Manufacturing Factoring & Funding

Manufacturing Financing Alternatives

Are you looking to fund your manufacturing operations or expand your manufacturing business? This article will guide you through the best manufacturing financing options available. Learn how to secure the capital you need to thrive and grow.

Key Takeaways

- Invoice factoring offers immediate cash flow relief for manufacturing start-ups by converting outstanding invoices into cash without incurring additional debt.

- Manufacturers can access various financing options, including business loans, equipment financing, and alternative solutions, to enhance growth and manage operational costs effectively.

- Understanding specific business needs and comparing financing costs and terms are essential for manufacturers to select the most suitable financing options for their growth strategies.

Invoice factoring for start-up and fast-growing manufacturing companies.

Maintaining a healthy cash flow poses significant hurdles for manufacturing startups and rapidly expanding firms. Invoice factoring offers an invaluable lifeline, allowing such companies to turn their unpaid invoices into immediate funds swiftly. This method aids in resolving prevalent cash flow dilemmas by providing quick access to capital without incurring additional debt. It’s characterized by simplicity and minimal documentation requirements, relying on your clients’ creditworthiness rather than your enterprise’s.

The attractiveness of invoice factoring lies in its adaptability and expeditious nature, which is especially beneficial for new businesses. The funding is accessible within mere days—far quicker than conventional loan processing timelines—and gives entrepreneurs control over their finances while preserving ownership stakes in their companies. By selecting specific invoices, they wish to factor, business leaders can meet pressing financial demands with precision. Enterprises with seasonal variations find this option advantageous as it permits them through periods when income might be leaner without compromising their fiscal stability.

Understanding Manufacturing Financing

Manufacturing financing is crucial for the growth and sustainability of manufacturing businesses. It provides the necessary capital for investing in new technologies, expanding production capabilities, and managing operational costs more effectively. Improved cash flow through financing helps manufacturers meet fluctuating market demands and stay competitive.

Investing in new equipment with financing can significantly boost productivity and efficiency. This financial support allows manufacturers to purchase tangible assets, balance their cash flow, and enhance production capabilities.

Any manufacturing company aiming to thrive in today’s fast-paced market must understand these financial tools.

Manufacturing Business Loans Explained

Many manufacturers rely on manufacturing business loans as a cornerstone of financial support. These loans, which include term loans, SBA loans, and lines of credit, cater to specific business needs. Whether bridging temporary cash flow gaps or supporting business growth, these loans provide the working capital to keep operations running smoothly.

Also, SBA loans and asset-based lending offer flexible and tailored solutions to the unique challenges of manufacturing loans in the manufacturing sector.

Term Loans

Manufacturing firms receive a lump sum with term loans, repaid over a specified period at fixed interest rates. This structure is commonly used for financing facilities based on machinery and manufacturing equipment in asset-based loans.

Predictable monthly payments help manufacturers budget effectively, making term loans reliable for large capital investments and long-term planning. Manufacturing loans are desirable loans for most banks.

SBA Loans

Manufacturing companies can secure long-term funding through Small Business Administration (SBA) loans with advantageous interest rates that foster expansion and development.

The predominant types of SBA loans suitable for manufacturers include the 7(a) Loan, notable for its more extended payback period and less stringent eligibility requirements compared to standard financing options, and the 504 Loan, which is specifically designed to provide fixed-rate financial support over a long term for substantial assets such as real estate or buildings. Each project can receive up to $5.5 million in funds from an SBA 504 loan, making it a valuable tool for significant capital expenditures.

When deciding whether to obtain an SBA loan for your business operations, it’s imperative to assess your company’s needs meticulously and whether the loan’s specifics align with them. Preparing your application will involve gathering thorough documentation. Owners holding at least a one-fifth stake must submit personal financial details and their applications.

The lure of low interest rates coupled with favorable repayment conditions makes SBA loans particularly attractive. They serve as pivotal resources offering financial solidity needed by manufacturing firms aiming to progress robustly within their industry sectors.

Lines of Credit

Business lines of credit offer flexible borrowing options, allowing manufacturers to access funds up to a predetermined limit as needed. This type of financing is ideal for managing cash flow and handling operational challenges, providing a steady cash flow to keep the business running smoothly.

Adaptable repayment terms and the ability to borrow up to 85% of the borrowing base make lines of credit valuable for financial management in the manufacturing sector.

Equipment Financing Options

Equipment financing is crucial for manufacturers looking to obtain or modernize their machinery without incurring significant initial expenses. Various options are available, including equipment loans, leases, and vendor financing, each designed to meet distinct business requirements.

Manufacturers can use equipment financing strategies to enhance their production capabilities and manage expansion. This ensures they maintain a competitive advantage while achieving optimal operational efficiency.

