Best Startup Business Loans and Start-Up Funding Alternatives Starting a new business has many challenges, and finding the right funding source is often at the top. This article walks business owners through the best business loans for startups, the different types available, and steps to increase your chances of approval. Whether you need funds for […]

Start-Up & Small Business Financing Challenges to Funding Growth

Start-ups face unique challenges with funding needs and limited sources. Building a start-up is an exciting venture, but getting it funded with venture capital or a business loan with very little business credit can be hard. And most factoring companies don’t understand revenue-based startup businesses and their business financing needs.

Per the CFPB, the nation’s 33 million small businesses employ nearly half of all private sector workers in the U.S. and account for the majority of new job creation. Operators of small and local businesses finance their enterprises through a variety of sources, including loans from banks, credit unions, and nonbank finance companies. Many of these businesses have a relationship with a local financial institution to help grow their business, but typically it is not enough.

However, the employee-owners at Bankers Factoring have lived through those challenges. We have a combined 50 years of personal experience funding start-ups through our non-recourse invoice factoring programs. Here, we share our thoughts and experiences on using A/R financing and purchase order funding to have your new business both survive and thrive.

Top 2026 Factoring Trends for Small Businesses: Navigate Cash Flow Challenges

Accounts receivable financing for small businesses Are you looking forward to the 2026 factoring trends for small business owners? This article covers the major developments impacting how small businesses manage working capital through invoice factoring business financing. Discover the emerging technologies and market changes set to shape the future. Key Takeaways Please read the top […]

Women-Owned Business Factoring

Women Owned Business Funding through Invoice Financing and PO Funding Invoice Factoring for Women-Owned Companies and Women Entrepreneurs Women-Owned Business Funding Woman-Owned Business Enterprise (WBE) is a company owned, operated, and controlled by at least 51% of one or more females. Female entrepreneurs require the same access to working capital as other businesses. However, cash […]

Top Strategies for Finance for Company Growth and Stability

Finance for Company Options, including invoice factoring Adequate finance for company growth and stability involves strategic budgeting, cash flow management, and selecting the right financing options. This article covers essential strategies like angel investors, equity, factoring, debt, SBA loans, government grants, and more to help you make informed decisions for your company’s financial health and […]

Top Strategies to Successfully Grow a B2B Business

Fix B2B cash flow problems with an Invoice Factoring Company Are you looking to grow a B2B business? This guide offers practical strategies to expand your market reach, strengthen client relationships, and improve operational efficiency. Discover how to optimize marketing and sales, secure financing, and leverage data for growth. Start driving your B2B business forward […]

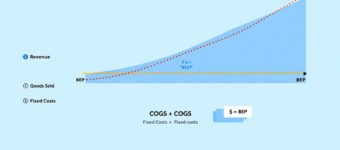

Break-Even Analysis: Simple Steps to Calculate

Understand Your Business’s Break-Even Point Wondering when your business will start making a profit? Break-even analysis can give you the answer. This analysis helps you find the sales volume you need to cover your costs. This article will explain how to calculate your break-even point and why it’s vital for your business strategy. Key Takeaways […]

Latino-Owned Business Funding Options in 2025

Financing for Latino-Owned Companies If you’re a Latino entrepreneur seeking to finance your venture, you may wonder what reliable funding options exist beyond traditional loans. This article cuts straight to the chase: Latino-owned business funding is evolving, with accessible options that understand your unique challenges. From grants to invoice factoring and culturally attuned lenders, we’ll […]

Top Alternative Financing Options for Small Businesses

Alternative Lending Solutions for Business Owners Are you struggling to get a business loan or a bank loan? Alternative business lending offers flexible options for small businesses. This article covers the top alternative funding solutions from alternative lenders offering small business financing options. Key Takeaways Understanding Alternative Financing Many small businesses have found a viable […]

How Do I Prepare a Cash Flow Statement

Sample Cash Flow Statement for Small Business Improve Your Cash Balance with Invoice Factoring Are you wondering how to prepare a cash flow statement? This guide covers everything from gathering financial documents to categorizing cash flows and choosing the correct method. You’ll also learn how to calculate net cash flow and verify the statement’s accuracy […]