The 5 Steps to Fast Working Capital with A/R Factoring

Is Invoice Factoring Right for My Business?

Table of contents

- The 5 Steps to Fast Working Capital with A/R Factoring

- What is a Factoring Company?

- Who Bankers Factoring Helps

- The 5 Steps of Invoice Factoring

- What Companies Use A/R Factoring

- The two types of invoice factoring include:

- Invoice Factoring Terms, Rates & Fees

- Bankers Factoring Invoice Financing at a Glance

- Invoice Factoring Qualifications

- Invoice Factoring Rates

- Example of invoice factoring costs:

- Invoice Factoring with Bankers Factoring

- Benefits of Invoice Factoring with Bankers

- Ready for the owner-employees of Bankers Factoring to fund your entrepreneurial dreams with A/R factoring? Call 866-598-4295 or go to Bankers-Factoring-Application .

What is a Factoring Company?

Invoice factoring, also known as A/R Factoring, is a financing solution for companies to turn their 30-90 days outstanding invoices and open accounts receivable into working capital. Accordingly, if your business invoices business or government customers for products and services, your unpaid accounts receivable can be assigned to Bankers Factoring for an ongoing 80-90% advance to your checking account on the day you invoice your customers.

Moreover, With Accounts receivable financing or invoice factoring with Bankers Factoring, we offer your business up to a 90% cash advance of your invoices. Conversely, after the customer pays Bankers Factoring, we also rebate you the remainder of the invoice minus our fees.

Who Bankers Factoring Helps

Bankers Factoring partners with businesses needing up to $5 million in an invoice factoring credit facility. In addition, we do not hassle your customers, offering a light touch by only verifying that approved invoices are in your system and will be paid according to your agreed-upon terms with your customers resulting in a beneficial relationship with all parties. Bankers Factoring and our employee-owners are also ready to help your business utilize our non-recourse invoice factoring and purchase order financing cash flow solutions.

