A Local Baltimore Factoring Company

Invoice Factoring for Your Baltimore Company

Are you struggling with slow-paying customers in Baltimore? Factoring companies can offer the quick cash injection your business needs. This no-nonsense guide provides vital insights into the best Baltimore factoring company options, helping you make an informed choice quickly. Learn how to leverage your accounts receivables effectively without the red tape and get back to growing your business.

Key Takeaways

- At competitive rates, Baltimore factoring companies offer flexible, tailored financial solutions, such as recourse and non-recourse factoring. These solutions help local businesses improve cash flow and stimulate growth.

- Factoring services in Baltimore provide immediate cash advances to businesses against outstanding invoices, allowing them to meet urgent cash flow needs and invest in operations without the wait associated with customer payments.

- Compared to traditional bank loans, invoice factoring in Baltimore offers easier qualification and faster access to funds. It does not incur debt or dilute equity, making it an attractive cash-flow solution for businesses.

Exploring Baltimore’s Factoring Services

Immerse yourself in the world of Baltimore’s factoring services, characterized by flexibility and custom-fit financial solutions. Maryland factoring companies provide a wide array of options, including recourse and non-recourse factoring, to meet the diverse needs of local businesses. With competitive rates as low as 0.69% to 1.59%, it’s no wonder that savvy business owners are turning to factoring as a reliable source of immediate cash advances against outstanding invoices.

Baltimore’s factoring process offers the following benefits:

- Bolstering cash flow

- Managing business expenses

- Propelling growth initiatives

- Fostering job creation

- Contributing to the stability of the regional economy.

The Role of a Baltimore Factoring Company

What role does a factoring company play for Baltimore businesses? The answer lies in their primary function: to provide immediate liquidity by converting outstanding invoices into cash payouts. Factoring companies purchase these invoices at a discounted rate, effectively assuming control over the accounts receivable. This financial maneuver allows businesses to infuse their operations with necessary funds without waiting for customer payments, which can often take 30, 60, or even 90 days.

Advantages of Local Invoice Factoring

What makes a local Maryland factoring company better than a non-local provider? Baltimore businesses enjoy personalized services that are attuned to the unique rhythms of the local economy. Companies like Bankers Factoring offer competitive factoring options and provide dedicated account teams to ensure services are tailored to each business’s specific needs.

With local invoice factoring, businesses gain immediate access to working capital, bypassing cash flow conundrums and focusing their energy on expansion and innovation without getting bogged down in administrative duties.

Furthermore, diversified factoring services in Maryland’s strong sectors, such as manufacturing and healthcare, contribute to a thriving business environment.

Streamlining Your Business with Baltimore Invoice Factoring

Baltimore, a city brimming with entrepreneurial spirit, boasts invoice factoring services that serve as pillars of financial support, aiding businesses in streamlining their operations. By transforming outstanding invoices into immediate cash flow, companies can tackle common financial challenges head-on and embrace sustainable growth. Invoice factoring in Maryland, particularly Baltimore, has become a reliable financial solution for needy businesses.

This injection of working capital allows business owners to divert their attention from collecting payments to growing their operations—a strategic pivot that can prove decisive in today’s fiercely competitive marketplace.

How Invoice Factoring Strengthens Cash Flow

Cash is the lifeblood of any business, and invoice factoring acts as a vital transfusion, instantly converting unpaid invoices into the cash needed to cover operational expenses. With the ability to rapidly infuse capital into their businesses, Baltimore entrepreneurs can respond swiftly to urgent cash flow needs and seize investment opportunities as they arise.

Maryland factoring companies offer quick verification processes, ensuring that businesses can receive funding within 24 hours and thus maintain a consistent cash flow, which is critical for long-term financial stability. Moreover, because invoice factoring services are relatively simple to qualify for, they allow businesses to mitigate financial constraints caused by slow-paying customers.

Addressing Urgent Cash Flow Needs by Factoring

When quick action is necessary and financial demands are urgent, Baltimore businesses can turn to factoring services for speedy cash advances. These advances can cover various expenses, from purchasing raw materials to funding payroll, ensuring operations continue smoothly. What’s more, factoring offers the flexibility to choose which invoices to factor, allowing businesses to manage their cash flow and meet crucial financial obligations strategically.

With the promptness of companies like Bankers Factoring, which can verify and payout within 24 hours, businesses facing immediate cash flow challenges can find solace in the efficiency of factoring services. This capability is essential for handling everyday business demands and ensuring steady cash flow during economic downturns or seasonal industry shifts.

Invoice Factoring vs. Traditional Bank Loans in Baltimore

Within Baltimore’s financial context, there needs to be a clear differentiation between the swift, accessible funding offered by invoice factoring and the often inflexible, drawn-out process involved in obtaining traditional bank loans.

