Finance for Trade Payables

Trade payable financing extends payment terms for businesses while paying suppliers early. This boosts cash flow and keeps supplier relationships strong. This article explains how trade payable financing works, its benefits, and its key roles.

Key Takeaways

- Trade payable financing improves cash flow management by allowing businesses to extend payment terms while ensuring suppliers receive early payments.

- Key participants in trade payable financing include the buyer, supplier, and finance provider, each playing a specific role in facilitating timely transactions.

- Dynamic discounting and reverse factoring are common trade payable financing solutions that offer unique benefits in enhancing working capital management and supplier relationships.

What Is Trade Payables Financing?

Accounts payable financing, a financial tool aimed at optimizing cash flow for companies, allows businesses to defer their payments and ensure suppliers are paid promptly. Through this innovative strategy of managing accounts payable, companies can align payment times with their cash flow conditions without compromising the timeliness of supplier payments.

The operation typically involves approaches such as reverse factoring and dynamic discounting. These methodologies enable suppliers to be compensated in advance for issued invoices, alleviating concerns over delayed receipts and bolstering their cash positions. Such arrangements yield mutual benefits: buyers enhance working capital by extending payment terms. Conversely, suppliers receive earlier access to needed funds—these efficiencies improve overall supplier relationships.

Trade payables financing tools are an integral solution for robust cash management within businesses striving toward operational smoothness and fiscal health. They afford enterprises improved command over working capital and sustain strong connections with parties they depend on due to reliable early payment processes facilitated by these systems.

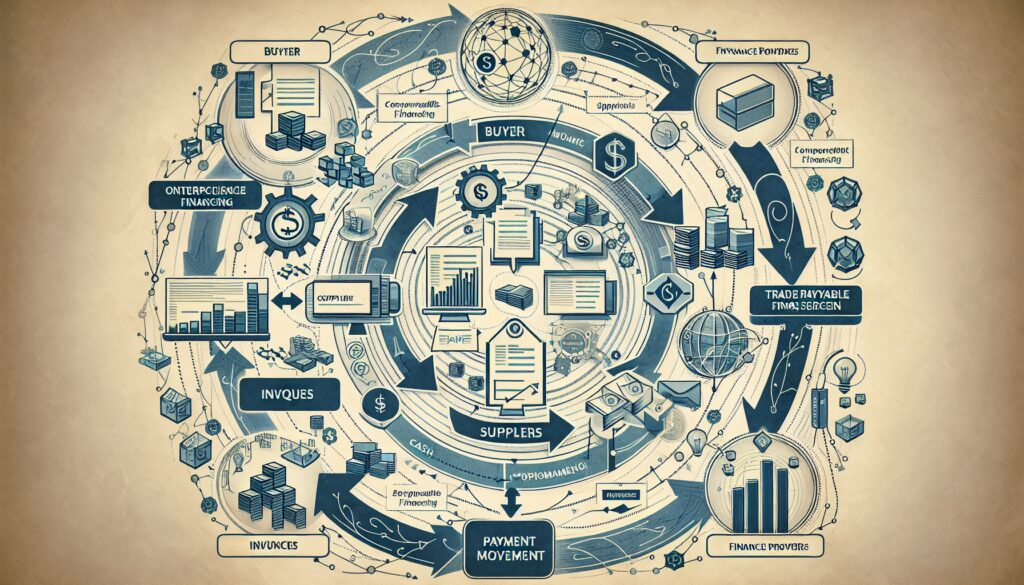

Key Parties Involved in Trade Payable Financing

Understanding the crucial participants in payables funding is fundamental to grasping its operational mechanics. The essential entities include the buyer, supplier, and finance provider. Each fulfills a distinct role that is critical for the payables finance programs to work.

Initiated by the buyer, this process involves negotiations with suppliers and finance providers to secure extended payment terms. Suppliers gain an advantage from such arrangements as they receive payments sooner than standard terms would typically allow, enhancing their cash flow while mitigating non-payment risks.

The finance provider’s role is pivotal. It acts as a mediator within this financial construct, guaranteeing timely compensation to suppliers while managing any potential hazards associated with these transactions.

