Sample Cash Flow Statement for Small Business

Improve Your Cash Balance with Invoice Factoring

Are you wondering how to prepare a cash flow statement? This guide covers everything from gathering financial documents to categorizing cash flows and choosing the correct method. You’ll also learn how to calculate net cash flow and verify the statement’s accuracy to ensure it reflects your business’s actual cash movements.

Key Takeaways

- A cash flow statement or statement of cash flow assesses a company’s cash position, tracking cash inflows and outflows to maintain financial health.

- The statement consists of three main sections: operating activities, investing activities, and financing activities. Each provides insights into different cash flow sources.

- Preparation can use either the direct or indirect method, with tools and templates available to enhance accuracy and streamline the process.

- You can maximize your cash balance using invoice factoring and funding against your Accounts receivable (AR).

- Please read Maximizing Analysing Cash Flow.

Understanding the Cash Flow Statement

The statement of cash flow measures the company’s cash position and net cash flow over a specific reporting period. It focuses on tracking the movement of cash within an organization, providing insights into how cash is generated and spent. This statement is essential for maintaining financial health and stability, helping to manage accounting, and ensuring sufficient cash for operations.

The cash flow statement or statement of cash flow complements both the balance sheet and income statement, offering a comprehensive view of a company’s liquidity. Acting as a bridge between these financial documents, it provides information on available cash necessary for operating expenses and debt repayment. Investors and managers rely on cash flow statements to assess financial stability and make informed decisions regarding the financial statement.

Unlike the income statement, which measures profitability, the statement of cash flow shows actual cash inflows and outflows, painting a clearer picture of a company’s financial health. By understanding and utilizing cash flow statements, businesses can ensure they have enough liquidity for daily operations and long-term investments.

You can also create a 13-week cash flow budget to help manage your cash flow issues.

Main Components of a statement of cash flow

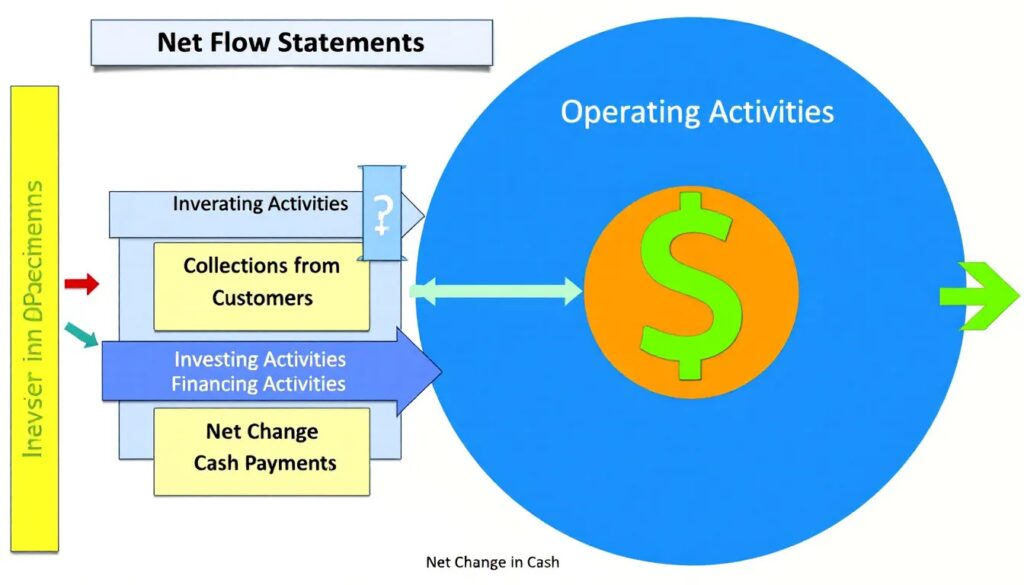

The cash flow statement has three main sections: operating activities, investing activities, and financing activities. Each section is crucial in providing a complete picture of a company’s cash flow.

Operating activities include the cash flows generated from a company’s core business operations, such as sales revenue and expenses. Investing activities involve cash flows related to the purchase and sale of long-term assets like property and equipment. Financing activities involve cash flows from borrowing, repaying loans, and equity transactions with stakeholders.

Operating Activities

Operating activities refer to the principal revenue-producing activities, including sales, purchases, and expenses. Cash inflows in this section typically arise from sales of goods and services, directly measuring how much cash a company generated from its operations.

For small businesses, cash inflows from operating activities include earned cash from sales and cash spent on ingredients and labor. Expenses related to salaries, rent, and utilities are included as cash outflows, capturing the direct costs of running the business.

Understanding cash flow from operating activities provides insight into the financial health of a business.

