What makes up a Factoring Contract?

Are you struggling with cash flow? The first step is a factoring contract with an invoice factoring company. It lets businesses get instant cash by selling their invoices to a factoring company. Forget waiting for customer payments. Our detailed guide explains how a factoring agreement works, including key terms, the process, the factoring services offered, and the types of invoice factoring available.

Key Takeaways

- A factoring agreement allows businesses to sell accounts receivable for immediate cash, enhancing cash flow and relieving them of debt collection responsibilities.

- Key terms in factoring agreements, such as advance rates and factoring fees, dictate businesses’ financial outcomes, necessitating careful understanding and comparison before entering contracts.

- There are two primary types of factoring agreements—recourse and non-recourse—each with distinct risks and benefits. Businesses must assess their credit risk tolerance when choosing a suitable arrangement.

What is a Factoring Agreement?

A factoring agreement is a financial contract between a business and a factoring company detailing their invoice financing arrangement. This arrangement allows businesses to sell the company’s accounts receivable to the factoring company in exchange for immediate cash. Instead of waiting for customers to pay their invoices, businesses receive an upfront payment, which can be crucial for covering operational costs and seizing new opportunities.

The factoring process involves transferring ownership of unpaid invoices from the business to the factoring company. Once the invoices are sold, the business is no longer responsible for collecting payments; this responsibility shifts to the factoring company. This not only accelerates cash flow but also relieves businesses of the burden of debt collection.

Factoring agreements serve as a financial lifeline, especially for small businesses. They provide a steady cash flow, enabling businesses to cover immediate expenses like payroll, equipment purchases, or growth-related costs. Converting receivables into cash allows businesses to maintain liquidity and focus on growth.

Key Terms in Factoring Agreements

Understanding the key terms in factoring agreements is essential for businesses to navigate these financial contracts effectively. Key terms outline the obligations and rights of both parties, ensuring clarity and transparency. Common terms include security interest, advance rates, factoring fees, and reserve accounts.

Advance rates determine the percentage of the invoice value that the business receives upfront. Factoring fees are the costs associated with the service, typically calculated based on the invoice value. Reserve accounts act as collateral the factoring company holds to protect against non-collection or disputes.

Understanding factoring contracts rates and terms helps businesses make informed decisions and avoid unexpected costs.

Advance Rates

Advance rates refer to the percentage of the invoice value that a business receives upfront when entering a factoring agreement. These rates typically range from 70% to 90%, depending on factors such as the invoice amount and industry involved. For instance, Bankers Factoring offers an advance rate of up to 95% against the invoice’s face value, delivering substantial immediate cash to businesses.

The advance rate can significantly impact a company’s cash flow. Higher advance rates mean more immediate funds, which is crucial for covering urgent expenses. However, the specific rate offered may vary based on the creditworthiness of the customers and the overall risk assessed by the factoring company.

Factoring Fees

Factoring fees are the costs associated with the factoring service. These fees can include discount fees, which are calculated as a percentage of the invoice value, and miscellaneous fees that cover additional services. Typically, the factoring fee is applied to the amount advanced, reflecting the difference between the total invoice value and what is paid upfront.

Factors influencing the cost of factoring include the total number of invoices, the amounts involved, and the clients’ creditworthiness. Businesses should be aware of any hidden fees that may be included in the contract to avoid unexpected costs.

Transparency in the factoring fee structure is crucial for businesses to make informed decisions. Please read our factoring terms glossary.

Factoring Reserve Account

Reserve accounts are funds the factoring company holds as collateral to protect against payment non-collection or disputes. These accounts ensure the factoring company has a buffer to cover potential losses.

Typically, funds from reserve accounts are released once a week on a pre-agreed day, providing businesses with additional cash flow stability.

The Factoring Process Explained

The factoring process is straightforward and involves three main steps: application and approval, invoice submission and funding, and collection and payment. Being aware of these steps helps businesses navigate the invoice factoring process efficiently.

