Creating an Invoice as a Sole Proprietorship

You can make an invoice without a company. Many business owners who are freelancers and independent contractors often wonder, “Can I make an invoice without a company?” They frequently issue invoices without a formal business entity. This article will show you how to create professional invoices, ensure legal compliance, and use handy tools to streamline the process. Please read invoice factoring for professional service companies.

Key Takeaways

- Freelancers and self-employed individuals can legally invoice without a formal company, maintaining organized financial records for tax compliance.

- Professional invoices enhance trust and clarity, including essential details like itemized services, unique invoice numbers, and clear payment terms to prevent misunderstandings.

- Utilizing online tools, customizable templates, and automation can streamline invoicing processes, improve cash flow, and enhance client relationships.

- Use invoice factoring from Bankers Factoring to get paid faster, improve cash flow, and offload the credit risk.

Understanding Invoicing Without a Company

Invoicing without a company is not only possible but also quite common among freelancers and self-employed individuals who may choose to operate through their own business entity. You can legally invoice yourself, providing flexibility in requesting client payments. This process allows you to maintain organized financial records, which is crucial for personal financial management and tax compliance.

Integrating invoicing into your business operations guarantees well-documented and transparent financial transactions.

Please read what is an invoice.

Importance of Professional Invoices

Professional invoices are essential for transparent business relationships and effective financial management. As a self-employed individual, you must provide proof of transactions and meet client requirements. Professional invoices help you formally request payments, maintain financial records, and ensure tax compliance. A comprehensive invoicing system enhances professionalism, improves cash flow, and ensures compliance with IRS requirements.

A well-crafted invoice can also serve as a marketing tool, enhancing client relationships. Including necessary details like your full name, contact information, and a logo creates professional invoices that instill client confidence. Utilizing professional templates ensures clarity and serves as an important financial record.

Legal Compliance

Legal compliance is a critical aspect of invoicing without a company. While private invoices do not need to be registered, they must adhere to local tax regulations and include necessary details, such as tax numbers for tax purposes. As a private individual, you can issue invoices when doing work independently, but it’s essential to understand the tax implications of your transactions.

Having a tax number on your invoices ensures compliance with local tax regulations. However, invoicing yourself can complicate your tax situation and make accounting more challenging, so it’s important to keep detailed records and consult a tax professional to navigate these complexities effectively.

Please read is an invoice a legal document.

Key Elements of an Invoice Without a Company

A thorough and detailed invoice ensures prompt and full payments. An invoice acts as a billing tool. It is also an important record for tax and financial tracking. Including essential details like invoice number, contact information, description of goods or services, dates, and the total amount owed is crucial.

Clear and precise invoicing language prevents confusion and delays, fostering trust and prompt payment from client billing.

Personal and Client Information

Include your name, unique invoice number, date, itemized services, and pricing when invoicing clients. Additionally, providing the client’s details, including their name and contact information, ensures effective communication and helps prevent disputes. Placing contact information prominently on the invoice, with the recipient’s information on the left and the senders on the opposite side, enhances clarity.

Detailed personal and client information on invoices enhances communication and professionalism, preventing misunderstandings. This level of detail is essential for maintaining positive relationships with your clients and ensuring that all the necessary details are clearly communicated.

Invoice Number and Dates

Unique invoice numbers are crucial for tracking payments and staying organized. Invoices should be numbered logically, potentially including the freelancer’s name, year, and a sequential invoice number. This numbering system helps in maintaining organized records and simplifies the tracking process.

The issue date on the invoice helps track service provision. Clearly stating the due date and any penalties or discounts in the payment terms prevents misunderstandings and ensures that both parties know the payment expectations. This clarity helps in chasing unpaid invoices and ensures timely payments.

Itemized Services and Costs

Comprehensive invoice details mitigate misunderstandings. When itemizing services provided, include descriptions and quantities of the services rendered or products provided. Specify quantity, hours, and project names for a clear picture of the work done.

Including unit prices and total amounts for each item enhances transparency for both the issuer and the client. This level of detail not only ensures that your clients understand the charges but also provides a clear financial record for your own tracking and sales tax purposes.

Using Excel to create invoices can automate these calculations, making the process more efficient.