Please read the top business startup loans in 2025.

Equipment Loans

Manufacturers can acquire machinery by utilizing a manufacturing loan designed explicitly for equipment purchase, securing the loan against the equipment they buy. This arrangement typically leads to lower interest rates than unsecured loans.

Upon complete repayment of the loan, manufacturers gain full ownership of the equipment. Consequently, it is economical to invest in vital long-term manufacturing assets to increase production capacity.

Equipment Leasing

Leasing equipment presents a compelling option for small manufacturing firms that might be ineligible for conventional loans. It enables these businesses to access state-of-the-art machinery without the responsibilities of ownership or hefty initial expenses.

Upon the termination of the lease, enterprises have the choice to either hand back the apparatus or acquire it at a minimal cost, which provides flexibility in controlling capital and manufacturing equipment requirements.

Vendor Financing

Equipment suppliers and manufacturers frequently engage in vendor financing agreements, which enable the latter to finance their machinery acquisitions. This arrangement bolsters the manufacturer’s cash flow and promotes business expansion by simplifying access to essential equipment. Manufacturers benefit from trade credit—one aspect of vendor financing—by postponing payment for raw materials, which increases liquidity and financial maneuverability.

Manufacturers can also leverage purchase order financing, a facet of vendor financing that provides funds for substantial orders rooted in received purchase orders. This strategy allows them to execute large-scale orders without exhausting their working capital reserves. Especially when making considerable equipment investments, vendors find this financing instrumental in preserving their fiscal health.

Invoice Factoring for Manufacturers

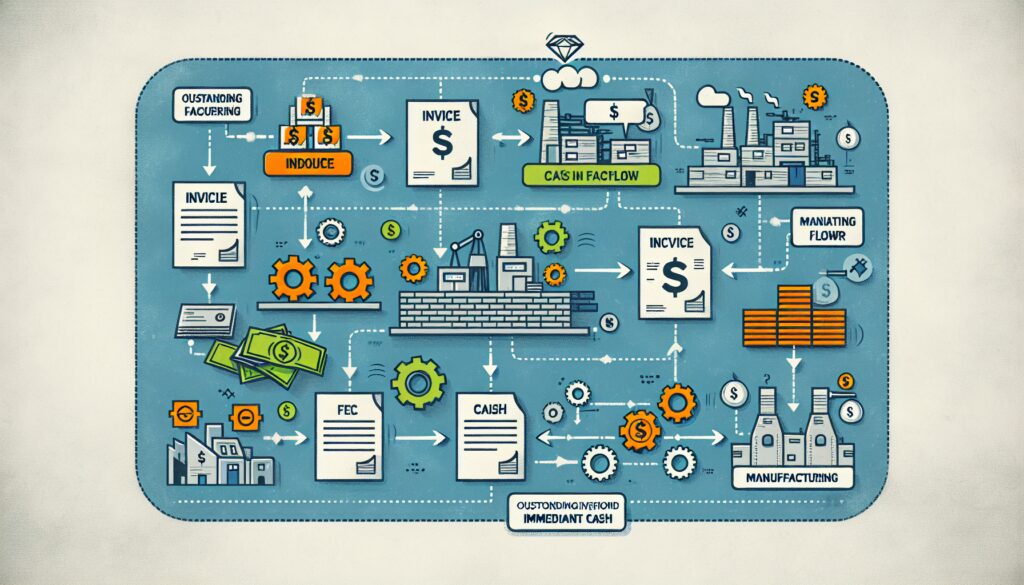

A Manufacturing business can use invoice factoring to improve cash flow by converting accounts receivable into immediate funds. Manufacturing factoring unlocks cash from unpaid invoices, bridging the gap between production costs and customer payments.

Turning outstanding invoices into working capital helps manufacturers manage cash flow more effectively and support ongoing operations.

How Invoice Factoring Works

In the process known as invoice factoring, a manufacturing business can quickly convert its accounts receivable into cash by selling them to a factoring company. The company typically gets between 50% and 85% of the invoice’s value upfront, with the rest coming after its client settles the bill—deducting a fee for this service.

To initiate this transaction, companies must gather detailed financial records and become familiar with the criteria set by the factoring company for approval. This method grants rapid access to working capital, which is crucial in sustaining seamless business operations.

Benefits of Invoice Factoring

Invoice factoring bestows a wealth of advantages, notably the provision of prompt access to cash, which enhances liquidity and empowers manufacturers with the capital necessary for operational expenditures. This strategy facilitates the swift acquisition of working capital, enabling businesses to handle supplier costs effectively and guarantee punctual employee compensation.