Read our article about business factoring.

While bank loans have their place, invoice factoring’s immediacy and ease make it an appealing alternative for many businesses. This form of financing allows businesses to grow without diluting equity or accruing debt, a significant advantage over the commitments associated with conventional loans.

Baltimore’s Maryland invoice factoring companies, including a reputable MD factoring company, offers a lifeline to those looking for a fast and efficient way to transform their outstanding invoices into working capital.

Ease of Qualification for Factoring Services

The qualification process for invoice factoring services in Baltimore is simpler and more efficient than traditional bank loans. Factoring companies typically focus on the creditworthiness of a business’s customers rather than the business itself, making it a viable option even for those with less-than-perfect credit.

To qualify for invoice factoring, businesses need to have:

- Invoices on net terms

- Creditworthy customers

- A proper corporate structure

- An absence of restrictive UCC filings.

Factoring companies assess operational history and revenue alongside customers’ financial health without the stringent requirements often encountered in bank loan applications. This focus on the customer’s ability to pay, rather than the business owner’s personal credit, allows a wider range of businesses to secure the needed funding.

In Baltimore, where a blend of established companies and startups thrive, factoring services provide a more accessible cash advance option, particularly for those dealing with slow-paying customers or rapid growth.

Speed of Funding: Factoring vs. Bank Loans

In business, speed matters, and when it comes to financing, invoice factoring decisively outstrips traditional bank loans. Baltimore companies approved for invoice factoring can often start receiving funds within a day or two, starkly contrasting the weeks or months it can take to secure a bank loan. This expedited approval process is tailored to meet the rapid funding needs of businesses, especially those with creditworthy customers.

Invoice factoring, also known as accounts receivable factoring, is designed to provide an immediate cash response, a speed and efficiency that traditional bank lending processes rarely match. An invoice factoring service can help businesses achieve this financial flexibility.

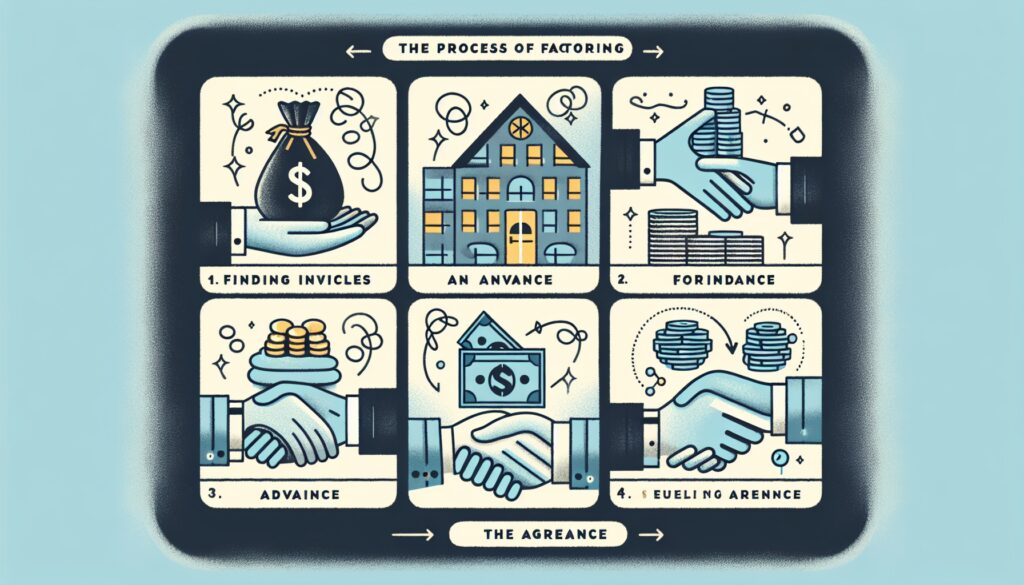

The Factoring Process: A Step-by-Step Guide for Baltimore Companies

For Baltimore businesses aiming to maximize their cash flow via invoice financing, grasping the factoring process is crucial. The process is straightforward: companies submit their invoices for a cash advance, receive the funds, and settle the account once the customer pays. Fees for this service are determined by variables such as invoice volume, customer creditworthiness, and the length of the factoring period.

After the customer pays, the factoring company releases the reserve amount, minus their fee, to the business.

Submitting Invoices for Factoring

To embark on the factoring journey, businesses begin by issuing invoices and establishing an account with their chosen factoring company. After setting up the account, companies can submit their invoices for processing and receive cash advances to keep their operations running smoothly.

The application process involves submitting various documents, including invoices for completed orders, an accounts receivable aging report, corporate paperwork, bank details, tax ID, and personal identification.