Accounts receivable (AR) play a significant role in the statement of cash flows, particularly within the operating activities section. An increase in accounts receivable indicates that the company is selling more on credit, which can temporarily boost revenue but may lead to a cash shortfall as cash is not immediately collected. Conversely, a decrease in accounts receivable signals that the company is effectively collecting payments from customers, resulting in an inflow of cash.

By analyzing changes in accounts receivable, stakeholders can assess the company’s cash management practices and its ability to convert credit sales into cash, highlighting the importance of efficient collection processes for overall liquidity.

Investing Activities

Investing activities in a cash flow statement detail cash flows related to buying and selling long-term assets. This section includes acquisitions and sales of assets, loans, and payments related to mergers and acquisitions.

Types of transactions under investing activities are purchasing or selling long-term assets, lending, and collecting loans. When a company purchases equipment, this is recorded as a deduction from cash, reflecting the asset’s value. Conversely, divesting an asset increases cash flow, highlighting the importance of managing investments strategically.

Financing Activities

The financing activities section of a cash flow statement details the cash inflows and outflows related to financing activity. These transactions are specifically related to debt and equity financing. This section is crucial as it provides insight into how a company funds its operations and investments.

Cash flows from borrowing money, repaying loans, and equity transactions are included in financing activities. Cash inflows can occur when a company issues stock or debt, while dividends paid to shareholders are recorded as cash outflows. Understanding these activities is essential for assessing a company’s financial strategies and stability.

Invoice Factoring

Startups and fast-growing B2B companies can have all their working capital trapped in their accounts receivable. AR Factoring can increase your cash balance by converting 80-95% of your open AR to same-day working capital, giving you an injection of permanent working capital.

Choosing the Right Method for Your statement of cash flow

The cash flow statement can be prepared using two main methods. These are known as the direct method and the indirect method. Each cash flow computation method offers unique advantages and is suited to different business needs.

The direct method is generally preferred for its simplicity in interpreting cash inflows and outflows. It focuses on actual cash transactions, providing a clear view of cash flow from operating activities.

The indirect method starts with your net income and adjusts for changes in working capital, offering insights into the relationship between net income and cash flow.

Both statements of cash flow methods should yield the same bottom-line result in terms of cash flow.

Direct Method

The direct method of cash flow statement preparation reveals actual cash receipts and payments. This method records known cash receipts and payments straightforwardly, making it easier for small businesses that use cash-based accounting.

An advantage of the direct method is its clarity and precision in cash tracking, providing a clear view of cash management. However, it requires more detailed record-keeping and can be slower compared to the indirect method.

The direct method includes summing all cash payments and receipts. This encompasses payments made to suppliers, receipts received from customers, and salaries.

Indirect Method

The indirect method begins with net income. It then makes adjustments for non-cash transactions and changes in working capital. This approach focuses on reconciling net income with cash flow, offering insights into the relationship between these two metrics.

An advantage of the indirect method is that it provides a comprehensive view of how net income translates into cash flow. However, it may be less intuitive for those unfamiliar with accounting principles compared to the direct method.

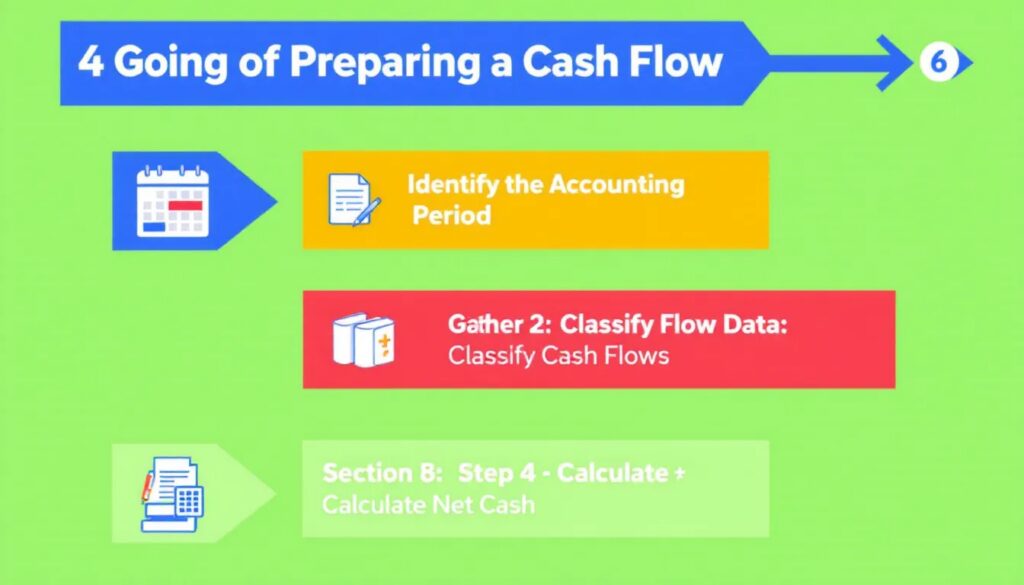

Step-by-Step Guide to Preparing a Cash Flow Statement

Creating a statement of cash flow involves several key steps: gathering financial statements, categorizing cash flows, calculating net cash flow, and verifying accuracy. Utilizing cash flow statement templates can streamline the process and ensure consistency in your calculations.

