866-598-4295

A Jacksonville Factoring Company

Jacksonville invoice factoring programs

If your Jacksonville-based business is facing cash flow challenges due to customers not paying on time, consider leveraging the services of a factoring company. Such companies offer an effective solution by buying your outstanding invoices and providing instant access to cash. This discussion delves into factoring operations in Jacksonville and how they can benefit businesses encountering invoice-related financial concerns.

Bankers Factoring has factoring offices throughout Florida.

Key Takeaways

- Factoring companies in Jacksonville offer up to 90% of the invoice value upfront, providing immediate cash flow solutions and allowing businesses to maintain financial stability despite delayed customer payments.

- Invoice factoring transforms accounts receivable into immediate funding, reduces credit risks through non-recourse factoring, and streamlines collections management, thus enhancing financial efficiency and credit scores.

- Choosing a reliable factoring partner involves evaluating competitive rates, company reputation, and customer support to ensure alignment with business goals and industry-specific needs, fostering long-term financial health and growth.

Discovering Jacksonville Factoring Companies

In Jacksonville’s dynamic economic landscape, factoring companies are critical pillars supporting businesses facing cash flow challenges. They offer a vital service by unlocking up to 90% of an invoice’s value upfront, casting light on paths toward enhanced financial liquidity. When customers delay payments deliberately or due to their own monetary hurdles, these institutions extend a much-needed lifeline to local entities by selling outstanding invoices at a discounted rate in exchange for crucial immediate funds.

Factoring is woven into the fabric of Jacksonville’s commercial sector, serving as more than just an avenue for swift capital infusion. It acts as a cornerstone for reassurance and stability. Factoring services can typically be mobilized within days, enabling Jacksonville enterprises to tread water amidst the irregular tide shifts brought on by customer payment variances.

Engaging with one of these reliable finance partners means businesses are not left navigating fiscal matters alone; they’re provided partnership support designed specifically to solidify their financial footing in Jacksonville’s marketplaces.

Key Benefits of Invoice Factoring

Factoring companies in the Jacksonville area provide a lifeline to businesses striving for efficient cash flow management. These companies convert outstanding accounts receivable into usable capital by enabling immediate access to funds through invoice factoring. Such invoice factoring programs offer more than just liquidity. They bolster your company’s creditworthiness and introduce agreeable repayment conditions, helping you maintain steady financial sailing.

Working with an invoice factoring service in Jacksonville safeguards against potential credit pitfalls. Opting for recourse factoring means that any risk associated with unpaid invoices is shifted away from your balance sheet directly to the factoring firm—this ensures smooth business operations without being encumbered by possible payment defaults.

Delegating collections tasks to seasoned professionals curtails the need for internal resources to pursue overdue payments. The outcome? Simplified processes regarding invoicing, credit control, and debt recovery lead toward better economic effectiveness and open avenues of opportunity previously uncharted due to restrictive cash flow scenarios.

How Factoring Works in Jacksonville

In Jacksonville, factoring revitalizes your business’s cash flow by mitigating the challenges of delayed invoice payments. When your company issues an invoice after providing goods or services on terms of 30 to 90 days for payment, you no longer have to endure the wait. Factoring companies are there to step in. They purchase these accounts receivable at a reduced rate through receivable financing and provide your business with an instant cash infusion.

The efficiency of this process is remarkable, with approval for such factoring often granted within three days or less of submitting an invoice. Once your order has been fulfilled and the required documentation provided, funds equaling the value of the invoices minus a discount will be swiftly transferred into your hands. This streamlined approach ensures businesses maintain steady momentum and supports Jacksonville’s economic vitality via continuous fluidity in corporate cash flows.

Comparing Factoring and Traditional Bank Financing

Navigating the turbulent waters of finance, factoring emerges as a clear alternative to conventional bank loans. Instead of adding debt to your ledger, it represents an asset-based transaction that injects funds into your company for growth without piling up loan obligations on your balance sheet. Factoring involves a sale where the factor purchases accounts receivable at a reduced rate, steering you towards immediate access to working capital.

Financing options such as business loans and purchase order financing hinge on the creditworthiness of your customers rather than your firm’s financial status. This makes them especially well-suited for nascent enterprises and those cruising toward expansion.