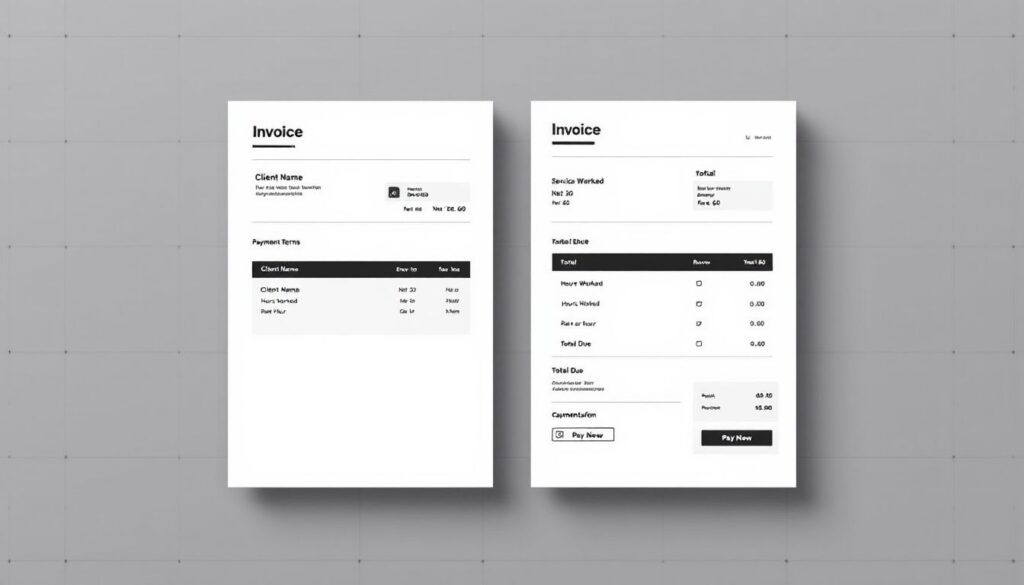

Tools and Templates for Creating Invoices

The right tools and templates simplify invoicing and enhance professionalism, particularly for individuals. Online invoicing tools, accounting software, and customizable templates can significantly streamline the process, ensuring that your invoices are professional-looking and accurate.

Adopting these tools maintains consistent cash flow and reduces administrative burdens.

Online Invoicing Software

Online invoicing software simplifies creating and sending professional invoices for individuals. Platforms like PayPal and Remotify offer a paperless business management solution, ideal for freelancers. To further streamline the process, tools like GoCardless can be connected to over 350 partner apps, including Xero and Microsoft.

Invoice tracking software automates follow-ups and notifies overdue payments, allowing you to focus on your sales and operations.

Using Microsoft Excel and Word

Microsoft Excel is a versatile tool that allows you to create invoices from scratch or use pre-made templates, enhancing customization. Excel automates calculations for totals and subtotals, ensuring accuracy and saving time.

Invoice Templates

Invoice templates simplify the invoicing process and track outstanding invoices. Utilizing templates is the best way to create professional invoices that include sales, if applicable. Many online platforms offer free and customizable invoice templates suited for various industries.

These templates ensure your invoices maintain a consistent and professional appearance, enhancing your brand image.

Sending and Managing Invoices

Sending and managing invoices effectively ensures timely payments and maintains steady cash flow. Personalized communications when sending invoices to strengthen client relationships and encourage prompt payment. Implementing an automated invoicing solution can significantly reduce errors and save processing time.

Streamlined payment processes enhance cash flow management and reduce administrative burdens.

Emailing Invoices

Use clear subject lines when emailing invoices to avoid them being overlooked. Personalizing your email communications can help build stronger client relationships and encourage timely payments.

Ensuring all invoice details are included in the email can further enhance clarity and prompt action.

Tracking Payments

A consistent numbering system for invoices maintains organized records and simplifies tracking. Every item on the invoice needs to have a corresponding cost. The total amount due is calculated by summing these costs. Automating invoicing reduces administrative tasks and improves cash flow.

Chasing unpaid invoices can burden your operations, but Bankers Factoring can streamline the collection process. Keeping careful records for invoicing is essential for tax purposes and reminders for past-due amounts.

Keep a copy of private invoices for annual tax returns to maintain proper financial records.

Automating Reminders

Automated invoice collection reduces administrative tasks, allowing freelancers to focus on core work. Miscommunication can cause issues in invoicing relationships; automation ensures clarity.

Automated reminders ensure payments are received without constant manual follow-up.

Common Challenges and Solutions

Invoicing without a formal company setup can present various challenges, especially for independent contractors. These challenges include slow payment processes, high fees, and difficulty in establishing credibility and trust. To mitigate these issues, it’s essential to establish a systematic approach for documenting payments.

Utilizing invoicing tools and resources streamlines the process and reduces frustration.

Late Payments

Late payments can lead to negative cash flow, which is critical for the survival of self-employed individuals. Implementing ACH Debit can help reduce the likelihood of late payments and speed up the payment process. Detailing late fees for overdue invoices in payment terms can incentivize timely payments.

Late client payments are a common issue for freelancers, hindering cash flow. By setting clear payment terms and using tools to automate reminders and follow-ups, you can minimize the impact of late payments and ensure steady cash flow.

Please read top strategies to resolve open invoices.

Maintaining Records

Accurate records of invoices and payments are crucial for effective financial management. Accurate invoicing serves as a vital financial record and is essential for tax compliance. Comprehensive records facilitate timely payments and help ensure compliance with tax regulations.

