Bankers Factoring: Your Tennessee Invoice Factoring Company

Tennessee COVID Small Business Resources

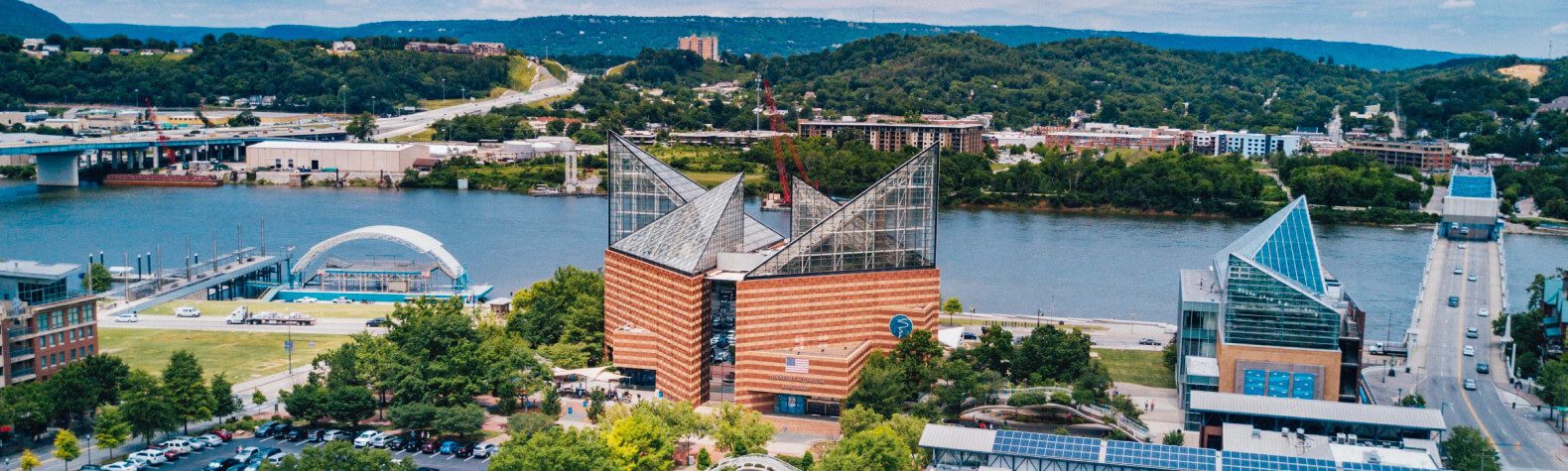

Tennessee, the Volunteer State, is known for its friendly people who are always ready to help others. That cooperative spirit is apparent in its pro-business climate, which allows all businesses a chance to thrive. This makes the state one of the best for starting or growing a business. Bankers Factoring is proud to offer non-recourse invoice factoring and PO funding to Tennessee entrepreneurs so they can turn their accounts receivable into same day working capital.

We are one of the few award-winning payroll funding companies for Tennessee businesses that offers same-day direct deposit via wire. On a non-recourse basis, we turn your unpaid invoices into safe working capital. You can see why we are the invoice factoring company of choice for so many small business owners in Tennessee and North Georgia.

Tennessee consistently ranks within the top 5 states that are considered best for businesses. CNBC, for example, puts Tennessee at number 5 in their recent America’s Top States for Business 2021. And for Business Facilities magazine, Tennessee comes in 3rd for Best Business Climate in 2020. And in last year’s International Economic Development Council (IEDC) Annual Conference, Tennessee was the number 5 state with the best business climate.

So, what makes Tennessee great when it comes to business? It’s because of the following:

- There is no personal income tax on wages and salaries.

- A right-to-work state.

- A long history of fiscal responsibility

- According to The Tax Foundation, state and local taxes paid per capita are the second lowest in the country.

- They were rated Triple A by all major rating services.

- And a successful overhaul of our tort and workers’ compensation laws.

In addition, Tennessee also offers many tax incentives and business grants that appeal to starting entrepreneurs. That’s why Bankers Factoring is Tennessee’s go-to invoice factoring company—turned down for bank financing? We have special programs for that, too.

Bankers Factoring funds via invoice factoring Tennessee Companies in the Industries of:

Aerospace & Defense

Appliances & Electrical

Automotive & Electric Vehicles

Chemicals

Military Vendors

Healthcare & Life Sciences

Rubber, Ceramics & Glass

Fast Funding

"*" indicates required fields

PO Financing in Tennessee

Suppose you run a manufacturing business in Tennessee, and you receive a large purchase order. However, you don’t have the funds to buy the supplies you need to fill that order. In this situation, purchase order financing from Bankers Factoring is the solution you need.

And what is PO financing? It’s a B2B or B2G solution where we can buy the supplies for you. Alternatively, you can also use our credit to arrange terms with your vendor. And since you will be factoring the invoice for that order with us, we can provide the needed PO financing. As a result, you can deliver your promise to your customers as your local factoring company.

We know you have many choices in Chattanooga, Memphis, and Nashville among Tennessee invoice factoring companies. We hope you choose award-winning and employee-owned Bankers Factoring for help with your cash flow problems. Have the money to make payroll and pay suppliers with Bankers Factoring Company unlimited working capital solutions versus sweating slow-paying customers. We are one of the few award-winning Tennessee factoring companies.

We also have special funding programs for Dollar General, Publix, and other Tennessee retailers. From Chattanooga to Johnson City, from Memphis to Nashville, from the Music City to the Smokies, we want to be your local invoice factoring company.

To qualify for PO financing, you must:

- Sell to B2B or B2G Customers

- Your minimum gross margin must be at least 20%

- Have experience with similar products and comparable clients

- Transactions per month of no less than $50,000

- Provide qualified purchase orders or letters of credit from your customers

The Bankers Factoring Advantage:

Being an employee-owned invoice factoring company, we know how cash flow issues can set your business back. Thus, we provide the capital you need to keep working.

- We take the Credit Risk with low-cost customer credit checks.

- Discount Rates are as low as .95-1.6%.

- $25,000-$10,000,000 Invoice Credit Line.

- Same Day Funding after Setup with Bankers personal attention.

- Fast 24 hours approval process versus bank line turndowns.

- Safely offer payment terms to grow your small business with competitive advances.

- Accounts receivable financing and factoring financial services.

- One of the few financing companies with funding programs for tax issues.

- TN Payroll Funding-Let us be your TN payroll office.

- Apply Online in Minutes for fast cash flow.

- No Hidden Fees with a small factoring fee.

- Memphis, TN factoring offices are available to meet your financial needs.

- 24/7 Online A/R Reporting to monitor your cash flow.

- Credit Services & Risk Analysis included in our invoice factoring programs.

- Low costs, quick cash against open invoices.

Ready For Bankers Factoring To Fund Your Tennessee company through invoice factoring services for small businesses?

Call or go to our Bankers-Factoring Application

Bankers Factoring Mississippi Offices | Bankers Factoring Kentucky Offices | Bankers Factoring Georgia Offices