The advantages of invoice factoring include:

- Elimination of collateral or personal guarantees

- A flexible funding solution scaling with your enterprise

- Funding availability within the same day

- Reliable cash flow to maintain solvency in operations

Consequently, for ventures charting their path through Jacksonville’s vibrant economic scene, choosing factoring aligns you with an ideal financial ally conducive to sustained growth.

Choosing the Right Jacksonville Factoring Partner

Selecting a Jacksonville factoring company is like appointing a reliable financial co-pilot for your enterprise’s voyage. This process necessitates an in-depth assessment, rather than just a superficial review, to find a factor that resonates with your fiscal aspirations and possesses adept knowledge of your sector’s intricacies.

Emblematic of such expertise is Bankers Factoring, which brings over four decades to the table and maintains client relations averaging beyond four years—a testament to their commitment to fostering solid partnerships while judiciously avoiding precarious clientele. This highlights how pivotal the stature of an invoice factoring firm can be in attaining economic prosperity.

The standing of any Jacksonville factoring entity isn’t merely forged through longevity but also by earning other businesses’ confidence. Client referrals are at the heart of new business acquisitions for these firms, underscoring the imperative role played by integrity-bound and steadfast companies like Bankers Factoring. They prioritize providing unrivaled backing on your journey toward financial milestones.

Importantly, although scrutiny will extend to your own credit history when partnering up with invoice financing services, it’s predominantly customer solvency that factors into consideration—enabling you as their partner to have trust vested not solely within yourself but importantly too within those customers who bolster both yours and our commerce.

Evaluating Factoring Rates and Fees

Exploring the benefits of factoring demands a meticulous examination of cost implications. It is imperative to scrutinize rates and fees associated with factoring and how they synchronize with your commercial aims. Companies like Bankers Factoring distinguish themselves by delivering services that encompass:

- Market-competitive rates

- Estimates provided without charge

- Rapid enhancement of cash flow

- Accessibility to credit evaluations

- ACH transfers at no extra fee

They offer customizable financial solutions, such as recourse factoring, which features adjustable monthly minimums, attuned to the distinctive dynamics within the Jacksonville area.

The essence of conducting an in-depth analysis extends beyond searching for minimal expenses. It involves a holistic grasp of a spectrum of offerings from prospective partners. The value derived should be appraised regarding energy invested in services rendered and additional support received, ensuring your business extracts maximum benefit from every angle when selecting a factoring ally.

Checking Company Reputation and Track Record

In the realm of factoring, the reputation and historical performance of a company is as vital as the integrity of a vessel’s structure. A factoring partner with a proven track record in Jacksonville is evidence of their ability to efficiently manage local financial currents and comprehend the specific challenges businesses encounter in this area. To evaluate such credibility, one should seek testimonials from other businesses previously engaged with this factoring entity. Their experiences act like maritime charts that disclose how well the company has performed and demonstrate how robust its client relations are.

Conducting thorough research before choosing your factoring ally is akin to using a compass for navigation—it’s an essential step toward safeguarding your business’s prospects. Making sure you place your commercial ventures safely guarantees you are aligning yourself with a supportive partner equipped to propel you toward your intended financial goals. The ideal choice for a factor isn’t merely an inconspicuous financier. They must be akin to Polaris, offering guidance and insights enabling you to navigate economic waters adeptly—with conviction and lucidity.

Prioritizing Customer Support and Responsiveness

Responsive customer service and support are the foundations of any successful factoring relationship. When dealing with financial matters, having a supportive factoring company by your side can be the key to navigating smoothly through complex situations. Open lines of communication act as crucial connectors that sustain a positive and cooperative partnership, guaranteeing you never find yourself without direction.

Continual assistance throughout the entire factoring process is a beacon to safely guide your way, ensuring an effortless and tranquil financial journey. A factoring firm that puts customer care first creates an environment ripe for collaborative growth in business—providing peace of mind knowing expert help is always within reach, like a distress signal answered promptly.

Industry-Specific Factoring Solutions in Jacksonville

The diverse economic landscape of Jacksonville presents various opportunities for businesses across multiple sectors, all with unique financial needs. Companies in this area can greatly benefit from specialized factoring services designed to meet the individual requirements of industries like:

- transportation

- logistics

- manufacturing

- service-based companies

These services are essential to propel these enterprises forward, capturing the momentum necessary for success. Bankers Factoring is an example that offers tailored cash flow solutions, ensuring businesses ranging from healthcare to transportation have access to industry-specific factoring programs.