Buyer

Buyers are crucial in the realm of trade payable financing because they trigger the financing process. By negotiating payment terms with their suppliers, buyers can better regulate their accounts payable, which enhances their cash flow and working capital.

This arrangement offers substantial advantages to buyers by allowing them to defer payments. This improves cash resource management and provides more opportunities for investment across different business areas. This tactical financial leeway is a primary incentive for numerous companies to utilize trading.

Supplier

Within the ecosystem of purchase financing, suppliers are pivotal participants. The expedited payments they receive through this arrangement confer substantial advantages on them. Suppliers can acquire cash more quickly by offloading receivables to a finance provider, thereby bolstering their cash flow management and diminishing dependence on traditional banking avenues that often come with higher costs. Supply chain finance amplifies these gains by offering enhanced versatility.

For suppliers, there is the notable benefit of decreased credit risk exposure. This occurs because the buyer initiates the supply chain finance process. Suppliers can capitalize on the buyer’s stronger credit status, which may result in lowered costs associated with obtaining financing. Enhanced relationships between supplier and buyer might also arise from such arrangements—alongside potentially greater sales volumes—as buyers enjoy improved access to credit and thus can make timely payments facilitated by this kind of financial support.

Finance Provider

A finance provider often represents a financial institution intermediary in trade payable financing. This entity is essential because it accelerates payment to suppliers by supplying the necessary funds in advance on behalf of buyers, thereby sustaining the effectiveness and dependability of the payables finance program.

These providers are tasked with overseeing buyer repayments and addressing any risks involved. As a result, transactions proceed punctually while providing purchasers with extended payment terms without adversely affecting their credit standings.

By utilizing obligations the buyer owes as security, these finance entities present an affordable and reliable substitute for conventional loan options. They capitalize on this collateral to ensure smoother financing operations within payment systems between buyers and suppliers.

How Trade Payable Financing Works

Trade payable financing commences with evaluating a buyer’s credit standing. Upon receipt, each invoice is meticulously verified to confirm its validity and accuracy before payment. This verification process ensures all transactions are legitimate and accurately recorded.

Once the invoicing passes scrutiny, the finance provider intervenes by issuing payment directly to the supplier. This guarantees suppliers receive their money without delay while relieving buyers from immediate financial pressure, as they can defer repayment according to prearranged terms with their finance provider.

When settling up with the finance entity involved wholly or via negotiated discounts, this systematic procedure empowers enterprises to handle their working capital needs adroitly and uphold strong bonds with suppliers. Consequently, Payables funding has emerged as a popular choice among companies looking for efficient management of funds associated with payments for goods and services received.

Benefits of Trade Payable Financing for Buyers

Utilizing trade payable financing can significantly enhance buyers’ cash flow management by allowing them to defer payments while ensuring suppliers are financed promptly. This deferred payment strategy supports business liquidity and allows redistribution of funds for various needs, marking a notable benefit over conventional loan options that typically impose more rigid repayment schedules.

Securing extended repayment terms through negotiations also presents another substantial advantage. It enables companies to leverage their working capital better, creating room for growth investment or efficiently handling unexpected expenses. Finance providers play an instrumental role here as they guarantee that supplier payments are made on time, which is crucial for preserving robust supplier relationships.

Incorporating purchase financing into a company’s financial toolkit can significantly improve its working capital management. Approaches such as dynamic discounting facilitate discussions between buyers and suppliers regarding early payment incentives. These arrangements profit both stakeholders by reinforcing financial solidity and nurturing stronger connections with finance partners.

Advantages for Suppliers

Implementing payables funding can benefit suppliers, primarily through improved cash flow. Receiving early payment makes suppliers better equipped to handle their financial affairs and less dependent on costlier conventional banking methods.

Suppliers can decrease their financing costs through trade payable financing by capitalizing on the buyer’s more robust credit standing. This strategy bolsters supplier cash flow and optimizes working capital management.

In addition to these benefits, prompt payments foster stronger bonds between businesses and suppliers. These improved relationships may lead to favorable negotiations regarding payment terms and open doors for Commercial ventures.

