Small Business Loan after Bankruptcy Filings and Alternative Funding Sources Securing a business loan after bankruptcy is not easy but achievable. This article will help you understand the impact of bankruptcy, how to rebuild your credit, and explore different loan options. Learn the steps to improve your chances for a business loan after bankruptcy. Cash […]

Turnarounds & Distressed Situations

How do you mitigate risks and keep your business afloat with the right turnaround strategy?

Did a bank turn down your LOC request? Bankers Factoring can assist you with Non-Recourse Factoring & DIP Financing.

Top Strategies to Effectively Avoid Business Bankruptcy

Invoice Factoring to Reduce Business Debts Are you worried about keeping your business afloat and avoiding bankruptcy? You’re not alone. This article provides essential strategies to avoid business bankruptcy. Understand where your money is going, mix your income, optimize operations, manage credit, explore alternative financing, seek expert advice, have a backup plan, and foster strong […]

Navigating the Challenges: Insights from a Bank Workout Group

The Role of a Bank’s Special Assets Group A bank workout or special assets department is a specialized team within a bank that helps manage and restructure distressed loans. Their primary goal is to stabilize the financial health of borrowers facing difficulties and reduce the bank’s loan losses. This article explores the role of bank […]

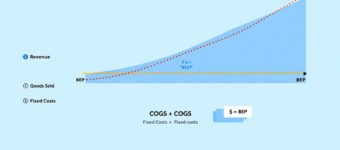

Break-Even Analysis: Simple Steps to Calculate

Understand Your Business’s Break-Even Point Wondering when your business will start making a profit? Break-even analysis can give you the answer. This analysis helps you find the sales volume you need to cover your costs. This article will explain how to calculate your break-even point and why it’s vital for your business strategy. Key Takeaways […]

Top Ways to Secure Financing for a Lost Opportunity

Invoice Factoring Funds Lost Sales Opportunities Did you miss a business opportunity due to unexpected events or funding issues? Learn how to secure financing for a lost opportunity and get back on track. This article explores practical financing strategies to help your business recover and thrive. Key Takeaways Understanding Lost Opportunities in Business Lost opportunities […]

Stop Chasing Payments and Get Paid Faster

A/R Management and Credit Protection from Invoice Factoring Safely accelerate invoice payments Chasing payments is a common issue for small business owners. Unpaid invoices disrupt cash flow and operations. Learn strategies to get paid faster while preserving your client relationships. Key Takeaways Understanding Overdue Invoices Overdue invoices are a frequent challenge for businesses, referring to […]

Top Strategies to Resolve Open Invoices Efficiently

Turn Open Invoices into Same-Day Working Capital Are you struggling to get your invoices paid on time? You’re not alone. This article on top strategies to resolve open invoices will help you tackle the issue head-on. Learn how to prioritize payments, set clear terms, and use reminders. Say goodbye to unpaid invoices and hello to […]

A Guide to acquiring a Business Line of Credit with Bad Credit

Is Invoice Factoring Possible with Bad Credit? How to secure a business loan with poor personal credit Can you get a factoring business line of credit with bad credit? Bad Credit Business Funding Receivable Factoring with Bad Credit or Bad Credit Business Financing Poor Credit Small Business Financing from Bankers Factoring You are a business […]

12 Most Common Business Cash Flow Problems and Solutions

Common Cash Flow Problems for Small Business Owners Non-Recourse Factoring as a Cash Flow Solution to Cash Flow Problems Is your company running out of cash? Most businesses experience cash flow issues as their revenue fluctuates based on the time of year. Fortunately, the correct planning and financing strategy can identify cash flow problems. Bankers […]