The first step is to collect documents such as income statements, balance sheets, and other financial statements. These documents are essential for identifying cash movements and ensuring accurate data. Next, categorize the cash flows into operating, investing, and financing activities. This categorization ensures accurate cash flow information and prevents data distortion.

Calculating cash flow net cash flow involves subtracting total cash outflows from total cash inflows within each category. To calculate cash flow, adjustments for non-cash items like depreciation and amortization are crucial for accurate representation.

Finally, verify the accuracy of your cash flow statement by cross-referencing with balance sheets and income statements. This step ensures that all inflows and outflows are balanced and accurately depict financial reality.

Gather Financial Statements

Collecting documents such as income statements and balance sheets is essential for identifying cash movements. Dependable data sources are crucial for generating accurate cash flow statements.

The first step in preparing a statement of cash flow is to prepare a trial balance. Include cash in bank accounts, cash equivalents, and outstanding liabilities to ensure comprehensive data.

Categorize Cash Flows

Cash flows are categorized into three groups. These include operating, investing, and financing activities. Ensuring proper categorization is crucial for accurate cash flow information and preventing data distortion.

Calculate Net Cash Flow

Net cash flow is determined by subtracting total cash outflows from total cash inflows within each category. Cash inflows include all actual cash received from sales, collections from previous sales, personal transfers, and loans.

It’s crucial to adjust for non-cash items such as depreciation and amortization to ensure the accuracy of the cash flow statement. These adjustments ensure that the net earnings reported reflect actual cash activity by accounting for changes in working capital.

Negative net cash flow indicates that more cash has been spent than earned during the period.

Verify Accuracy

A cash flow statement must ensure all inflows and outflows are balanced for accuracy. Maintaining consistency in data across the income statement, balance sheet, and cash flow statement is vital for balancing. Small mistakes in accounting can lead to discrepancies that cause a cash flow statement to not balance. Cross-referencing the cash flow statement with the balance sheet is essential. It also helps to verify the income statement, allowing for the identification of discrepancies and ensuring accuracy.

It’s also important to analyze net working capital and EBITDA together for verification in a cash flow statement. Forecasts in cash flow statement preparation should be reviewed for operations, finance, sales, and marketing categories.

A bookkeeper can assist in ensuring the accuracy of cash flow statements, making sure everything is balanced from beginning to end.

Common Mistakes to Avoid

Avoiding errors in your statement of cash flow is crucial for their accuracy and reliability. Having complete and up-to-date financial data saves time and reduces errors later in the process. Using reliable financial data reduces errors and misunderstandings during cash flow statement preparation.

Proper categorization of cash flows is essential. It ensures the creation of an accurate and meaningful cash flow statement. The accuracy of a cash flow statement is ensured through accurate bookkeeping. Here are some common mistakes to avoid to ensure your statements are as precise as possible.

Ignoring Non-Cash Items

Non-cash items must be accounted for to ensure the cash flow statement accurately reflects actual cash transactions. Failing to adjust for depreciation and similar non-cash items can lead to an inaccurate representation of cash flows. Depreciation and amortization reduce net income in the income statement but do not affect cash flows. Ignoring non-cash items like depreciation is a common mistake in cash flow statement preparation.

Always double-check non-cash expenses. This will help you reconcile them effectively when preparing a cash flow statement. Including an explanation of removed non-cash items in the footnotes of financial statements is also recommended.

Misclassifying Transactions

Accurate categorization of cash flows is crucial to prevent misclassification and data distortion. Incorrect classification of trade payables as net working capital can lead to significant reporting errors. Misclassifying loan repayments can also distort cash flow data, leading to flawed financial assessments.

If you’re unsure about categorizing cash flow, it’s a good idea to seek help. An accountant or financial advisor can provide valuable guidance.

Overlooking Changes in Working Capital

Changes in working capital must be included for an accurate cash flow assessment. These changes are essential for understanding cash flow, especially under the indirect method. A rise in accounts payable is recorded as a cash inflow, impacting the overall cash flow positively.

Working capital is the difference between current assets and current liabilities, excluding cash. It plays a crucial role in influencing cash flow from operating activities.