Types of Trade Payable Financing Solutions

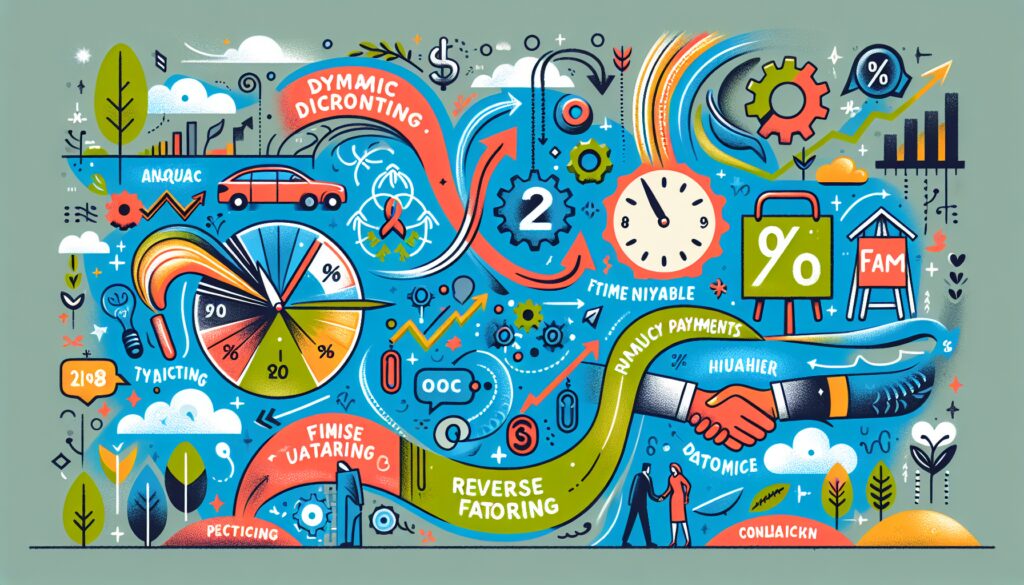

Various solutions exist under trade payable financing, designed to cater to diverse business requirements. Dynamic discounting and reverse factoring stand out as popular choices. Each offers distinct advantages that businesses can select according to their unique needs.

Dynamic Discounting

Dynamic discounting represents a financing option in which buyers suggest to suppliers that they accept a reduced payment percentage if the buyer pays the invoice before the scheduled due date. Suppliers benefit from this arrangement by obtaining payments beforehand, thus enhancing their cash flow. Simultaneously, buyers gain from reductions applied to their invoices.

The extent of discounts provided can be adjusted according to how promptly the buyer settles an invoice. A static reduction or one that diminishes incrementally over time may serve as an incentive for earlier payments. This level of adaptability renders dynamic discounting a compelling choice for managing finances among buyers and suppliers.

Reverse Factoring

In reverse factoring, a supplier receives payment from a finance provider who acts on behalf of the buyer. This setup grants buyers leverage to prolong their payment terms while guaranteeing that suppliers are compensated without delay—a boon for those needing an expedited cash flow rather than awaiting the buyer’s remittance.

Within this framework, the finance provider is responsible for credit risk, offering suppliers a more secure transactional experience. Suppliers can access immediate payments against their invoices at a reduced rate, which is often more financially favorable than standard factoring practices.

Comparing Trade Payable Financing with Other Funding Options

Unlike alternative financing methods, purchase financing distinguishes itself through its distinct setup and advantages. It provides an economical approach for companies aiming to handle their cash flow effectively while preserving robust supplier relationships.

Businesses must comprehend the contrast between this and other financial choices to make knowledgeable fiscal decisions.

Trade Payable Financing vs. Invoice Financing

Trade payable financing differs from invoice financing as it offers companies a better way to handle supplier payments instead of instantly transforming receivables into cash. While invoice financing relies on converting unpaid invoices into immediate funds, trade payable financing concentrates on lengthening the payment periods with suppliers.