Such customized cash flow strategies are crucial for smooth sales within Jacksonville’s economy. Given its advantageous position on the St. Johns River and alongside the Atlantic coast, it stands as a pivotal hub for transport and distribution networks, which reap substantial rewards from fast and adaptable factoring options offered by Bankers Factoring, among other providers. Through such personalized approaches, every business—no matter what product or service it may offer—can imbue its operations with the robust energy provided by expertly crafted factoring solutions.

Transportation and Logistics

Factoring services are a critical financial catalyst for the transportation and logistics sector, which is central to Jacksonville’s commercial vitality. Such services ensure that companies within this industry have access to consistent cash flow, allowing them to effortlessly manage essential costs like payroll, fuel, and vehicle upkeep despite irregularities in client payments. Local firms are given an indispensable source of support through Bankers Factoring by providing immediate cash via freight bill factoring, thus maintaining seamless business operations.

By utilizing invoice factoring options from providers such as Bankers Factoring, Jacksonville’s transportation and logistics businesses can:

- Concentrate on their primary activities without the strain of awaiting payment on outstanding freight invoices

- Maintain active fleets, ensuring smooth transit of goods

- Play a significant role in fortifying Jacksonville’s economic foundation through enhanced infrastructure contributions.

Manufacturing and Distribution

Jacksonville’s manufacturers, vital to the city’s industrial might, find factoring indispensable for maintaining uninterrupted operations. This financial tool provides custom-made solutions that help manage production expenses and guarantee on-time product delivery to distributors, thereby preserving a consistent and dependable supply chain flow.

Adept cash flow management is crucial for these manufacturers’ success. By utilizing factoring services, they can deftly handle the intricate fiscal demands of manufacturing. This enables them to focus on innovation and production while being confident that cash shortages will not impede their capacity to operate effectively or disrupt their contribution to the market.

Service-Based Businesses

Factoring services offer a tranquil financial setting for service-based businesses in Jacksonville, allowing them to secure their economic footing in the healthcare and consultancy sectors. These companies can adeptly handle receivables and maintain seamless operations by engaging in factoring. This method allows them to meet payroll, taxes, and debt obligations without disruption.

Service-oriented enterprises in Jacksonville have come to rely heavily on factoring as an essential guide for fiscal stability and progress. Because factoring firms offer immediate and dependable services, these organizations can concentrate on providing exceptional client service with the assurance that their financial affairs are under control and easily navigable.

Enhancing Business Growth with Factoring Services

Factoring serves as a potent catalyst for the expansion of businesses, providing an active and transformative fiscal approach that thrusts enterprises onward. By converting accounts receivable into accessible cash, companies enhance their liquidity and underpin growth initiatives, including entry into emerging markets. This mechanism permits firms to leverage the creditworthiness of well-established clients—such as leading retailers, government entities, and top-tier corporations—to secure financing for working capital.

Improved cash flow paves pathways to numerous opportunities for business development, such as diversifying product offerings and engaging with new clientele bases. Consider a textile producer who shifted towards utilizing factoring services through a bank-affiliated factor. They managed financing expenses more effectively while reinvesting the savings into enhancing their operations. Indeed, this kind of financial adaptability offered by factoring services equips businesses with the capacity to prosper within Jacksonville’s highly competitive commercial arena.

Unlocking Working Capital for Growth

Within companies’ dormant invoices lies a hidden wealth of working capital. Through factoring, this latent value is unlocked and turned into immediate cash, which can then be channeled back into the business’s vital operations. This acceleration of cash flow through factoring promptly transforms sales made on credit into essential capital for everyday business functions.

In Jacksonville, local enterprises facing fiscal dilemmas find solace in factoring services that enable them to:

- Meet obligations such as employee wages, tax requirements, and existing financial commitments uninterrupted

- Concentrate on scaling their businesses while leaving the management of accounts receivable to the expertise of a factoring company.

- Inject fresh working capital without accumulating Debt

- Keep their balance sheets unblemished, thereby setting a solid foundation for long-term growth

By choosing a Jacksonville-based factoring firm:

Businesses can tackle monetary challenges head-on by transforming outstanding invoices into accessible funds. Factoring provides an efficient solution for managing credit and debts – it is more than just an emergency bandage. It acts as strategic leverage, enabling firms to reinforce their position amid tight markets or seasons when liquidity is typically strained.

