Small Business Purchase Order Financing plus Invoice Factoring

Table of contents

- Small Business Purchase Order Financing plus Invoice Factoring

- PO Funding for Small Business Summary

- What is purchase order funding or purchase order financing?

- How does PO funding work for the small business owner?

- What are the steps in the PO financing process?

- The typical process for PO funding or purchase order financing:

- Bankers Factoring is a Business PO Funding Company

- Ready for the owner-employees of Bankers Factoring to fund your business with PO Funding and Invoice Factoring? Use our fast online factoring application or call the toll-free number 866-598-4295

PO Funding for Small Business Summary

Purchase order funding, also called PO financing, facilitates the sale of physical goods, ensuring the buyer and seller are financially protected. PO financing helps small businesses lacking the financial position to acquire new inventory, grow their business, and overcome cash flow obstacles.

We have many articles on purchase order financing on our website.

Purchase Order Financing for Startups

Startups, small businesses, and entrepreneurs run into issues when they receive large purchase orders from commercial customers but lack the working capital to finance the transaction. Small companies feel financial strain waiting up to 3 months for payment after goods are delivered. The extended operating cycle, especially with importing companies, makes it hard for startups to fund operations.

Purchase Order (PO) financing is the facility small companies need to fund new sales orders and future overhead. Small businesses selling wholesale distribution channels demand significant cash reserves or capital to fill orders. Cash flow issues make it hard to keep up with seasonal trends or unexpected new customers.

Complex supply chains and long international lead times stress small business owners. PO funding bridges cash flow gaps, providing a finance facility to acquire and sell goods. Bankers Factoring PO funding enables startups to compete with larger companies.

Purchase order funding allows you to fund large customer orders and create more significant economies of scale and profit margins. Bankers Factoring is a PO funding and invoice factoring company that helps small businesses secure working capital to operate more efficiently. Our flexible funding options grow as your business grows.

Please read how to fund an import business with PO funding to learn more about being approved for an import purchase order financing line of credit.

What is purchase order funding or purchase order financing?

PO funding is a financing option for small businesses that lack the credit or working capital to fulfill the order. Small businesses lacking working capital have a difficult time purchasing new inventory. Purchase order funding allows your company to access working capital without balance sheet debt.

With Bankers Factoring, you receive 100% PO financing and access to unlimited working capital needed to grow your small business rapidly. We can fund the entire purchasing process from manufacturing, shipping, and order delivery to your customer, also called the account debtor, with PO factoring and PO funding & trade financing.

Once the account debtor receives the goods and an invoice, the facility becomes an accounts receivable factoring scenario. This benefits our clients because they are advanced up to 93% of the invoice value, less PO funding and factoring costs. Your company has immediate working capital once goods are delivered, eliminating the 30, 60, or 90-day wait for payment.

Learn more in our previous article: Bankers Trade Financing and Fast Invoice Factoring Now

How does PO funding work for the small business owner?

Small businesses develop relationships with large commercial clients such as Walmart, Dollar General, and Bass Pro. These big-box retailers rely on small importing companies to deliver merchandise at the store and distribution center levels. When these large companies send over purchase orders, we can start funding within days with your PO factoring line of credit.

When your small business receives a purchase order from a customer, Bankers Factoring can finance the costs of acquiring inventory. Once the products are delivered and marked as sold, we factor the new AR invoices to provide immediate working capital for our small business clients.

When small companies conduct business with high-credit-quality customers, they overcome traditional financing obstacles. Small businesses often lack the financial strength, history, or credit to secure bank financing. However, they can use PO financing and invoice factoring to overcome cash flow obstacles by receiving new purchase orders and continually delivering goods.

Learn more in our previous article regarding PO Funding & Invoice Factoring for the Wholesale Industry and Government Factoring

What are the steps in the PO financing process?

The PO funding financing process benefits our customers by having a third party monitor PO fulfillment. Third-party oversight ensures the quality of the merchandise matches the unique specifications, quantity, and packaging and helps reduce risk.