The first step is to establish a relationship with a factoring company. This involves signing a factoring agreement that outlines the terms and conditions of the service. Once the agreement is in place, businesses can submit their invoices to the factoring company for immediate cash advances.

Application and Approval

Qualifying for invoice factoring involves requesting a complimentary rate quote and undergoing a credit check. Factoring companies must evaluate the creditworthiness of the customers responsible for paying the invoices rather than the business itself. This makes factoring an accessible option for startups and businesses with less-than-perfect credit histories.

After the credit check, businesses follow the process outlined by the factoring company to finalize the agreement. This usually involves providing necessary documentation and consenting to the terms of the factoring contract.

Upon approval, businesses can begin submitting their invoices for funding.

Invoice Submission and Funding

Upon approval, businesses submit their outstanding invoices to the factoring company. This step initiates the invoice factoring funding process, enabling the business to receive a cash advance, typically up to 90% of the invoice value. Immediate cash flow can be pivotal for maintaining operations and meeting financial obligations without delay.

Once the factoring company collects payment from the customers, the remaining balance, minus any applicable factoring fees, is remitted to the business. This ensures that businesses receive the full value of their invoices, albeit in two installments, minus the factoring fees stated in the factoring contract.

Collection and Payment

The factoring company is responsible for collecting customer payments on the factored invoices. This relieves the business of the time-consuming and often challenging task of debt collection. Once the payments are collected, the factoring company remits the remaining balance to the business after deducting any applicable fees.

This structured approach to collection and payment ensures businesses maintain steady cash flow and can focus on their core operations. The factoring company handles all aspects of payment collection, providing businesses with peace of mind and financial stability.

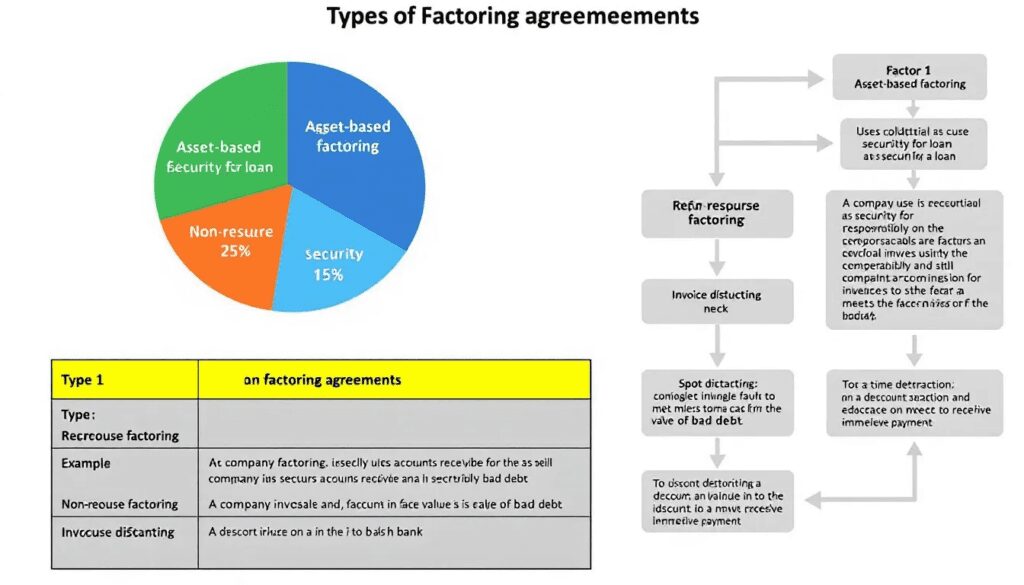

Types of Factoring Agreements

Factoring contracts or agreements have two primary types: recourse and non-recourse factoring. Each type carries different levels of risk and benefits, depending on the business’s specific needs and circumstances. Recognizing these types helps businesses select the most suitable factoring arrangement.

