Understand Your Business’s Break-Even Point

Wondering when your business will start making a profit? Break-even analysis can give you the answer. This analysis helps you find the sales volume you need to cover your costs. This article will explain how to calculate your break-even point and why it’s vital for your business strategy.

Key Takeaways

- Break-even analysis determines the minimum sales volume required to cover total costs and is essential for pricing strategies and financial planning.

- Key components include fixed costs, variable costs, semi-variable costs, and contribution margin, each significant in calculating the company’s break-even point.

- While valuable, break-even analysis has limitations, such as assumptions about cost behavior and market demand, necessitating consideration of additional factors for comprehensive decision-making.

- A business losing money or having a burn rate should frequently analyze its fixed costs, price variable, and total variable costs.

Please read our article on six tips to improve business cash flow.

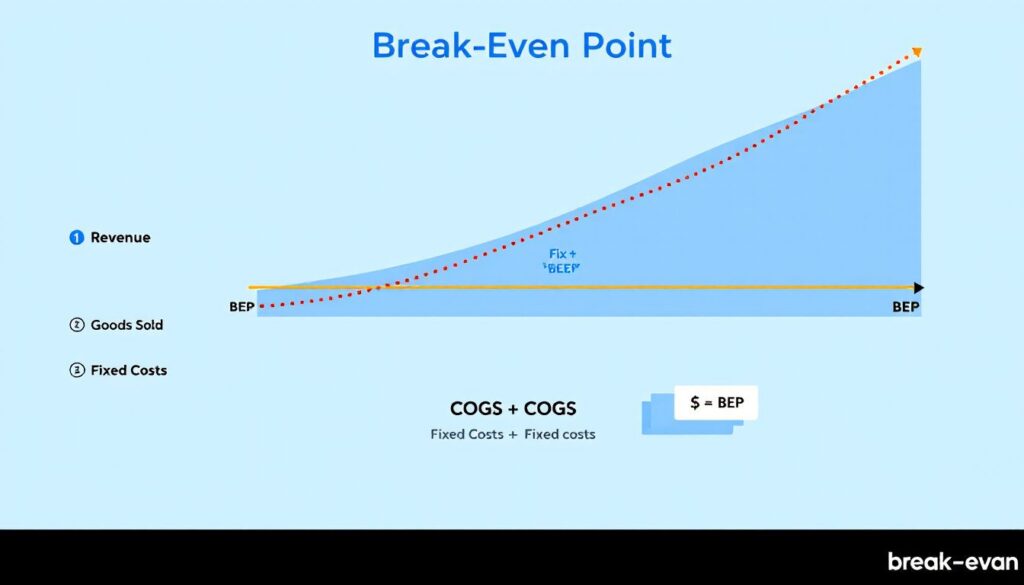

Understanding Break-Even Analysis

Break-even or break-even point analysis is a powerful tool for comparing your sales against fixed costs to determine the minimum sales volume needed to cover total costs. The break-even point is the critical juncture where your revenue equals your total costs, and profit begins to materialize. This break-even point analysis helps identify all financial commitments, limiting budgeting surprises and providing a more transparent financial roadmap.

Break-even analysis helps identify when your business can cover its costs and start making a profit. It assists in selecting pricing strategies, managing costs and operations, and determining the necessary sales volume to break even. For new businesses, knowing the break-even point is vital for understanding financial commitments and evaluating viability.

Your business’s break-even point helps management set concrete sales goals and make informed business decisions, especially when considering new investments or changes in the product mix. It offers a framework for evaluating sales targets and operational adjustments, ensuring strategies align with financial realities.

Please read our article on the six causes of cash flow problems.

Key Components of Break-Even Analysis

Mastering break-even analysis requires understanding its key components: fixed costs, variable costs, and the contribution margin. Each element plays a distinct role in calculating and interpreting your financial data.