Expanding Sales and Customer Base

Factoring provides an immediate cash boost for businesses, acting as a propelling force that enables them to:

- Pursue expansion and draw in new customers

- Allocate funds toward marketing and sales strategies

- Aim for growth by broadening their customer demographics and extending market presence

- Branch out into different areas with varied products or services

- Explore untapped markets with confidence

This judicious allocation of resources drives these enterprises’ success and scaling up.

Imagine the opportunities open to Jacksonville businesses once freed from cash flow limitations. They can concentrate on excelling at innovation and delivering top-tier goods or services while entrusting their financial complexities to a factoring partner. This partnership forms the basis of a growing business, paving the way for a substantial clientele and fortifying its standing within both local circles and further afield.

Supporting Long-Term Financial Health

Factoring isn’t merely a temporary solution. It’s an essential strategic approach for maintaining a business’s long-term fiscal health and equilibrium. It does so by facilitating consistent cash flow, which allows businesses to manage their financial resources more effectively, ensuring smooth day-to-day functions and promoting steady expansion. The adaptability associated with factoring aligns with the pace of business growth, affirming that financial stability is not an end state but rather an ongoing process.

A solid monetary foundation can significantly impact a business’s resilience against fluctuating economic conditions while positioning it to seize opportunities for advancement when it presents itself. Engaging in factoring arrangements through companies such as JAX Logistics enhances credit ratings and presents flexible repayment options vital for enduring success and prosperity.

Ultimately, engaging in factoring sets up a platform where businesses can expect continual financial stability and prioritize progressive development as a standard objective.

The Factoring Process Simplified

The factoring process is akin to plotting a straightforward course through tranquil waters.

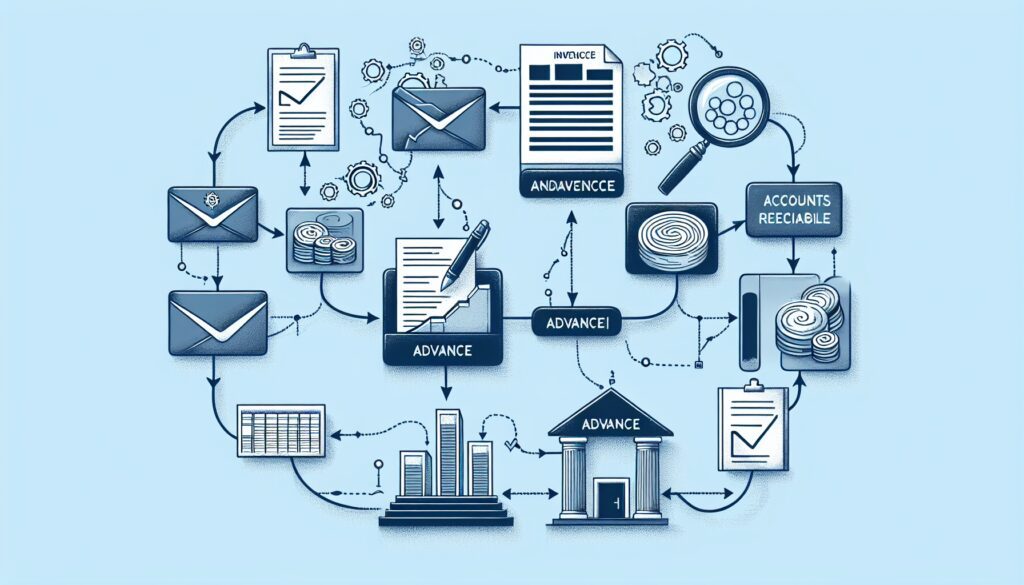

The invoice factoring journey begins with the following:

- Selling outstanding invoices to a factoring company at a discount for immediate cash flow

- This move can set your business on a course for smooth financial sailing

- This process is simple and efficient. It involves selling unpaid invoices for quick cash access, avoiding the headwinds of waiting for customers to pay.

The journey of invoice factoring involves:

- Setting up an account with a factor

- Qualifying for the service

- Submitting invoices

- Receiving a prompt cash advance based on a percentage of those invoices

The simplicity of this process is a beacon for businesses seeking financial stability, lighting the way to a future where reliable cash flow concerns are a relic of the past.

