Can I make a living as a factoring broker? How to become an invoice factoring broker. A factoring broker is a financial intermediary that helps businesses find and secure factoring services from different factoring companies. Factoring brokers work with businesses to understand their working capital and financing needs. They also match this capital with the most appropriate factoring company. Factoring brokers may […]

Factoring

Invoice factoring comes in many types with even more ways to utilize it and with cost structures just as varied and (some) complex.

Here is a repository of recent articles from Bankers Factoring on the best practices in A/R financing for entrepreneurs.

Invoice Factoring for Landscaping Companies

A Landscape Factoring Company Turn Your Landscaping Contractor Invoices into Ready Cash Flow Invoice Factoring for Landscape Contractors For most small businesses, a cash flow problem is a severe issue. If your landscaping company needs an influx of working capital—and you cannot get it from traditional lenders—Bankers Factoring is your best option. The factoring process […]

Who Qualifies for a Factoring Company?

Invoice Factoring Requirements: Does Your Business Qualify? Qualifying for Receivable Factoring In 2022 over 5 million new businesses started. With Entrepreneurship playing such a prominent role in our economy, small businesses need access to working capital (Inc.com). Entrepreneurs spend countless days raising money, investing their life savings, and dealing with cash flow struggles. Start-ups need […]

What is a UCC Filing in Invoice Factoring?

Invoice Factoring and the Uniform Commercial Code Uniform Commercial Code (UCC) Filing in Factoring Summary Factoring companies file UCC-1 financing statements to protect their interests and provide solutions for the factor and its clients. UCC filings place liens on a specific asset or blanket liens on all business assets for factoring agreements. The lien reveals […]

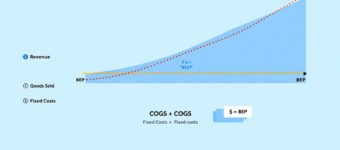

Break-Even Analysis: Simple Steps to Calculate

Understand Your Business’s Break-Even Point Wondering when your business will start making a profit? Break-even analysis can give you the answer. This analysis helps you find the sales volume you need to cover your costs. This article will explain how to calculate your break-even point and why it’s vital for your business strategy. Key Takeaways […]

Understanding Merchant Cash Advances or MCA Loans

A Merchant Cash Advance or MCA Loan can be Very Fast but Expensive Is a Merchant Cash Advance Working Capital at an Expensive Price? Small business funding or financing issues impact over 50% of current business owners. Merchant cash advances (MCA) seem easy to inject working capital into operations. However, depending on the information on […]

What is a Factor Company?

Receive Working Capital with an Invoice Factoring Company What is a Factor Company, and How Can It Help Your Business? Choosing the Right Factor Company A factor company buys unpaid invoices from businesses, providing them with immediate cash and improving cash flow. Unlike traditional loans, this process does not add debt. This article will explain […]

Is an Invoice a Legal Contract

Is an invoice a legal document? How to make an invoice legally binding When completing business transactions and dealing with invoices, there may be confusion on the exact definition of an invoice and whether or not invoices count as a legal contract. Simply, an invoice or sales invoice is not a legal contract. This article […]

How to Start a Directional Drilling Company

Trenchless & Horizontal Boring Company Invoice Factoring Financing a Directional Boring Company Directional Boring Factoring Summary Directional Boring and Drilling Company financing through invoice factoring finance resolves working capital constraints. That’s because Factoring Financing provides horizontal drilling companies with fast cash flow for staffing, equipment, and expenses. So overcome cashflow gaps with invoice factoring financing. […]