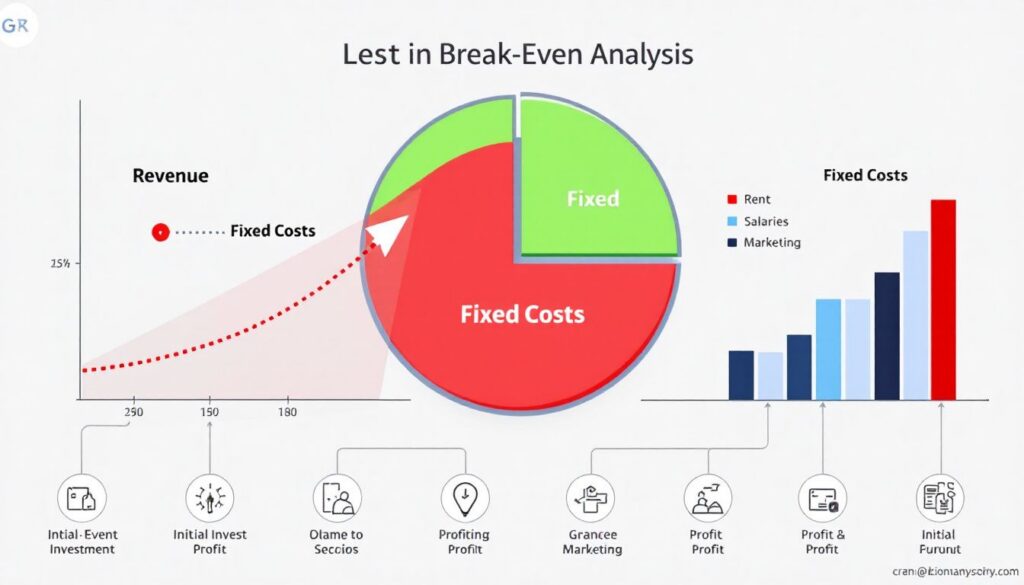

Fixed Costs

Fixed costs are expenses that remain constant regardless of your production levels. Think of costs like rent, salaries, and insurance. These costs do not fluctuate with the number of units you produce or sell, making them a predictable part of your budget. For instance, even if your production halts, you still need to pay for your factory lease and staff salaries. A fixed cost is an essential consideration in budgeting.

Fixed costs are assumed to remain constant over time in break-even analysis, offering a stable base for calculating your break-even point. This stability simplifies determining the revenue needed to cover these expenses before generating profit.

Understanding your fixed costs helps manage financial commitments and avoid unexpected expenses.

Variable Costs

Variable costs, on the other hand, fluctuate with your production levels. These include costs like raw materials, direct labor, and utilities, which increase as you produce more units. For example, if your variable cost per unit is $10, and you make 1,000 units, your total variable costs would be $10,000, while your fixed costs price variable would remain constant.

These costs are directly tied to output, significantly affecting overall profitability. Factors like inflation, technological changes, and market conditions can influence variable costs, making them a dynamic aspect of break-even analysis.

Knowing your variable costs aids in setting realistic production targets and pricing strategies considering variable components.

Contribution Margin

The contribution margin is the difference between your selling price and variable costs. It’s calculated using the formula: Selling Price per Unit – Variable Cost per Unit. This margin reflects the revenue available to cover your fixed costs and eventually contribute to your profits.

The contribution margin is vital in break-even analysis as it indicates the revenue remaining after covering variable costs. For example, if your selling price is $100 and the variable cost is $20, the contribution margin per unit is $80.

This remaining revenue covers fixed costs, with any excess contributing to net profit. A higher contribution margin reduces the units needed to break even.

How to Calculate Your Break-Even Point

Calculating your break-even point involves balancing your fixed costs with the revenue generated from sales. The basic formulas for break-even calculation include dividing your total fixed costs by the contribution margin or by using sales dollars.

Understanding the following formula is essential for determining how many units you need to sell or how much revenue you need to generate to cover your total costs.

Break-Even Point in Units

To find the per unit break-even point, divide Total Fixed Costs by the difference between Selling Price per Unit and Variable Cost per Unit. For example, with total fixed costs of $50,000, a selling price of $100 per unit, and a variable cost of $20 per unit, you need to sell 625 units to break even.