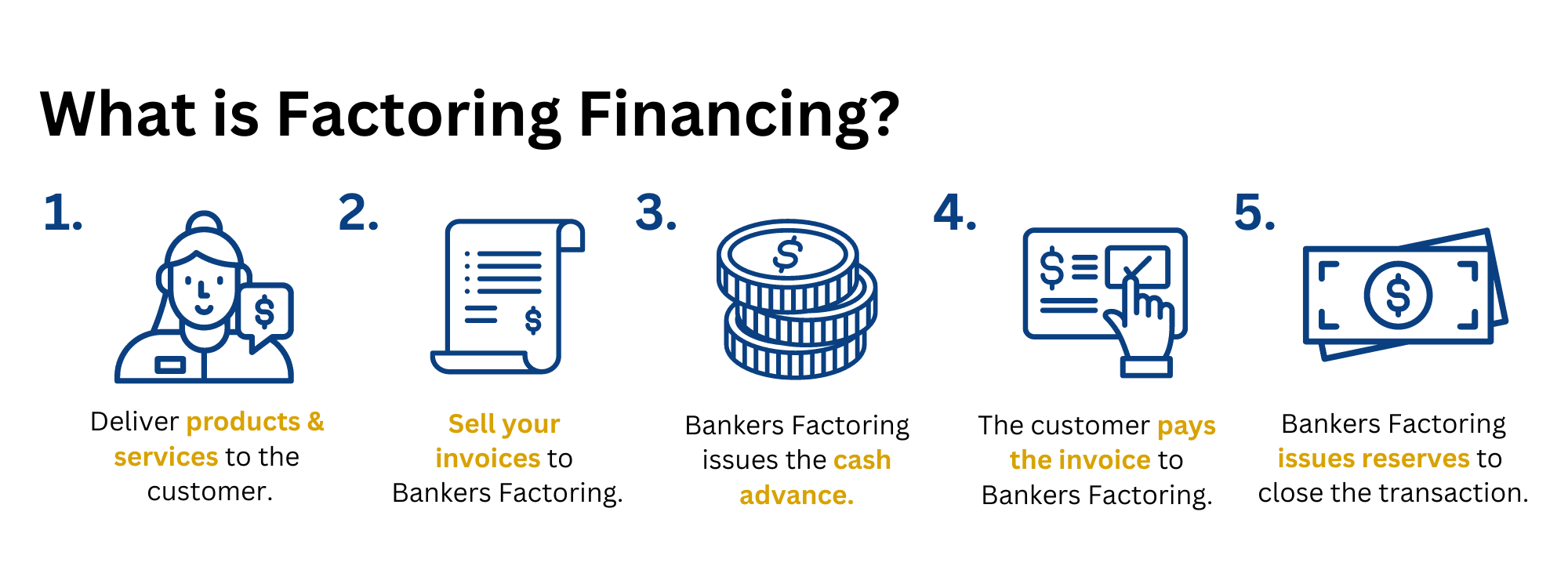

The 5 Steps of Invoice Factoring

1. invoice Your Customer

When you deliver products or services to your business-to-business (B2B) or business-to-government (B2G) customers, you currently quickly bill them so your invoices can get in their accounts payable system so you can get paid in 30-90 days. However, that will not change when you get on board with Bankers Factoring.

In fact, qualifying for invoice factoring with Bankers is effortless through our online application. Moreover, generating an invoice for your customer will create the accounts receivable for Bankers Factoring to purchase in exchange for an 80-90% cash advance.

2. Sell Your Invoices (Accounts Receivables) to Bankers Factoring

Bankers Factoring will qualify and approve your business for A/R factoring financing after our quick and easy process. In addition, we look at the creditworthiness of your customers to ensure they have the financial means to pay your open invoices and that your customers have a reliable payment history.

When Bankers Factoring approves your invoice factoring line, we buy your accounts receivable as an asset purchase and the rights to future payments. Also, the deal’s structure is determined during this time, including the initial factoring line, factoring fees, and cash advance amount, which are mapped out in the factoring agreement.

The deal structure depends on variables such as your history of chargebacks and returns with your clients.

3. Bankers Factoring Issues the Cash Advance

After we approve your invoices in the morning, we wire the first installment or the factoring advance to your bank account, typically 80-93% of your total open accounts receivable by 4 pm. You also supply Bankers with a Funding schedule that gives us the batch of invoices each day you want to be funded. We will wire you by the day’s end if we verify one or all the invoices.

Bankers Factoring, the most dependable invoice factoring company in North America, provides same-day funding after approval in most cases. Our light touch is well respected by our client’s customers when repaying the invoice. Moreover, our proven process enhances business relationships.

Bankers Factoring serves clients across the globe with accounts receivable financing services. Some common industries include trucking and transportation, construction, payroll and staffing, technology, and wholesale businesses.

4. Customer Pays the Invoice

Your customer will pay Bankers Factoring according to the terms of the invoice. In fact, we manage all receivable activities, allowing you time to operate and grow your business. Also, The Federal Assignment of Claims Act governs invoice factoring transactions that are assigned by the federal government.

5. Bankers Factoring Issues the Earned Reserve Rebate to Close the Transaction

After receiving your customer’s payment, we then pay out the remaining invoice balance minus our fees. This closes the invoice factoring transaction. For example, if your advance was 80%, we pay the final 20% minus our daily factor rate.

What Companies Use A/R Factoring

Invoice factoring, or accounts receivable factoring, is an efficient form of capital for businesses lacking consistent cash flow. Our customized factoring services could work for your company if your business has invoices of at least $25,000 per month to B2B or B2G customers. Bankers Factoring is also proud to offer full invoice factoring and PO financing solutions.

The two types of invoice factoring include:

- Full Recourse Factoring: the factoring company does not take on the non-payment risk plus the credit risk if the customer does not pay the accounts receivable or unpaid invoices they owe.

- Nonrecourse Factoring: the factoring company takes on the credit risk, including bankruptcy, insolvency, and protracted slow pay. Bankers Factoring also provides a transparent factor fee, no hidden fees, and unlimited capital. As our client, you are responsible for the quality and performance of your products and services with your customer, the account debtor.