Recourse factoring means the business retains the risk of non-payment, making it liable if the customer defaults. Non-recourse factoring shifts the risk to the factoring company, offering businesses protection against bad debts. Both types have their advantages and considerations.

Recourse Factoring

In recourse factoring, the business remains liable for the payment if the customer does not pay for any reason. If the factoring company cannot collect the purchased invoices, the industry must repay the invoice amount and any recourse fees. This type of factoring generally involves lower fees but higher risk for the business.

Businesses opting for recourse factoring should have confidence in their customers’ ability to pay. This arrangement can be more cost-effective but requires careful consideration of the potential bankruptcy risks.

Knowing the factoring agreement obligations under recourse factoring is crucial for businesses to mitigate financial exposure.

Non-Recourse Factoring

Non-recourse factoring provides businesses with a safety net by transferring the risk of non-payment due to a customer’s bankruptcy or insolvency to the factoring company. If a customer defaults, the factoring company bears the loss, offering protection against bad debts. This factoring benefits businesses with concerns about customer credit risk.

If you only sell to Walmart or the United States government, your risk of non-payment is not bankruptcy but dilution, disputes, and returns.

Non-recourse factoring sometimes has higher fees to compensate for the increased risk the factoring company bears. Businesses should weigh these costs against the benefits of bad debt protection when choosing this type of factoring agreement.

In both recourse and nonrecourse, the factoring agreement will reference your customer’s limits based on their creditworthiness.

Common Provisions in Factoring Contracts

Factoring contracts include various provisions that outline the terms and conditions of the agreement. These provisions ensure clarity and protect the interests of both parties. Common provisions include the initial term, origination fees, upfront fees, termination clauses, monthly minimum, security interests, renewal fees, customer limits, and representations and warranties.

Knowing these provisions helps businesses avoid unexpected costs and ensure compliance with the contract terms. Reviewing the fine print of a factoring agreement is crucial to avoid hidden fees and understand the full scope of the agreement.

Termination Provisions

Termination provisions outline how and when a factoring agreement can be terminated. Typically, these provisions require a notice period of 60 to 90 days before the initial or renewal term ends. A Factoring Company termination fee, ranging from 3% to 15% of the credit line, is usually charged if the agreement is terminated.

These provisions dictate the conditions under which the agreement can be ended and the potential costs involved, making them crucial for businesses to understand. Clear knowledge of termination provisions helps businesses plan their financial obligations effectively.

Security Interests

Security interests in factoring agreements refer to the business’s collateral to secure the repayment of the factoring proceeds under the uniform commercial code or UCC. This collateral can include accounts receivable, inventory, and other essential business assets. Reserve accounts are also used as collateral to cover potential non-collection risks and ensure compliance with the terms.

Managing these security interests is crucial for both the factor and the business. It helps mitigate financial risks and ensures that the factoring agreement benefits both parties.

Representations and Warranties

Representations and warranties in a factoring agreement provide legal assurances about the quality and validity of the accounts receivable. These clauses protect the factoring company against untrue statements and the event of default, ensuring that the business operates legally and is financially solvent.

Reviewing these clauses ensures compliance and helps avoid potential legal issues.

Benefits of Factoring Agreements

Factoring agreements offer several benefits that can support business growth and stability. Most factoring agreements provide quicker access to cash than traditional loan options, helping businesses maintain operational liquidity and seize new opportunities.

Converting receivables into immediate cash helps businesses cover urgent expenses, invest in growth, and manage financial obligations more effectively. Factoring agreements also help businesses manage credit risk by leveraging their customers’ creditworthiness.

Immediate Cash Flow

One of the primary benefits of factoring agreements is the provision of immediate cash flow. This is crucial for businesses that need to cover operational costs, payroll, and other financial obligations without waiting for customer payments. The ability to access funds quickly helps businesses maintain liquidity and operational stability.