A higher contribution margin means you need to sell fewer units to break even, while a lower margin means you need to sell more. This calculation is not just a theoretical exercise; it directly informs your sales targets and operational strategies.

Knowing your unit break-even point allows you to set realistic production goals and align your pricing strategy with financial objectives.

Break-Even Point in Sales Dollars

To calculate the sales dollar break-even point, divide Total Fixed Costs by the Contribution Margin Ratio. The contribution margin ratio is the contribution margin per unit divided by the selling price per unit. For example, with total fixed costs of $50,000 and a contribution margin ratio of 0.8, the break-even point in sales dollars is $62,500.

This method provides a different perspective by showing the total revenue needed to cover all costs. It benefits businesses with multiple products or services, as it aggregates the financial requirements into a single revenue target.

Calculating your break-even point in sales dollars helps you understand overall financial needs and make informed decisions about pricing, marketing, and sales strategies.

Practical Applications of Break-Even Analysis

Break-even analysis is not just a number-crunching exercise; it has practical applications that can significantly impact your business decisions. From setting pricing strategies to making informed product launch decisions and planning expansions, break-even analysis provides a solid foundation for evaluating the financial feasibility of various business activities.

Pricing Strategy

Knowing your break-even point aids in setting prices that cover costs and ensure profitability. You can price products smarter by understanding how many units need to be sold at a given price to break even. For example, if discounted pricing raises the break-even point, calculate the additional units needed to offset the price decrease.

Lowering fixed expenses, such as rent and salaries, can also reduce your break-even threshold and improve profitability. Analyzing overhead expenses and renegotiating vendor contracts can help minimize fixed costs, thus adding to your contribution margin.

Aligning pricing strategies with effective cost management ensures long-term profitability.

Product Launch Decisions

Break-even analysis evaluates the financial feasibility of new products or services before launch. Understanding the costs and required revenue helps make informed decisions about proceeding with a product launch and assessing whether expected revenues will cover anticipated costs.

Break-even analysis helps set realistic sales targets for new products and understand the financial implications of decisions. It enables you to evaluate potential profitability and adjust your business plan accordingly.

This proactive approach minimizes financial risk and ensures that your product launches are grounded in solid financial analysis.

Expansion Plans

Break-even analysis helps assess the financial viability of expansion plans, such as opening a new location or entering a new market. It determines the minimum sales required to cover associated costs. For example, understanding how long it will take to become profitable in a new location is crucial for informed decisions.

Implementing strategies like remote work can reduce overhead costs associated with office space, lowering the break-even point for expansions. By understanding your break-even point, you can better plan for the financial requirements of your expansion and ensure that it aligns with your overall business strategy.

This analysis allows business owners to make data-driven decisions that support sustainable growth.

What if you don’t have enough working capital to fund your growth? Non-recourse invoice factoring from Bankers Factoring allows you to offer selling terms with tiered factor pricing as you grow.

Case Study: Break-Even Analysis Example

Let’s delve into a real-world example to illustrate how break-even analysis works. Imagine a company with total fixed costs of $50,000 and a product that sells for $100 per unit with a variable cost of $20 per unit. The company must sell 625 units to break even using the break-even formula. This means the revenue generated from selling these units will cover all the fixed and variable costs.

Accurately identifying fixed and variable costs is crucial for effective break-even analysis. Miscalculating these costs could lead to either overestimating or underestimating the units needed to break even, causing financial mismanagement.

This example highlights the importance of precise cost identification and the practical application of break-even analysis in business planning.

Limitations of Break-Even Analysis

While break-even analysis is a valuable tool, it has its limitations. One major limitation is the assumption that fixed and variable costs can be neatly divided, which may not always reflect reality. This simplification can impact the accuracy of the analysis, especially in complex business environments where costs do not always follow linear patterns.

Assumptions and Simplifications

Break-even analysis relies on several assumptions and simplifications, such as a linear correlation between costs and production output. This means it assumes that costs increase proportionally with production levels, which may not always be true. Additional revenue directly contributes to profit once sales exceed the break-even point, but this linearity can oversimplify complex cost structures.

