Top Maine Factoring Company: Boost Your Business Cash Flow

If your business is grappling with cash flow challenges in Maine, consider turning to an invoice factoring company serving Maine. These companies specialize in invoice factoring, which allows businesses to convert their accounts receivable into immediate cash. We will explore how partnering with Bankers Factoring can enhance your company’s cash flow and secure the required financial stability.

Key Takeaways

- Invoice factoring can significantly improve cash flow for Maine businesses by converting unpaid invoices into immediate working capital without adding new debt to the balance sheet.

- Various types of invoice factoring services, including spot, recourse, and non-recourse factoring, offer different levels of risk and flexibility to meet specific business needs.

- For Maine businesses that cannot qualify for traditional bank loans, invoice factoring and accounts receivable financing provide quicker access to funds with less stringent eligibility requirements.

Maine Invoice Factoring Company: What You Need to Know

Invoice factoring is a financial tool that provides crucial support for businesses grappling with cash flow issues, particularly in the context of Maine invoice factoring. It entails selling your accounts receivable to a specialized company and receiving immediate funds in return. This approach can be transformative for emerging and established Maine entities seeking rapid fund access.

A key benefit of leveraging invoice factoring lies in its non-debt nature. Unlike traditional bank loans, which saddle a business with Monetary commitments, invoice factoring capitalizes on revenues from completed work or products already shipped. Thus, companies can boost their cash reserves and pursue growth strategies without being weighed down by additional repayment pressures.

Securing funding via this method tends to involve less stringent criteria than those associated with conventional bank financing options since factors evaluate the commercial reliability of your client base and your firm’s operational solidity rather than fixating on just your enterprise’s credit ratings.

This ease of access could prove instrumental for firms operating out of Maine that aim to scale up operations or bridge fiscal shortfalls. Invoice factors provide swift infusions of funds essential for exploiting new ventures while ensuring smooth, continuous operation.

Invoice Factoring Services for Maine Businesses

Maine businesses can enhance their cash flow through various invoice factoring services catering to diverse needs and risk tolerance levels. Companies can choose from three main types of factoring services within Maine: spot, recourse, and non-recourse factoring.

Spot factoring allows for a more selective approach, as businesses are not committed to ongoing factoring arrangements. With this service, companies can:

- Opt to factor only specific invoices with a factoring company

- Maintain control over which invoices they wish to sell and the timing

- This makes it particularly suitable for businesses needing occasional cash flow assistance or those initially looking into invoice factoring.

Both recourse and non-recourse financing provide full-scale solutions while managing different degrees of risk. If you opt for recourse, your business will be responsible if customers fail to settle the invoiced amounts. Although usually accompanied by lower fees than other options, this type entails additional financial responsibility for the business. Non-recourse invoice factoring applies risk regarding unanswered details of the hacking form.

Accounts Receivable Financing Options

Another potent mechanism Maine enterprises can employ to boost their cash flow is receivable financing. This method enables businesses to utilize outstanding accounts receivable as security for acquiring a loan or advance. Effectively, this arrangement permits you to obtain an upfront sum on the amounts due from your customers by submitting your invoice documentation.

Accounts receivable financing’s significant benefits, often referred to as invoice financing, include its capacity to:

- Convert overdue invoices into immediate working capital

- This will be a critical solution for companies dealing with extended payment periods or clients who are slow to pay.

- Offer discount rates that may be comparable or even more favorable than charges associated with accepting credit card transactions, presenting it as an economical option for many enterprises.

By deploying accounts receivable financing strategies, Maine businesses stand poised to enjoy several key advantages, such as:

- Seizing early-payment discounts from vendors which could result in considerable cost savings

- Enhancing day-to-day operations through stabilized cash flow management allows business owners and managers to prioritize expanding their ventures over pursuing client remittances.

-Investing the funds obtained via accounts receivable financing right back into avenues of expansion aids the business’ scale-up and remains competitive within aggressive marketplaces

Comparing Working Capital Funding to Traditional Bank Loans

Recognizing the distinctions is vital when choosing funding solutions for your Maine business, such as invoice factoring versus traditional bank loans. A primary benefit of working capital funding options is their promptness in approval and provision of funds.

The prolonged processing time that can accompany a traditional bank loan—ranging from several weeks to months—working capital financing methods can deliver cash swiftly, often within 24 hours. This expediency in acquiring funds can be critical for businesses faced with immediate monetary demands or opportunities sensitive to timing.

Invoice Factoring Criteria versus a Bank Loan

The criteria for eligibility represent another notable contrast between these financial products. Traditional bank loans enforce rigorous standards that may prove daunting for smaller ventures or those lacking stellar credit histories. Conversely, working capital financing alternatives like invoice factoring tend to have more lenient qualifications than you’d find at a conventional bank. They assess your clients’ creditworthiness rather than solely focusing on your company’s track record, thus easing qualification requirements even if a business has minimal fiscal history or subpar credit.