Submitting Invoices and Receiving Advances

In factoring, handing over invoices is akin to charting a course through well-known seas. Jacksonville businesses can present their outstanding invoices using traditional manual methods or by harnessing modern integrated invoicing systems that complement their business operations. Once an account has been established with a factor, these businesses can submit their unpaid invoices and, in return, receive an immediate cash advance that reflects a pre-determined percentage of those invoice amounts.

The expedition from submitting an invoice to receiving funds mirrors sailing with a strong tailwind. After presenting and gaining approval for said invoices, companies typically see the money promptly deposited into their accounts. This efficient influx of capital is vital for businesses dependent on robust cash flow to sustain daily functions and embark on expansion endeavors.

This approach provides enterprises operating within Jacksonville with a smooth transition from offering sales on credit terms to securing essential working capital necessary for flourishing in competitive markets.

Managing Your Accounts Receivable

Upon assuming control of a business’s invoices, a factoring company relieves that business of the need to manage its accounts receivable.

Factoring services available in Jacksonville provide significant advantages, including:

- Proficient handling of accounts receivable

- A steady stream of cash infusion

- Decreasing the administrative load tied to debt collection tasks

- The option for companies to delegate their collections process entirely

- Minimizing potential credit risks associated with customers

- Cutting down on expenses incurred during collections

Such services benefit small businesses seeking more efficient operations and enhanced cash flow.

With fewer resources devoted to chasing up payments on receivables, businesses can redirect their energy toward essential strategic activities and expanding their market presence.

The roles played by a factoring company include:

- Upkeep of the ledger pertaining to accounts receivable

- Administration of customer credit linked to invoice amounts

- Streamlining crucial financial processes within the firm

- Undertaking payment collection efforts from clients directly

Consequently, this setup empowers businesses with more latitude to dedicate themselves to achieving their main objectives.

Monitoring and Reporting

Maintaining consistent oversight and documentation is crucial for guiding a business’s fiscal path. These measures enable companies to closely track the success of their factored invoices and gauge the overall value derived from employing factoring services. Factoring entities equip businesses with comprehensive updates and insights, analogous to how a captain diligently records navigational details in a ship’s log.

With knowledge from these documents, firms can make astute financial decisions akin to navigating by compass. They gain clear visibility into both cash flow and pending receivables. This empowers businesses to confidently traverse their financial landscapes, equipped with critical data needed for successful passage. Regular scrutiny and thorough record-keeping go beyond simple course maintenance – they are key instruments in enhancing operational efficiency and achieving economic growth.

Summary

As we dock at the end of our journey through Jacksonville factoring, we reflect on the robust financial solutions these services offer. The benefits are as clear as the Florida sun, from unlocking working capital to enhancing business growth and simplifying the factoring process. With the right factoring partner, businesses can set sail toward a future of stability and success, confident that their cash flow is in capable hands.

May the winds of factoring propel your business forward to thriving shores. Of your many choices in Jacksonville invoice factoring companies, we hope you choose award-winning Bankers Factoring.

Frequently Asked Questions

What percentage of the invoice value do Jacksonville factoring companies typically advance?

Factoring businesses in Jacksonville usually offer up to 90% cash advances based on the value of submitted invoices, substantially boosting companies’ cash flow.

How quickly can I receive funds from an invoice factoring company in Jacksonville?

Upon presenting your invoice to a factoring company based in Jacksonville, you are anticipated to obtain funding within 24 hours since such companies typically sanction financing in no more than three days.

Is invoice factoring a good option for startups or businesses focused on growth?

Indeed, factoring may be a viable option for startups or growth-oriented businesses since it relies on customers’ creditworthiness rather than the company’s own net worth. This attribute makes it especially appropriate for these types of enterprises.

Can factoring help my business expand its market reach and customer base?

Certainly, by enhancing cash flow through factoring, your business has the potential to broaden its market presence and acquire a larger clientele. This infusion of cash permits investment in marketing and sales efforts that can lure new customers and propel expansion.

Does invoice factoring add more debt to my business’s balance sheet?

No, Jacksonville companies engaging with a factoring company by selling your outstanding invoices does not increase your business’s debt on the balance sheet since it is not an act of borrowing but rather an instance of factoring or selling those invoices.

Ready for the owner-employees of Bankers Factoring to grow your business with our award-winning receivable factor financing, including bad debt protection? Use our fast online factoring application or call 866-598-4295.

Fast Funding

"*" indicates required fields