Well-organized records save time during tax season and provide a clear financial history for your business.

Handling Disputes

Effective dispute handling is crucial to maintaining positive client relationships. Keeping a record of all communications regarding payment reminders can help track disputes or misunderstandings. Curt emails or missed calls can create misunderstandings between businesses and vendors.

Clear communication and maintaining a professional tone avoid serious relationship fractures.

Enhancing Your Invoicing Process

Improving your invoicing process enhances cash flow and reduces administrative efforts. Customizable invoice templates can enhance brand visibility and professionalism in billing. Consistent and clear invoicing practices enhance your reputation, leading to more referrals and repeat business.

By adopting efficient invoicing strategies, you can achieve significant financial savings and better manage your cash flow.

Branding Your Invoices

Incorporating a prominent logo and a carefully selected font enhances the professionalism of your invoices. A consistent color palette from your brand reinforces recognition with each invoice sent. Branding your invoices establishes a professional image and enhances brand recognition. By integrating your logo and brand colors, you transform invoices from mere payment requests to extensions of your brand identity.

Maintaining consistent design in invoice templates aids in branding and creates a professional look for invoices. This consistency helps clients immediately recognize your invoices, reinforcing your brand every time they see it. Templates ensure your invoices maintain a professional appearance, leading to more referrals and repeat business.

Offering Multiple Payment Options

Various payment methods increase the likelihood of prompt client payments. Diverse payment options, like online platforms and traditional methods, cater to different client preferences and enhance their experience.

This flexibility leads to quicker payment processing and improves cash flow. You can grow your sales by offering terms by using Banker Factoring.

Setting Clear Payment Terms

Clear payment terms ensure clients understand their financial obligations. Defined payment terms establish mutual understanding and prevent disputes. Invoices should include specific payment methods, such as cash, check, credit card, PayPal, ApplePay, or payment by check/ACH to Bankers Factoring.

Clarity in payment terms and methods minimizes misunderstandings and achieves smoother transactions.

Case Study: Successful Invoicing Without a Company

A real-life example can illustrate the effectiveness of proper invoicing practices. The individual began their freelancing career without a formal business structure, leading to confusion and difficulty managing invoices.

Adopting an organized invoicing system and online tools enabled them to create professional-looking invoices and streamline their process.

Background and Challenges

The individual faced significant obstacles like slow payment turnaround, high transaction costs, and currency exchange risks. Their experience in freelance services without a formal company structure highlighted the need for an effective invoicing system.

Solutions Implemented

The individual began factoring with Bankers Factoring to improve their payment process. This integration enabled automated payment collection, reduced late payment risk, and simplified reconciliation.

Implementing such solutions led to enhanced cash flow management and better client relationships with weekly wires into their business bank account.

Results Achieved

As a result of these efforts, the individual reported improved cash flow, timely payments from clients, and a more streamlined invoicing process. Effective invoicing practices significantly improve cash flow management for businesses.

Summary

Issuing invoices without a company is feasible and essential for freelancers and self-employed individuals. By understanding the key elements of an invoice, utilizing the right tools and templates, and adopting efficient invoicing practices, you can ensure timely payments and maintain organized financial records. Legal compliance and clear communication with clients are critical for building trust and preventing misunderstandings.

In summary, professional invoicing is a powerful tool to enhance your business operations and improve cash flow. By branding your invoices, offering multiple payment options, and setting clear payment terms, you can create a seamless invoicing process that supports your financial goals. Embrace these strategies to transform your invoicing system and achieve greater success in your freelance or self-employed journey.

Frequently Asked Questions

Can I legally create an invoice without a company?

Yes, you can legally create and issue invoices as a freelancer or self-employed individual without a formal company structure. This allows you to manage your services and payments professionally.

What information should I include on my invoice?

Ensure your invoice contains your name, a unique invoice number, the date, itemized services with pricing, and the client’s details for clarity and professionalism. This comprehensive approach facilitates smoother transactions and prompt payments.

How can I ensure timely payments from clients?

To ensure timely payments from clients, establish clear payment terms, provide various payment options, and automate reminders for payments. This proactive approach will streamline the process and reduce delays.

Can I use invoice factoring to get paid faster?

Slow-paying customers can stretch your cash flow to the breaking point. Invoice factoring is a cash flow solution if you wait for 30-, 60-, or even 90-day payment terms. Factoring lets you fast forward through those slow-paying B2B customers by turning unpaid invoices into immediate capital.

What tools can I use to create professional invoices?

Consider using online invoicing software like PayPal or Remotify or customizable templates in Microsoft Excel to create professional invoices. These tools will help you design clear and professional invoices efficiently.

How can I handle late payments from clients?

To effectively handle late payments from clients, clearly outline late fees in your payment terms and utilize automated reminders to prompt timely payments. This proactive approach can significantly reduce instances of late payments.