Example of a Cash Flow Statement

Let’s look at some examples to help you gain a clearer understanding of cash flow statements. We will provide examples using both the direct and indirect methods to illustrate the differences and applications of each.

In these examples, you’ll see how net income, operating activities, investing activities, and financing activities are recorded and adjusted to reflect the company’s cash flow. These practical examples will help you see the process in action and understand the final cash flow statement.

Direct Method Example

The direct method for preparing a cash flow statement focuses on recording actual cash transactions. For instance, a nonprofit organization might use the direct method to provide a clear view of cash inflows and outflows, highlighting real-time cash transactions.

This method offers better insights into cash management, helping assess liquidity effectively.

Indirect Method Example

The indirect method starts with net income and makes adjustments for non-cash transactions to reflect the actual cash flow. For example, a company might report a total amount used in investing activities of $33.8 billion.

Adjusting for non-cash transactions and changes in working capital ensures an accurate representation of cash flows.

Tools and Templates for Cash Flow Statements

Utilizing customizable cash flow statement templates can save time and boost accuracy. Professional templates often simplify the creation process, making it easier for users to prepare accurate cash flow statements.

Software tools like QuickBooks can streamline invoicing and cash flow tracking, providing real-time insights that facilitate better financial decision-making. These tools help automate processes, reducing manual errors and improving overall accuracy.

Excel Templates

Various Excel templates for cash flow management can be downloaded for free online. Using Excel templates for preparing cash flow statements can greatly simplify the process and enhance accuracy.

These templates help in organizing financial data systematically, making it easier to track cash inflows and outflows.

Accounting Software

Accounting software can create cash flow statements from information in the general ledger. Popular accounting tools like FreshBooks and Xero include cash flow statement features, automating calculations and reducing manual errors.

These tools provide real-time insights into a company’s financial health, aiding in better decision-making.

Enhancing Your Cash Flow Management

Strategies to improve cash flow include leveraging technology for efficient invoicing, offering early payment discounts, establishing clear credit policies, and exploring invoice factoring. Using the direct method can provide investors with a clearer understanding of a company’s cash flow situation.

Frequent monitoring of financial statements helps in avoiding misinterpretation of business progress. Cash flow analysis can assist in predicting future performance by identifying patterns and problems impacting future outcomes. Utilizing cash flow management software tools can assist in tracking cash flows and forecasting, ensuring effective resource allocation and cost management.

Regular Monitoring

Regular cash flow analysis helps in early detection of financial issues and promotes proactive management. Monitoring cash flow is important because it helps identify potential issues early and make informed decisions to ensure long-term success.

Consistent monitoring of cash flow allows businesses to spot potential financial issues before they escalate, enhancing overall decision-making and financial planning. Bankers Factoring will monitor your open AR.

Leveraging Technology

Incorporating technology into cash flow management can significantly improve efficiency and accuracy. Cash flow management software like Invoicera facilitates efficient financial management, allowing businesses to streamline their cash flow processes.

These software solutions typically include features for automated invoicing, real-time tracking of cash inflows, and effective cash flow forecasting, ensuring better financial control.

Summary

In summary, understanding and preparing cash flow statements is essential for maintaining the financial health of your business. By mastering the components and methods of cash flow statements, you can ensure accurate financial reporting and make informed decisions. Avoiding common mistakes and leveraging tools and templates can further enhance the accuracy and efficiency of your cash flow management.

Remember, regular monitoring and the use of technology can significantly improve your cash flow management, helping you stay ahead of potential financial issues. Embrace these practices, and you’ll be well on your way to achieving financial stability and success.

Frequently Asked Questions

What are the three main parts of a cash flow statement?

The three main parts of a cash flow statement are operating activities, investing activities, and financing activities. Understanding these components to calculate cash flow is essential for analyzing a company’s financial health.

How does the direct method differ from the indirect method in cash flow analysis?

The direct method offers a clear view of cash transactions that produce net cash flow, while the indirect method starts from net income, making adjustments for non-cash items and changes in working capital. Each method serves different analytical needs but leads to the same overall cash position.

Why is regular cash flow monitoring important?

Regular cash flow monitoring is crucial as it enables early detection of potential issues and facilitates informed decision-making for sustainable financial health.

What is the impact of overlooking changes in working capital on a cash flow statement?

Overlooking changes in working capital can significantly distort a cash flow statement, leading to an inaccurate assessment of an organization’s cash balance position, mainly when using the indirect method. It’s crucial to account for these changes to ensure a true reflection of cash flow.

How can leveraging technology improve cash flow management?

Leveraging technology enhances cash flow management by automating processes and delivering real-time insights, thereby improving efficiency and accuracy. This leads to better financial control and informed decision-making. With tech and invoice factoring, cash flow problems can disappear.