Receiving Your Advance

After verifying the submitted invoices, factoring companies typically advance between 70% and 90% of the invoice value. This cash infusion is usually made available within 24 hours, providing immediate financial relief to needy businesses.

The speed of this service is a testament to the efficiency of factoring companies like Bankers Factoring, which prioritize rapid funding to meet their clients’ needs.

Final Settlement After Customer Pays

Once the customer settles the invoice, the factoring process culminates. The factoring company deducts the fees and the initial cash advance from the reserve account and wires the remaining balance to the business’s bank account. This final step concludes the transaction, ensuring all parties are financially satisfied.

The focus on efficient fund transfer and transparent fee deduction is pivotal for businesses that rely on factoring services for consistent cash flow.

Selecting the Right Baltimore Factoring Company for Your Industry

Selecting the appropriate factoring company is vital for Baltimore businesses, given that the right partner can deliver custom-made financial solutions addressing the specific cash flow requirements of diverse local industries.

Companies like Bankers Factoring offer non-recourse factoring options, taking on the credit risk for the invoices they factor, which can be a significant advantage for businesses concerned about their customers’ creditworthiness.

Furthermore, comprehensive services that include credit analysis and risk assumption are paramount for businesses operating in industries where managing credit risk is essential.

Factoring for Baltimore’s Prominent Industries

Baltimore’s economy is as diverse as the city itself, with prominent industries like transportation, staffing, healthcare, construction, and manufacturing all benefiting from the agility and support that invoice factoring provides. A staffing company, for instance, frequently turns to factoring services to manage its payrolls, particularly when it is experiencing growth in high-demand sectors such as consulting, IT, and medical fields.

Criteria for Choosing a Factoring Partner

In the process of choosing a factoring company, Baltimore businesses need to take into account multiple essential aspects. Here are some factors to consider:

- Industry experience

- Factoring agreement terms

- Fee structure

- Collection Practices

- The reputation of the factoring company can be assessed through client testimonials and reviews.

These factors can impact a business’s cash flow and customer relationships, so it’s important to evaluate each carefully.

Personalized service ensures the factoring experience is smooth and adapted to each company’s needs.

Success Stories: Baltimore Businesses and Their Factoring Journey

The success stories of Baltimore businesses that have navigated through the process serve as a testament to the potential of factoring. Some examples include:

- Consulting firms securing substantial lines of credit

- IT staffing companies managing government contracts

- Bankers Factoring’s ability to relieve a local business from the clutches of a Merchant Cash Advance loan and subsequently provide the necessary capital for growth

These examples show how transformative invoice factoring can enable businesses to efficiently meet their cash flow demands.

Business owners like Linda Villanueva praise the steady cash flow and personalized service that factoring companies provide, often describing the relationship as akin to family.

Summary

As we conclude our exploration of invoice factoring in Baltimore, it’s clear that this financial solution offers a powerful tool for businesses seeking to improve cash flow, manage growth, and easily navigate financial challenges.

Through personalized services, competitive rates, and a focus on the customer’s creditworthiness, factoring companies in Baltimore provide a lifeline that can transform the way businesses operate. Local businesses can unlock the potential of their outstanding invoices by choosing the right factoring partner, freeing themselves from the constraints of traditional payment cycles and banking processes.

Frequently Asked Questions

What is invoice factoring, and how does it benefit Baltimore businesses?

Invoice factoring allows Baltimore businesses to sell their unpaid invoices to a factoring company at a discount, providing immediate cash flow and enabling them to concentrate on expansion rather than collection efforts.

How does the factoring fee structure work?

Factoring fees are based on invoice volume, customer creditworthiness, and the factoring period. After the customer pays the invoice, the factoring company deducts its fee and cash advance from the reserve account and sends the remaining balance to the business.

Can new or small businesses in Baltimore qualify for invoice factoring?

Yes, new and small businesses in Baltimore can qualify for invoice factoring based on the creditworthiness of their customers rather than their own credit or operational history. This makes it accessible even for businesses with less-than-perfect credit.

How quickly can a Baltimore business receive funds through invoice factoring?

Baltimore businesses can receive funds within 24 hours after the invoice factoring company verifies the submitted invoices, offering a faster alternative to traditional bank loans.

What should I consider when choosing a factoring company in Baltimore?

Consider the factoring company’s industry experience, agreement terms, fee structure, collection practices, and reputation in Baltimore, shared through client testimonials and reviews. This will help you make an informed decision.

Ready for the owner-employees of Bankers Factoring to grow your business with our award-winning receivable factor financing, including bad debt protection? Use our fast online factoring application or call 866-598-4295.

Fast Funding

"*" indicates required fields