and Relationships

Factoring could alter the dynamics of customer interactions in several ways.

- Having a factoring company handle payment collection directly from clients changes how businesses interact with customers.

- Having to correspond with an external entity for payments may influence customers’ impressions of the business.

- On the positive side, a factoring service can relieve businesses from pursuing overdue payments and overseeing debt collections.

On the other hand, when taking out traditional loans, customers are not required to deal with anyone other than your company regarding payments. This maintains a direct relationship between you and your clientèle. Bankers Factoring’s renowned gentle approach to accounts receivable ensures that Days Sales Outstanding (DSO) shrinks while bolstering supplier relationships. Consequently, cash flow improves along with stronger ties within the business network.

Understanding Fee Structures and Contract Terms

To make well-informed choices, businesses must grasp the intricacies of fee structures and terms within factoring agreements. Factoring firms often apply a charge that is a portion of the invoice’s value, commonly ranging from 1% to 5%. The charge varies based on the volume of invoices and how creditworthy the customer is deemed.

When considering these costs, enterprises need to examine them while meticulously understanding their agreements related to factoring. Key considerations should include evaluating contract duration, flexibility, and obligations over an extended period. Grasping these components enables enterprises to identify an appropriate partner for factoring purposes while avoiding unforeseen financial burdens.

The choice between shorter or more protracted contracts depends on individual business needs. Both offer distinct advantages, while short-term agreements deliver liberty without enduring commitments at a much higher cost than a one-year contract.

Common Fees in Factoring Agreements

Typically, factoring fees are between 1% and 5% of the invoice amount. This rate can vary based on various elements, including a company’s number of invoices and customers’ credit standing.

Advance rates provided by factoring companies often range from 60% to 97% of an invoice’s value. Industries perceived as higher risk, like healthcare and construction, might receive lower advances than others.

Typically, general business entities and staffing firms receive advance percentages from around 80% up to the low ‘90s percentile. The transport sector frequently benefits from some of the highest rates in this context, which may fall between 92% and 97%.

Navigating Long-Term Contracts vs. Short-Term Agreements

Factoring agreements with a short-term structure allows businesses to adapt cost-effectively to changing cash flow needs. By choosing to factor invoices only when necessary, companies avoid the obligations associated with long-term contracts, which is especially advantageous for those experiencing seasonal fluctuations in their cash flows.

Conversely, long-term factoring arrangements may provide more consistent and foreseeable terms than short-term counterparts. Businesses are advised to thoroughly examine these contract terms and consider legal guidance to comprehend the consequences of such extended commitments fully. Careful consideration of flexibility and consistency will assist businesses in determining the most suitable factoring agreement for their situation.

The Future of Factoring in Oregon’s Financial Landscape

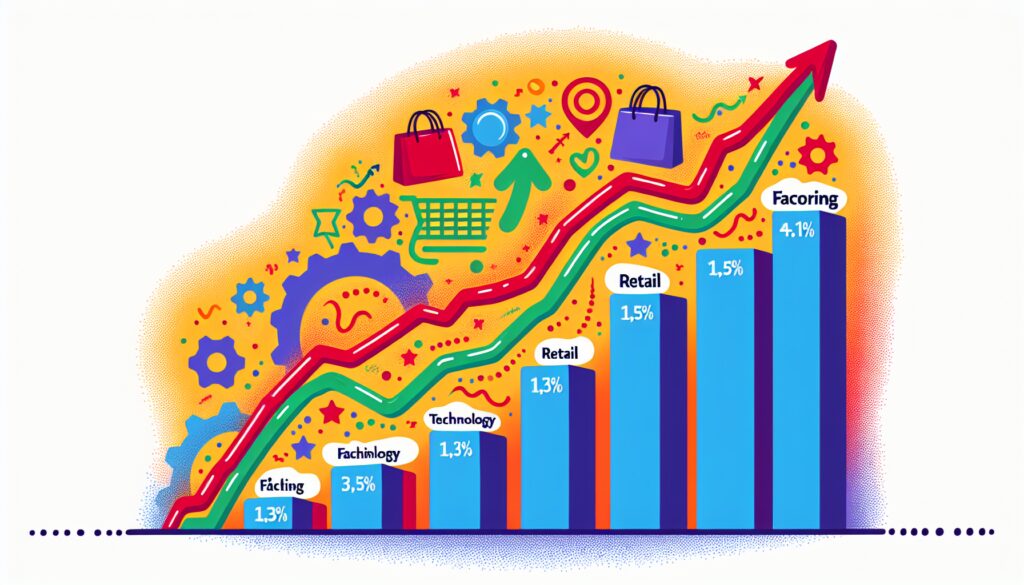

The financial landscape in Oregon is witnessing a promising trend toward the future of factoring, fueled by technological advancements and escalating demands across various sectors. Small and medium-sized enterprises (SMEs) are particularly driving this growth, seeking alternative financing solutions to facilitate quick cash flow through factoring services.