These assumptions can impact the accuracy of break-even analysis since actual costs may fluctuate due to various factors. For instance, economies of scale might reduce variable costs per unit at higher production levels, or fixed costs might increase due to additional investments. Recognizing these limitations is essential for making informed business decisions.

Market Demand Considerations

Another significant limitation of break-even analysis is its failure to consider market demand fluctuations and competitive pressures. The analysis assumes that all units produced will be sold at the anticipated price, which is often not true in real-world scenarios. Market conditions can vary widely, affecting costs and revenues in ways that break-even analysis does not account for.

Additionally, break-even analysis overlooks qualitative factors such as customer satisfaction and brand reputation, which can significantly influence sales. It also does not address when or if the required units will be sold, which is a critical aspect of product sales.

While break-even analysis offers valuable insights, it should be used alongside other tools and analyses for comprehensive business planning.

Tips to Lower Your Break-Even Point

Lowering your break-even point enhances profitability by reducing the total revenue needed to cover costs. Effective cost management and strategic pricing help achieve this by lowering both fixed and variable costs.

Here are some practical tips to help you lower your break-even point.

Reducing Fixed Costs

Reducing fixed costs is a straightforward way to lower your break-even point. This can involve negotiating lower rent, reducing salaries, or cutting unnecessary expenses. For example, if you can lower your rent by moving to a less expensive location or negotiating a better deal, you directly reduce your fixed costs, lowering your break-even point.

Additionally, analyzing overhead expenses and finding ways to operate more efficiently can help. Implementing remote work policies to reduce office space costs is another effective strategy.

Continuously reviewing and adjusting fixed costs helps maintain a lower break-even point, enhancing overall financial stability and profitability.

Increasing Contribution Margin

Increasing your contribution margin also lowers your break-even point. This can be achieved by decreasing variable costs or rising selling prices. For instance, improving operational efficiency to reduce waste or negotiating better prices for raw materials can lower variable costs. Similarly, raising product prices without significantly affecting demand can boost your contribution margin.

Another approach is to enhance the value proposition of your products, allowing you to justify higher prices. Focusing on cost management and pricing strategies increases your contribution margin, reducing the number of units needed to break even and improving profitability and financial health.

Summary

In summary, break-even analysis is a vital tool for understanding when your business will start to turn a profit. By analyzing fixed and variable costs, and calculating the contribution margin, you can determine your break-even point and make informed business decisions. Whether setting prices, launching new products, or planning expansions, break-even analysis provides a solid financial planning and risk management foundation.

Understanding the limitations of break-even analysis is equally important. While it offers valuable insights, it should be used with other analytical tools to account for market demand fluctuations and qualitative factors. Applying the tips to lower your break-even point can enhance your business’s profitability and financial stability. With this knowledge, you’re better prepared to navigate the financial complexities of running a successful business.

Frequently Asked Questions

What is the primary purpose of break-even analysis?

The primary purpose of break-even analysis is to identify the point at which a business can cover its costs and begin to make a profit. This crucial insight helps make informed financial decisions for pre-revenue startups and existing businesses.

How do fixed costs differ from variable costs?

Fixed costs remain unchanged regardless of how much you produce, such as rent and salaries, while variable costs change based on production levels, like raw materials and direct labor. Understanding these differences is crucial for effective budgeting and financial planning.

What is the formula to calculate the break-even point in units?

To calculate the break-even point in units, use the formula: Total Fixed Costs divided by (Selling Price per Unit minus Variable Cost per Unit). This will help you determine the number of units you need to sell to cover all costs.

How can a business lower its break-even point?

To lower its break-even point, a business should reduce fixed and variable costs while enhancing the contribution margin through effective cost management and strategic pricing. This approach leads to a more sustainable financial position.

What are some limitations of break-even analysis?

Break-even analysis has limitations, such as assuming linear cost relationships and ignoring variations in market demand and competitive dynamics. These factors can significantly impact the accuracy of the analysis.