In stark contrast to conventional loans, invoice factoring does not add to a company’s debt burden, thus affording uninterrupted availability of funds as circumstances warrant. This elasticity is pivotal in seizing opportunities for growth or profitable transactions.

Non-Recourse Factoring

Non-recourse factoring enables manufacturers to safeguard against potential financial losses by transferring the credit risk of customer non-payment to the factoring company. This payment protection form ensures manufacturers can avoid bad debts, thus offering an appealing solution for reducing fiscal uncertainties.

Asset-Based Lending

Manufacturers secure loans by leveraging company assets such as inventory, accounts receivable, or equipment in asset-based lending. This method provides significant liquidity, helping businesses manage cash flow and fund operations.

A ledgered line of credit, an intermediate between invoice factoring and a traditional line of credit, is secured by accounts receivable and offers flexible borrowing terms. Real estate-backed loans provide substantial financing with favorable repayment terms and are viable for high-value investments.

Purchase order financing helps businesses fulfill large orders by providing funds based on your gross margins and your customer’s creditworthiness.

Inventory Financing

Inventory financing allows companies to use their saleable inventory as loan collateral, which supports cash flow management and facilitates stock procurement. This transformation of inventory into working capital provides crucial funding necessary to cover production expenses and uphold supply chain effectiveness.

Such financing plays a vital role for businesses that must keep substantial inventories but encounter issues with liquidity.

Accounts Receivable Financing

Companies utilize accounts receivable financing to access instant capital by borrowing against outstanding invoices, thus ensuring steady cash flow without customer payment delay. This approach differs from conventional invoice factoring, permitting companies to control their invoices while obtaining funds.

This form of financing offers rapid working capital that improves cash flow management and reduces the duration manufacturers must wait for payments, enabling them to cover operational costs promptly.

Real Estate-Backed Loans

Manufacturers employ their property assets, including land and buildings, as security to obtain sizable loans on improved terms by opting for real estate-backed financing. The stability of real estate as an asset often leads to more advantageous loan conditions and reduced interest rates since lenders perceive it as a less risky investment.

Using properties, structures, and parcels of land allows manufacturers to access diverse forms of collateral when seeking funding options that will facilitate their growth and scale-up operations.

Supply Chain Financing

Financing within the supply chain encompasses a range of financial solutions that enhance the movement of funds from suppliers to manufacturers and purchasers, easing the capital strain on manufacturers during procurement.

Equipment Leasing

Equipment leasing benefits manufacturers by enabling them to utilize essential machinery while retaining capital for additional investments. This arrangement also allows them to adapt to technological advancements. Vendor financing typically offers advantageous conditions for manufacturers, helping foster loyalty between suppliers and buyers.

Trade Credit

Through trade credit, manufacturers can procure raw materials and postpone payment for a specified duration, usually 30 to 90 days. This arrangement allows manufacturers to transform these materials into final goods and earn income before settling their dues. By deferring payments on raw materials via trade credit, manufacturers enhance cash flow management, facilitating more efficient business processes.

Supplier Financing

In the manufacturing sector, companies acquire raw materials required for amplifying their production levels by utilizing supplier financing, enabling them to do so without an immediate cash outlay. Funding plays a pivotal role in enhancing the firms’ capacity for manufacturing by ensuring access to essential supplies, thereby fostering continuous expansion and escalation of production.

Offering trade credit that may extend up to 90 days within this arrangement of supplier financing creates a scenario where there is a trade payable on the books rather than an incurred debt.

Purchase Order Financing

Manufacturers can leverage purchase order financing to obtain funding anchored on validated orders, allowing them to proceed with production while preserving their cash reserves. This approach gives a manufacturing business the financial means to fill substantial orders without facing limitations due to cash flow issues.

It is essential for manufacturers who aim to take advantage of significant orders and guarantee prompt delivery that they utilize purchase order financing effectively.

Alternative Financing Solutions

Manufacturing businesses searching for capital can access various alternative financing options beyond conventional bank loans. Options such as merchant cash advances, crowdfunding, and venture capital offer distinct advantages and cater to multiple funding requirements.

These alternative financing solutions can be especially advantageous for cutting-edge ventures and nascent enterprises within the manufacturing sector. They supply the essential financial backing required to transform innovative concepts into reality.

Merchant Cash Advances

Merchant cash advances (MCA) or online lenders may be a convenient option for businesses needing funding. MCAs provide immediate cash based on anticipated sales, albeit with increased repayment expenses. By offering an advanced sum of money against the promise of future sales revenue, this financing form allows quicker access to capital.

The flexibility inherent in merchant cash advances is evident in their repayment model, which adjusts according to daily credit and debit card transactions. This creates a payment system that fluctuates with the business’s income levels.