With payables funding, unlike invoice financing, where the lender takes over the customer collection risk, this obligation stays with the buyer. This crucial variance renders purchase financing safer and more adaptable for controlling cash flow and preserving robust supplier relationships.

Trade Payable Financing vs. Receivables Financing

The primary distinction between trade payable and receivable financing is their respective collateral forms. Trade payable financing is secured using accounts payable, whereas receivables financing entails the sale of accounts receivable. This variance renders trade payable financing a more secure choice for lenders due to the type of collateral involved.

In contrast to trade payable financing that employs existing debts as leverage, receivables financing allows companies to convert future income into immediate cash flow by selling their revenue streams. Owing to this fundamental difference in structure, some businesses may find trade payable financing more appealing when seeking financial options that capitalize on current liabilities.

Steps to Apply for Trade Payable Financing

Commencing the application process for trade payable financing requires a preliminary evaluation of your funding needs, which hinges on the amount due in outstanding payables. This critical first step establishes how much finance you apply for.

Following this assessment, it is essential to scrutinize various financiers (both traditional banks and digital platforms) and compare what each brings. In selecting a suitable finance provider, one must weigh their market credibility, financial stability, and the terms they extend that facilitate prompt supplier payments.

After settling on an appropriate financier, gather all necessary documentation related directly to your accounts payable and any relevant invoices. Then, submit these documents along with your application for payable financing.

Best Practices for Implementing Trade Payable Financing

Integrating trade payable financing into your business operations and financial strategies is crucial to enhancing operational efficiency and managing cash flow effectively. Ensure that the chosen financing solution aligns with your company’s needs.

Assess Your Business Needs

Before opting for trade payable financing, evaluate whether your business engages in high transaction activity. Doing so will ascertain whether payables finance is a good fit and may improve your bargaining power with your suppliers.

Grasping the scale of your transaction volumes and the state of your finances aids in making educated choices about various financing alternatives. This analysis can affect how well your payables finance program performs.

Funding against your outstanding invoices may be a faster solution, depending on the quality of your balance sheet and your company’s cash flow.

Choose the Right Finance Provider

A business needs to choose a finance provider adept in trade payable financing, one that not only grasps the needs of your business but also presents an efficient application procedure with reduced bureaucratic formalities.

Monitor Program Effectiveness

Periodic reviews of purchase financing program are crucial for gauging its influence on the business’s cash flow and supplier interactions. Such continuous supervision guarantees that your financing endeavors remain aligned with corporate requirements while fostering robust supplier partnerships.

Summary

To sum up, trade payable financing is a powerful tool for businesses looking to optimize cash flow, strengthen supplier relationships, and improve financial stability. By understanding the mechanisms, benefits, and best practices associated with this financing option, businesses can make informed decisions and leverage payables funding to their advantage.

In conclusion, adopting purchase financing can transform your business’s financial health, offering flexibility, stability, and growth opportunities. Embrace this innovative solution to stay competitive and foster stronger partnerships within your supply chain.

Frequently Asked Questions

What is trade payable financing?

Trade payable financing enables businesses to extend their payment terms while ensuring suppliers receive early payment, thus improving cash flow management without damaging supplier relationships.

It is an effective strategy for optimizing financial operations.

How does trade payable financing work?

Trade payable financing works by having a finance provider pay the supplier directly after assessing the buyer’s creditworthiness and invoice accuracy.

The buyer then repays the finance provider according to the agreed terms, facilitating smoother transactions and extending payment terms.

What are the benefits of trade payable financing for suppliers?

Trade payable financing offers suppliers timely payments and improved cash flow, reducing their reliance on traditional banking options. By leveraging the buyer’s stronger credit profile, suppliers can lower their financing costs, enhancing their relationships with buyers.

How do dynamic discounting and reverse factoring differ?

Reverse factoring allows buyers to prolong their payment terms by having a financial intermediary facilitate payments to suppliers, while dynamic discounting rewards suppliers with discounts for receiving early payments based on the timing of such payments.

What steps are involved in applying for trade payable financing?

To apply for trade payables financing, determine your funding requirements first and then research potential finance providers.

After selecting a provider, compile the necessary documentation and submit your application for approval.