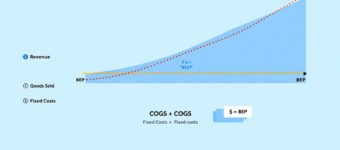

Understand Your Business’s Break-Even Point Wondering when your business will start making a profit? Break-even analysis can give you the answer. This analysis helps you find the sales volume you need to cover your costs. This article will explain how to calculate your break-even point and why it’s vital for your business strategy. Key Takeaways […]

Bankers Factoring Blog

Welcome to the Bankers Factoring Company Blog about small business issues, government contract sales, start-up funding, payroll funding, invoice factoring, A/R financing, and purchase order funding.

Invoice Factoring Blog

Here is information about starting, growing, and exiting business ownership that we think our fellow business owners will find exciting and compelling. We continue to learn and grow as owner-employees in this entrepreneurial journey offering business owners non-recourse invoice factoring.

We will discuss the differences in invoice factoring companies, invoice factoring costs, hidden fees, cash flow problems, other financial solutions, and having a healthy cash flow; all the issues small business owners deal with daily.

Top Ways to Secure Financing for a Lost Opportunity

Invoice Factoring Funds Lost Sales Opportunities Did you miss a business opportunity due to unexpected events or funding issues? Learn how to secure financing for a lost opportunity and get back on track. This article explores practical financing strategies to help your business recover and thrive. Key Takeaways Understanding Lost Opportunities in Business Lost opportunities […]

Mastering Analyzing Cash Flow: Best Practices and Tips

Understanding Cash Flow Cash flow refers to the movement of money into and out of a business over a specific period. It is a crucial indicator of a company’s financial health, revealing how well it can generate cash to pay debts, fund daily operations, and invest in growth initiatives. Monitoring cash flow requires regularly reviewing […]

Trucking A/R Factoring in 2025

Don’t Fight Slow-Paying Trucking Customers Non-Recourse Trucking Factoring from Bankers Factoring In 2022, the trucking industry dominated with over 70 percent of freight transportation in the USA, leaving owner-operators needing working capital to fight slow-paying customers. Thus, Accounts Receivable (A/R) Factoring with Bankers Factoring provides trucking companies, owner-operators, and over-the-road (OTR) haulers with an instant […]

Latino-Owned Business Funding Options in 2025

Financing for Latino-Owned Companies If you’re a Latino entrepreneur seeking to finance your venture, you may wonder what reliable funding options exist beyond traditional loans. This article cuts straight to the chase: Latino-owned business funding is evolving, with accessible options that understand your unique challenges. From grants to invoice factoring and culturally attuned lenders, we’ll […]

Top Working Capital Loan Options for Small Businesses

Small Business Loans for Working Capital What is a Working Capital Loan? A working capital loan covers short-term expenses like payroll and inventory for businesses facing cash flow challenges. In this article, you’ll learn about working capital loans, how they work, and the top options for small businesses needing working capital lines of credit. Key […]

Top Inventory Financing Options for 2025

Fund Your Company’s Inventory Inventory financing allows businesses to use inventory as collateral to secure a loan. This can help manage cash flow and ensure you have enough stock for busy seasons. In this article, we’ll explore the top inventory financing options for 2025, how they work, and what you need to qualify for an […]

Top Loan Options for a Business Acquisition

Using Invoice Factoring to Finance and Buy a B2B Business Do you need funding to buy an existing business? A loan for business acquisition can make it possible. This article covers your options, how these loans work, and where to find the best deals. Key Takeaways Understanding Business Acquisition Loans Business acquisition loans are designed […]

Stop Chasing Payments and Get Paid Faster

A/R Management and Credit Protection from Invoice Factoring Safely accelerate invoice payments Chasing payments is a common issue for small business owners. Unpaid invoices disrupt cash flow and operations. Learn strategies to get paid faster while preserving your client relationships. Key Takeaways Understanding Overdue Invoices Overdue invoices are a frequent challenge for businesses, referring to […]