Immediate cash flow allows businesses to accelerate growth by investing in new opportunities and managing their finances more effectively. Businesses can focus on their core operations and strategic goals by converting accounts receivable into upfront cash.

Credit Risk Management

Factoring agreements also help businesses manage credit risk by conducting credit evaluations on their customers. This mitigates non-payment risk and ensures that companies deal with creditworthy clients. Non-recourse factoring protects against bad debts, shifting the risk to the factoring company.

Leveraging customers’ creditworthiness allows businesses to lower the overall cost of factoring and focus on growth. This risk management aspect makes factoring a valuable financial tool for businesses of all sizes.

Considerations Before Signing a Factoring Agreement

Before signing a factoring agreement, businesses should consider several factors to ensure they are making a sound financial decision. Comparing the costs of factoring with other financing options and understanding the full scope of the agreement is vital.

Thoroughly reviewing the contract terms helps avoid unfavorable conditions and hidden fees. Businesses should pay close attention to the computation of interest, termination clauses, and any penalties for non-compliance with the collection procedures.

Cost Comparison

When comparing factoring costs with other financing options, businesses should weigh the purchase price, financial obligations, and potential hidden fees. Factoring costs are typically lower than merchant cash advances, which can have exorbitant rates ranging from 70% to 300% APR. In contrast, factoring fees generally range from 1.5% to 3%, making it a more cost-effective solution for immediate cash flow needs.

It’s also essential to consider the float period in tiered fee structures. The time taken to apply payments, usually up to three days, can significantly increase costs if a customer pays during this period. Knowing these nuances helps businesses make informed decisions and optimize their financing strategies.

Reviewing Contract Terms

Thoroughly reviewing contract terms is crucial before signing a factoring agreement. This includes understanding the computation of interest, float days, termination provisions, and associated fees.

Businesses should also know the terms of the security agreement and ensure that the contract aligns with their financial goals and capabilities.

Factoring agreements will reference monthly minimums. Bankers Factoring offers tiered factoring rates to reward fact-growing clients who grow their business and factoring volume.

Summary

Factoring agreements offer a viable solution for businesses looking to improve their cash flow and manage financial risks effectively. By converting accounts receivable into immediate cash, companies can cover operational expenses, invest in growth, and maintain liquidity. Understanding the key terms, types, and processes involved in factoring agreements helps businesses make informed decisions and leverage this financial tool.

In conclusion, factoring agreements provide numerous benefits, including immediate cash flow and credit risk management. However, it is crucial for businesses to carefully review contract terms, compare costs, and consider the implications of different types of factoring. By doing so, businesses can ensure that they make sound financial decisions supporting their growth and stability.

Frequently Asked Questions

What can businesses use the funds from invoice factoring for?

Businesses can utilize funds from invoice factoring for various expenses, such as raw materials, payroll, and operational costs. This flexibility helps maintain smooth operations and cash flow.

How quickly can businesses receive funding through invoice factoring?

Businesses can typically receive funding through invoice factoring within 3 to 5 days after submitting their online application. This receivable financing quick turnaround allows for immediate cash flow support.

What is the main advantage of non-recourse invoice factoring?

The primary advantage of non-recourse invoice factoring is its protection against customer non-payment without incurring additional costs due to bankruptcy or insolvency. This feature minimizes financial risk and accelerates cash flow.

Can a business qualify for invoice factoring if it sells for a net of 15 to 120 days?

Yes, a business selling on net 15 to 120 days can qualify for invoice factoring, as most businesses with such terms are eligible for Accounts Receivable factoring.

How does invoice factoring help businesses with cash flow issues?

Invoice factoring provides immediate cash for unpaid invoices, enabling businesses to manage operational costs and payroll effectively without delay. This quick access to funds alleviates cash flow issues and supports ongoing operations.

Bankers Factoring offers a funding proposal within 24 hours of completing our encrypted online factoring application, which maps out all our factoring arrangements.