Advances in technology are refining the effectiveness of factoring by:

- Simplifying paperwork and speeding up confirmation processes

- Offering instant access to services via digital interfaces and cloud-based technologies

- Broadening service reach for small to mid-sized businesses

- Increasing openness and cooperation between companies engaging a factoring firm.

Such improvements are making the procedures associated with factoring more streamlined and customer-friendly.

Oregon’s burgeoning sectors, such as tech, healthcare, staffing, and agriculture, increasingly rely on financing solutions like business factoring to maintain consistent cash flow for operational continuity. The Healthcare sector and Social Assistance appear set to escalate their reliance on such financing mainly because they stand poised for substantial expansion.

Likewise, trends within Wholesaling & Manufacturing signal an uptick in using account funding facilities like those offered under Factoring clauses within governing laws or contracts, which could have a bearing on development rates either way depending primarily on, though not exclusively, so thanks once again primarily Unto SME’s requirements therein.

Technological Advancements in Factoring

The realm of factoring is undergoing a revolution thanks to technological advancements optimizing its efficiency and availability. Noteworthy enhancements consist of:

- The emergence of digital platforms that provide immediate connection to services associated with factoring

- Quick submission procedures for invoices by businesses, paired with swift determinations regarding funding

- Enhanced expediency within the operations about factoring

These developments are boosting the appeal of factoring amongst various companies.

Cloud technology is pivotal in securing financial data storage while improving transparency. It also facilitates better collaboration between companies engaged in business activities and those offering factoring solutions. This progress bolsters the credibility and practicality of using such methods for effective cash flow management and fostering company expansion initiatives.

Growing Industries and Factoring Demand

Various sectors in Oregon, such as technology, healthcare, and agriculture, are increasingly utilizing factoring services to ensure consistent cash flow and foster business expansion. In 2023 alone, the Healthcare and Social Assistance sector accounted for a workforce of 311,388 individuals and is likely to bolster the demand for factoring services amid its growth trajectories. Likewise, with a workforce of 260,119 people employed within Retail Trade during that year, there is an anticipated increase in the need for factoring support among wholesalers serving this sector.

These demands emphasize how critical stable cash flow solutions have become across these evolving industries, which heavily rely on factoring to propel business advancements. Notably, manufacturing stands out regarding market share within factor-based financing, which claims dominance over other sectors primarily because production cycles can be extensive while payment receipts tend toward delays. These ongoing patterns underscore an essential part that these financial services will continue to have when nurturing corporate fiscal stability throughout Oregon’s diverse industries.

Oregon Invoice Factoring Summary

In summary, factoring provides a valuable financial solution for businesses in Oregon, offering immediate cash flow and supporting growth initiatives. Companies can make informed decisions that enhance their financial stability by understanding the different types of factoring services, the benefits of working with local factoring companies, and the critical considerations in selecting a factoring partner.

Whether managing seasonal cash flow fluctuations or expanding operations, factoring can provide the necessary working capital to sustain and grow a business. As the factoring industry evolves with technological advancements and increasing demand, it remains a crucial tool for companies looking to improve their cash flow and seize new opportunities.

Frequently Asked Questions

What is invoice factoring?

Factoring is a financial strategy in which a company sells its outstanding invoices to a factoring firm at discounted rates. This provides the company with immediate cash, which can enhance its cash flow and allow it to manage operational expenses without delay from customer payment schedules.

How does recourse factoring differ from non-recourse factoring?

In recourse factoring, if the customer fails to make a payment, the business is responsible for reimbursing the factoring company. On the other hand, with non-recourse factoring, the company offering factoring takes on the risk that customers default on payments. The choice between these two impacts how much risk a business will bear.

What are the typical fees associated with factoring?

Factoring fees vary between 1% and 5% of the total invoice amount, with potential extra charges for additional services such as processing invoices and conducting credit checks.

How quickly can I receive funds through factoring?

Factoring enables you to access funds within as little as 24 hours following approval, providing a quicker alternative to the longer process associated with traditional bank loans.

Why should I choose a local factoring company in Oregon?

It is advisable to select a factoring company in Oregon. They provide customized services tailored to meet the unique requirements of businesses within the area. Such specialized knowledge can be instrumental for your company’s prosperity.

Ready for the owner-employees of Bankers Factoring to grow your business with our award-winning receivable factor financing, including bad debt protection? Use our fast online factoring application or call 866-598-4295.

Fast Funding

"*" indicates required fields