Invoice Factoring Terms, Rates & Fees

Invoice factoring with Bankers is an efficient working capital solution for companies of all sizes, locations, and stages. So if your invoices qualify for invoice factoring, your business must be up to date on taxes or have a tax payment plan in place. Bankers Factoring also works with startups and clients with millions of dollars in monthly receivables.

Qualifying for invoice factoring with Bankers is more straightforward than qualifying for traditional financing sources such as large financial institutions and banks. You will typically qualify for invoice factoring with invoices from credit-worthy customers and have no personal tax or legal issues. Your credit report and scores are not part of the qualifying process.

Bankers Factoring Invoice Financing at a Glance

| Invoice Factoring Amount | $25,000 to $5,000,000 per month |

| Invoice Payment Terms | Payable within 30, 60, 90, or 120-days |

| Time to Receive Funding | Same day as approval-faster than a bank loan |

| General Qualifications | Invoice B2B or B2G creditworthy customers- No serious legal or tax problems- Consistent on-time paying customers |

| Paperwork Requirements | Standard personal & business information, Accounts receivable aging report, Accounts payable aging report. |

| Discount Rate | 0.75% to 2.9% |

| Advance Rate | 80% to 95% |

| Other Fees | Varies by client industry, customer creditworthiness, and other factors |

Invoice Factoring Qualifications

To qualify for invoice factoring with Bankers, we look at your customer’s creditworthiness and your tax compliance. Below are three core categories for qualifying for accounts receivable factoring:

- The invoice, A/R, and account debtor: We look at the customer of the invoices or the account debtor from your B2B or B2G customer entities. Collectively, we ensure no claims on the invoice that would interfere with the repayment of the A/R. Commercial customers often extend payment terms and have an established credit history and a history of on-time payments.

- Tax and legal history: Your business should not have a history of serious tax or legal problems. It is important to have your quarterly 941 forms and annual business returns ready for qualifying.

- Documentation: to expedite your approval process with Bankers, it is critical to have the proper documentation ready with your factoring application. Critical documents include accounts receivable aging reports, invoices, articles of incorporation, customer contracts, and general identification proof. Your credit score is not a significant variable like business financing at a bank.

Additional qualifying standards may exist depending on your situation, industry, or customer.

Invoice Factoring Rates

The base cost of an invoice factored depends on two things:

- Discount rate (or factor rate): The discount rate is the primary cost of borrowing money from the factoring company and is typically charged monthly. Bankers Factoring rates range from 0.75% to 3%, depending on your business. Bankers offer a tiered system for discount rates, so the more you factor invoices in a month, the lower your rate can be.

- Scope of the transaction: Discount rates are charged at regular intervals, so the invoice amount and time it takes for the customer to pay your invoice will determine your cost.

Example of invoice factoring costs:

Suppose you factor a $100,000 invoice with an advance of 80% and a discount rate of 1.8% per month. You, the client, would receive $80,000 initially as the first installment. If your customer pays within 30-days, Bankers Factoring keeps the $1,800 discount fee and pays you the remaining $18,200 rebate. Please read our article on Understanding Factoring Rates and Fees.

Invoice Factoring with Bankers Factoring

Accounts receivable factoring with Bankers Factoring is a straightforward process that leads to long-term growth for our clients. With Bankers, our employee-owners understand the realities of running a business. We remove the burden of collecting your receivables and provide immediate working capital to grow and market your company.

As the most dependable invoice factoring company, we have broad experience across many industries, access to unlimited financing, and proven results with our promise of strength, safety, and guidance.

Benefits of Invoice Factoring with Bankers

| Quick funding & Fast Due Diligence | Unlimited lines of financing-Not Capped Business Loan |

| Diverse Industry Experience | No hidden fees |

| 24-7 online A/R reporting | A/R credit services |

Bankers Factoring, the top employee-owned A/R factoring company, provides a factoring line to clients with slow-paying commercial customers. Instead of waiting up to 120 days for payment, we immediately fund you with 80-90% of your invoiced amounts.

We remove the cash flow shortages to operate your small business and want you to understand what invoice factoring is, what a factoring company is, the factoring costs involved, and how factoring invoices work.