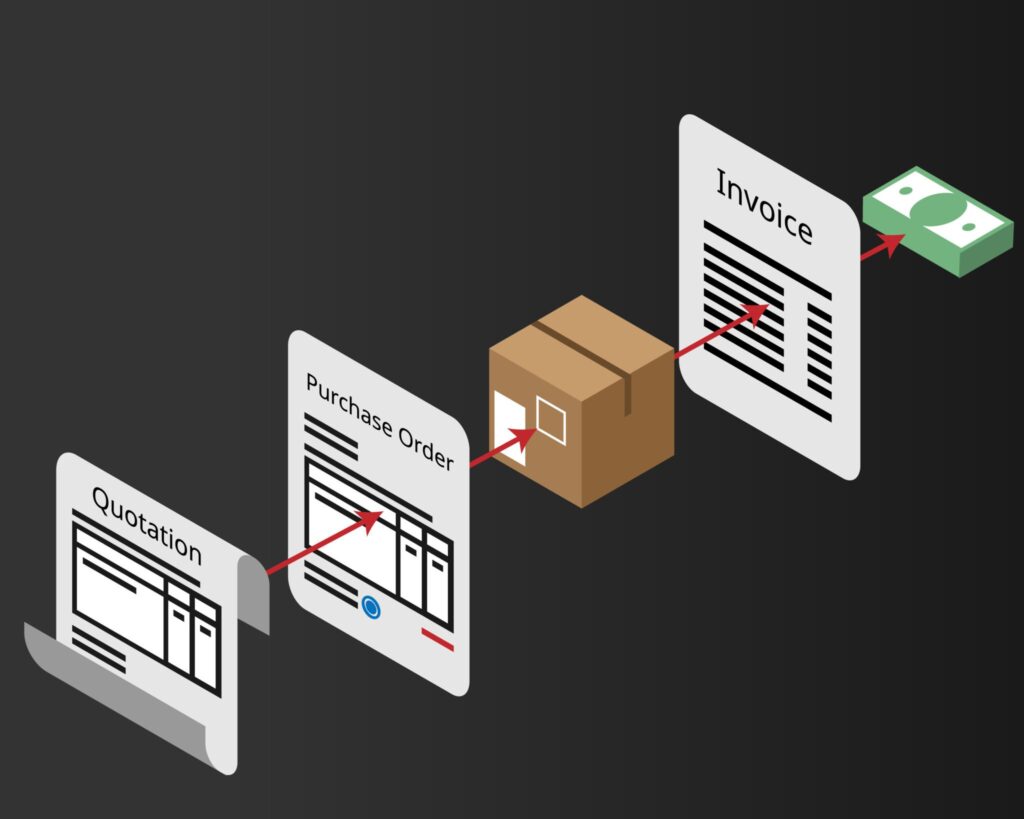

The typical process for PO funding or purchase order financing:

- Submit Online Funding Application

- Bankers Factoring works with your third-party supplier to negotiate terms. We provide Cash Against Documents and Letters of Credit Financing.

- Third-party supplier produces merchandise and ships directly to end-user (account debtor)

- Invoices for delivered goods transition into an invoice factoring agreement, allowing our client to receive up to 93% of the invoice value, less the purchase order funding costs.

- Once the final customer pays their accounts receivables, we deduct our small fees for the invoice factoring financing transaction and pay your remaining balance.

Learn more in our previous article, “What is trade financing?”

How much does Purchase Order financing cost?

Purchase order funding fees typically range from 2-4% per 30 days. Fee charges are based on the total PO cost, shipping, handling, and other costs. With Bankers Factoring, our PO funding fees start at less than 1%. Our PO financing costs begin at .9% per 30 days. Contact Bankers Factoring today to begin the PO funding process.

Can PO financing help my business grow?

PO financing is an excellent way for the not-yet bankable business to secure cash flow financing to grow your business. Bankers Factoring offers the unique financing ability to extend PO funding and invoice factoring financing. We are a one-stop shop for small business funding needs, including PO factoring, purchase order financing, and PO funding.

If you are bringing goods from overseas for resale and need purchase order financing, cash against documents or a vendor guarantee is a much cheaper option than a letter of credit. We have an article on the vendor guarantee process to help you understand how purchase order financing works.

Small companies can grow their business with PO financing plus an invoice factoring company by:

- Securing PO funding enables no upfront capital to acquire inventory

- Ability to take on larger purchase orders

- Increased buying power from the ability to take on larger purchase orders

- Based on your customer’s credit scores and not your or your business’s credit score.

- Improves cash flow by speeding up the receivables process

- Ability to forecast supply and demand more accurately

Please read our guide to purchase order financing and PO Funding Plus Factoring for Food Importers

Bankers Factoring is a Business PO Funding Company

Bankers Factoring works with small businesses in various industries to overcome financing obstacles. Our clients are importers, distributors, resellers, and wholesalers with customized PO funding and invoice factoring programs to have consistent cash flow. We help small businesses grow by financing purchase orders and accounts receivable. Suppose your business cannot secure traditional financing. In that case, our employee-owner team, offering services in Arizona, Georgia, Texas, Utah, and Florida, Missouri, Indiana, is ready to gameplan purchase order financing with you today.

We want to be your award-winning PO financing company.