There’s an essential aspect regarding collateral: it’s common for banks issuing traditional loans to necessitate this security pledge, which might obstruct some small businesses or new enterprises from moving forward with these financial avenues due to various constraints posed by such prerequisites. Conversely, working fundings typically don’t need any guarantee from assets.

Nevertheless, ample entities situated within the vicinity often deem the urgency of securing finances coupled with the simplicity of acquisition outweighs probable negatives, thereby rendering modes providing very appealing prospects satiating pecuniary demands present.

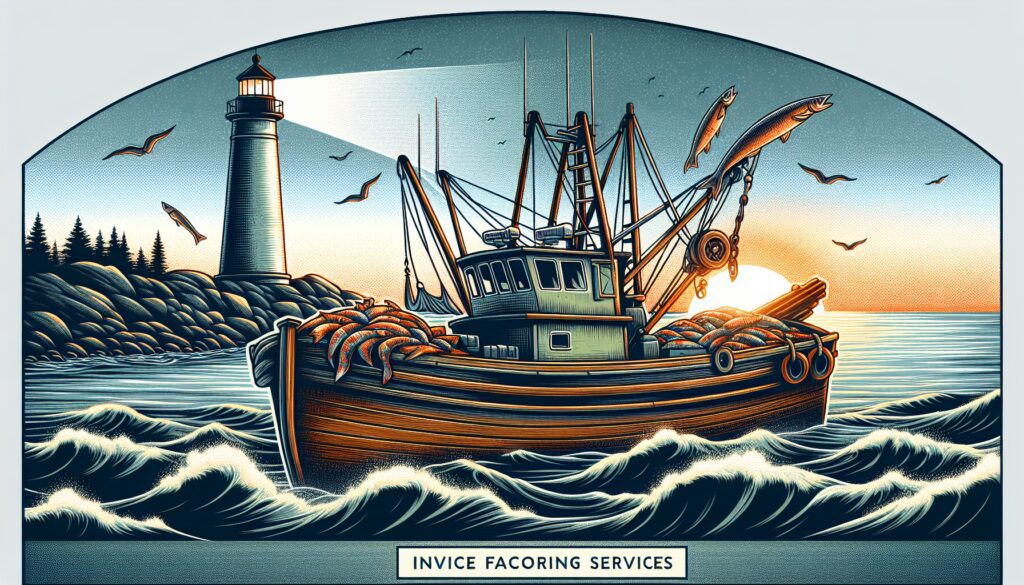

Industries Benefiting from Invoice Factoring in Maine

Various time-honored industries, such as fishing, shipbuilding, and paper production, bolster Maine’s economy. These sectors have shaped the state’s business environment alongside newer industries. Nevertheless, businesses within these fields often encounter challenges with cash flow management. For many Maine companies, invoice factoring has proven to be an essential strategy for managing their finances.

While all types of businesses can benefit from factoring services, they are precious for those who experience long waits between providing a service and receiving payment—a common scenario among manufacturing, wholesale, and transportation companies in Maine.

Take a local shipbuilder who finishes constructing a vessel but must endure 60 or 90 days before being paid. This leads to significant gaps in cash flow, just like when demand shifts cause irregular revenue periods at paper mills. Invoice factoring enables these enterprises to bridge such financial gaps swiftly by offering them immediate access to working capital necessary for covering day-to-day expenses or investing in opportunities to expand their operations without waiting on customer payments.

By incorporating invoice factoring solutions into their financial practices and collaborating with payroll service providers if needed (all while securing steady streams of capital). Main-based firms manage not only ongoing operational expenditures, including workforce remuneration but also capitalize on growth prospects presented over time, which contributes positively to both individual company success rates and overall economic resilience elevation across central labor market indicators like statewide mean earnings levels per week.

How Invoice Factoring Improves Cash Flow

Invoice factoring is a powerful mechanism for Maine businesses to enhance their cash flow significantly. This financing option turns unpaid invoices into immediate working capital by allowing companies to sell these accounts receivable to a factoring company in return for an upfront sum of money, between 70% and 90% of the total invoice amount. Once the business’s customer pays that invoice, they will receive the remaining balance minus any fees associated with factoring.

The primary benefit of invoice factoring is its ability to remove payment delays. Numerous businesses face considerable challenges when customers have lengthy payment terms stretching over 30, 60, or even more days, which can lead to critical liquidity issues.

By opting for invoice factoring services, companies gain instant access to funds already due. Thereby effectively filling financial gaps. This expedited infusion of funds can be pivotal for firms needing urgent cash resources—it allows them not only to meet ongoing operational costs but also provides leeway to invest in potential expansion projects or avail prompt settlement rebates from vendors.

Choosing the Right Maine Factoring Company

Maine businesses seeking to enhance their cash flow via invoice factoring should prioritize finding the right factoring company. This factoring company must have extensive expertise in your industry, as they will have a more comprehensive understanding of your business’s specific challenges, needs, and the rhythm of your cash flow cycles. This can lead to tailored solutions and beneficial insights for managing finances.