Crowdfunding

Through crowdfunding, manufacturers can gather small amounts of money from numerous individuals, which is especially beneficial for funding innovative endeavors and startups. Companies can leverage online platforms to accumulate contributions from a broad audience, aiding in financing new products or technology development.

This approach secures financial backing and fosters a community of enthusiasts who support the project.

Venture Capital

Venture capital involves substantial investments in high-growth potential manufacturing businesses, often requiring equity stakes in return for funding. This type of financing is ideal for manufacturing firms with high growth potential, as it provides significant funds in exchange for equity.

Venture capital investments focus on businesses with high growth potential, making them a key resource for companies looking to scale rapidly.

Choosing the Right Financing Option

Understanding manufacturers’ unique challenges, like significant initial expenses and extended production cycles, is crucial when selecting an appropriate financing option. It’s essential to assess these options carefully and ensure they align with the business’s operational obstacles and growth ambitions to fulfill precise requirements.

For example, supplier financing can be a strategic choice for manufacturers aiming to maintain healthy cash flow. Allowing them to lengthen their payment timelines assists businesses in sidestepping conventional forms of debt while managing their finances more effectively.

Assessing Business Needs

Manufacturers must recognize their unique financial needs and expansion goals when exploring financing options. Assessing future growth expectations and current financial status enables these businesses to pinpoint precisely what type of financing they require, allowing them to select the most appropriate alternatives to grow production capacity.

Comparing Costs and Terms

It’s imperative to carefully assess the costs and conditions of different financing alternatives for well-informed decision-making. Manufacturers have a selection, including business loans, equipment financing, solutions designed for cash flow optimization, and asset-based lending—each with advantages and disadvantages.

Options like term loans, SBA loans, and lines of credit in business loans typically provide fixed interest rates alongside clearly outlined repayment schedules, facilitating strategic fiscal planning. Equipment financing presents not only competitive rates but also favorable terms. Meanwhile, invoice factoring enables businesses to transform accounts receivable into cash swiftly.

Various strategies are available to bolster management over cash flow, such as non-recourse factoring, which helps mitigate potential risks arising from customer remittances. Leveraging a company’s assets directly through options like inventory or accounts receivable-backed financing provides immediate access to liquidity.

Manufacturers who experience variability in their cash flows can benefit from supply chain financing, which offers flexible repayment terms tailored to adaptability to these fluctuations.

Please read what industries use invoice factoring.

Consulting Financial Advisors

Engaging with professional financial advisors can assist manufacturers in deciphering intricate financing options and customizing solutions to fit their particular circumstances. Such collaboration offers insights adapted to a manufacturer’s unique economic environment, ensuring financing tactics are coordinated with their operational objectives.

Summary

Exploring the diverse array of financing solutions accessible to those in the manufacturing industry is crucial for fostering continuous growth and maintaining efficient operations. From conventional business loans to more novel approaches such as invoice factoring and venture capital, each financial tool has distinct advantages designed to suit different business requirements.

Employing these mechanisms effectively can lead to substantial improvements in cash flow, bolster technological development, and provide an edge over competitors in the manufacturing landscape.

To sum up, manufacturers must meticulously evaluate their financial needs by scrutinizing various loan terms and costs while seeking advice from fiscal experts. This careful selection process of appropriate financing strategies allows businesses to secure continual expansion, preserve efficiency across operations, and maintain a competitive stance amidst an ever-changing market environment.

Frequently Asked Questions

What is Manufacturing Invoice Factoring?

Manufacturing invoice factoring is a financial process where manufacturers sell their outstanding invoices to a factoring company to access working capital quickly.

This allows businesses to improve cash flow without waiting for customers to pay their invoices.

How much cash advance can manufacturers receive when selling invoices to Bankers Factoring?

When selling invoices to Bankers Factoring, manufacturers can receive an initial cash advance of up to 93% of their total invoice value. This provides significant liquidity to support their operations.

What are the benefits of Invoice Factoring for manufacturers?

Manufacturers can gain instant access to working capital through invoice factoring, which resolves cash flow challenges and helps maintain smooth operations, including payroll management, meeting operating expenses, and covering costs of goods sold.

By utilizing this financial strategy, manufacturers can bolster their operational consistency and promote business expansion.

What percentage of the total receivable value do manufacturers receive as cash advances when selling invoices?

Small business manufacturers typically receive up to 85% of their total receivable value as a cash advance when selling invoices. This allows them to access capital quickly for their operations to sustain growth.

What is the cost structure for Manufacturer Invoice Factoring?

The cost structure for Manufacturer Invoice Factoring typically starts with factoring rates ranging from 0.9% to 1.8% per 30 days. Understanding these rates can help you assess the financial impact on your cash flow.