When scrutinizing potential factoring companies, it is vital to meticulously evaluate their fee structure and service offerings. Search for explicit pricing models without hidden fees or additional charges that could diminish profits. Consider how practical the factoring company’s customer support is. Access to responsive and informed assistance is invaluable during first-time engagements with invoice factoring services or while handling complex issues.

The reputation of a prospective Maine-based financing partner also weighs heavily on decision-making processes regarding funding options.

When Choosing a Factoring Company, look for:

- Investigate reviews and client testimonials closely – especially from peers within similar industries.

- Consider clients’ opinions about dependability in communication and satisfaction levels with provided services.

- Ask questions concerning advance rates offered by these companies and timelines associated with accessibility to funds since both are fundamental components contributing to efficient cash flow management practices.

Finally, opt for a flexible factional firm whose contract terms can adjust over time, paralleling shifts within operational requirements faced by businesses as they grow.

Case Studies: Success Stories from Maine Businesses

Illustrative tales of Maine’s success clearly show invoice factoring’s impact on bolstering businesses within the state. Consider Jorge, a company president who credits more than eight years of sustained growth from invoice factoring. Through this financing method, his business secured stability and avoided cash flow challenges that might have impeded its development. Such long-term achievements underscore the potential for invoice factoring to underpin ongoing expansion in enterprises.

Similarly striking is the experience of an intermodal transportation and warehousing firm in Maine. It reaped significant advantages from immediate funding access and an efficient invoicing process via its factoring partner. The ease and speed with which they could secure funds enhanced cash flow and strengthened communication and trust with the lending entity—pivotal factors that allowed them to concentrate on essential business operations instead of financial uncertainties.

A diverse array sector-wise throughout Maine has felt these empowering effects firsthand. A Gardiner-based trucking enterprise obtained a $300,000 approval through factoring services, boosting its working capital sufficiently to pursue larger contracts confidently.

In another instance, Portland’s medical staffing agency successfully acquired $1.3 million through similar means—a substantial investment enabling it to fulfill payroll needs, expand staff recruitment efforts effectively facing healthcare industry demands head-on—and signaling lucrative avenues ahead for growing companies in various sectors across Maine when leveraging tailored solutions provided by finance partners like those offering inventive strategies such as bill-to-finance conversions (invoice factoring).

Summary

As explored throughout this article, invoice factoring offers a powerful solution for Maine businesses seeking to improve their cash flow and drive growth. From traditional industries like fishing and shipbuilding to emerging sectors in technology and healthcare, companies across the Pine Tree State can benefit from the quick access to working capital that factoring provides. By converting unpaid invoices into immediate funds, businesses can overcome cash flow challenges, seize new opportunities, and maintain steady operations without incurring additional debt.

The flexibility and accessibility of invoice factoring make it an attractive alternative to traditional bank loans, especially for small businesses or those with less-than-perfect credit. As you consider your financing options, remember that choosing the right factoring partner is crucial to maximizing the benefits of this financial tool.

With the right approach and a reliable factoring company, your Maine business can unlock its full potential and thrive in today’s competitive marketplace. So why wait? Take the first step towards financial stability and growth – explore how invoice factoring can boost your business’s cash flow today!

Frequently Asked Questions

What is invoice factoring, and how does it work for Maine businesses?

Factoring companies offer Maine businesses the opportunity to convert their unpaid invoices into immediate cash by purchasing them. This process, known as invoice factoring, provides a swift solution for businesses to access working capital without waiting for customer payment. Factoring companies typically grant businesses 70-90% of the value of the invoice in advance.

How does invoice factoring differ from traditional bank loans?

Unlike traditional bank loans, factoring does not increase your company’s debt on its balance sheet. Instead, it hinges on your customers’ credit standing rather than your business, simplifying the qualification process.

Compared to conventional bank loans with prolonged approval procedures, invoice factoring grants quicker access to funds for businesses in need.

Which industries in Maine can benefit most from invoice factoring?

In Maine, manufacturing, wholesale, staffing, transportation, fishing, and shipbuilding companies often face substantial delays from delivering services to receiving payment. Invoice factoring is an appealing solution for these businesses to alleviate cash flow concerns caused by such extended periods awaiting payment.

What should I consider when choosing a Maine factoring company?

Selecting a factoring partner familiar with your industry and presenting clear terms in the application process, flexible contracts, and appropriate advance rates is vital. Evaluate their reputation, customer support caliber, fee system, and understanding of your business’s unique cash flow patterns to ensure they align with your requirements for smooth operations.

How quickly can I receive funds through invoice factoring?

Invoice factoring offers companies a swift means to boost their cash flow by delivering funds within 24-48 hours after an invoice is submitted. Certain firms even provide access to cash on the same day, a suitable option for those requiring immediate funding.

Ready for the owner-employees of Bankers Factoring to grow your business with our award-winning receivable factor financing, including bad debt protection? Use our fast online factoring application or call 866-598-4295.

Fast Funding

"*" indicates required fields